Question: I got answer $6,572 and it was incorrect. Please help Carlos purchased a new business asset (five-year property) on February 10, 2021, at a cost

I got answer $6,572 and it was incorrect. Please help

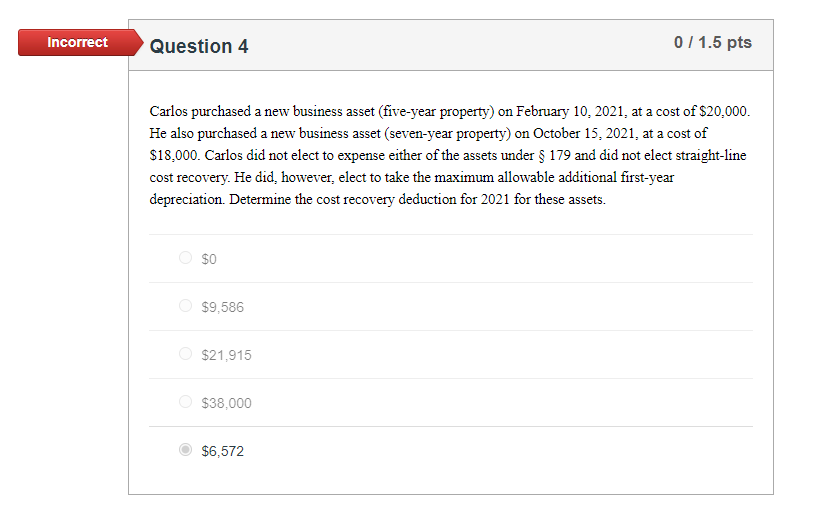

Carlos purchased a new business asset (five-year property) on February 10, 2021, at a cost of $20,000. He also purchased a new business asset (seven-year property) on October 15, 2021, at a cost of $18,000. Carlos did not elect to expense either of the assets under $179 and did not elect straight-line cost recovery. He did, however, elect to take the maximum allowable additional first-year depreciation. Determine the cost recovery deduction for 2021 for these assets. $0 $9,586 $21,915 $38,000 $6,572

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts