Question: I got answer about this question but i dont know how to calculate the effect quarterly rate in question b. Could u briefly explain that.

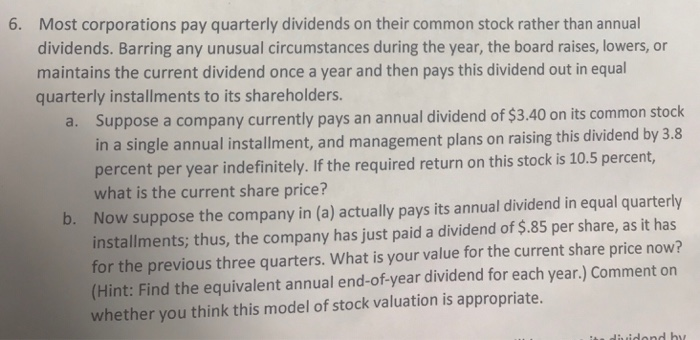

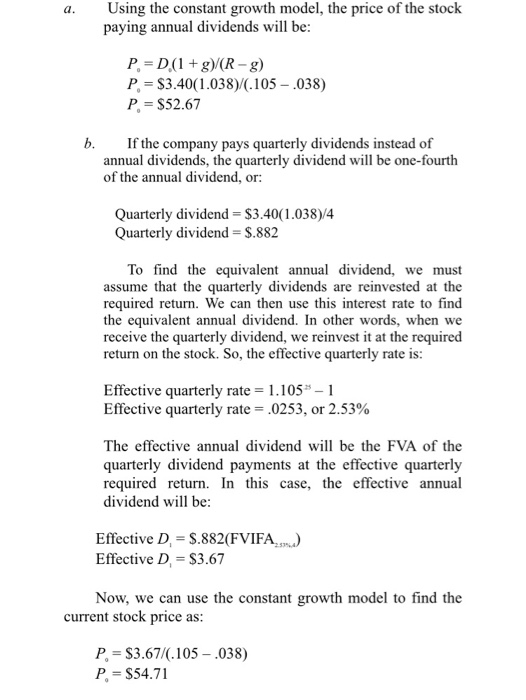

6. Most corporations pay quarterly dividends on their common stock rather than annual dividends. Barring any unusual circumstances during the year, the board raises, lowers, or maintains the current dividend once a year and then pays this dividend out in equal quarterly installments to its shareholders. Suppose a company currently pays an annual dividend of $3.40 on its common stock in a single annual installment, and management plans on raising this dividend by 3.8 percent per year indefinitely. If the required return on this stock is 10.5 percent, what is the current share price? a. b. Now suppose the company in (a) actually pays its annual dividend in equal quarterly installments; thus, the company has just paid a dividend of $.85 per share, as it has for the previous three quarters. What is your value for the current share price now? (Hint: Find the equivalent annual end-of-year dividend for each year.) Comment on whether you think this model of stock valuation is appropriate. di uidond hv Using the constant growth model, the price of the stock paying annual dividends will be a. P D()(Rg P S3.40(1.038)/(.105 .038) P, $52.67 If the company pays quarterly dividends instead of annual dividends, the quarterly dividend will be one-fourth of the annual dividend, or b. Quarterly dividend $3.40(1.038)/4 Quarterly dividend S.882 To find the equivalent annual dividend, we must assume that the quarterly dividends are reinvested at the required return. We can then use this interest rate to find the equivalent annual dividend. In other words, when we receive the quarterly dividend, we reinvest it at the required return on the stock. So, the effective quarterly rate is: Effective quarterly rate 1.105- Effective quarterly rate 0253, or 2.53% The effective annual dividend will be the FVA of the quarterly dividend payments at the effective quarterly required return. In this case, the effective annual dividend will be: Effective D, S.882(FVIFA. Effective D, $3.67 Now, we can use the constant growth model to find the current stock price as: P, $3.67/(.105- .038) P $54.71

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts