Question: I got so confused about this question. please take a look and figure out for me. thanks Bentley Mews is considering a new 4-year expansion

I got so confused about this question. please take a look and figure out for me. thanks

I got so confused about this question. please take a look and figure out for me. thanks

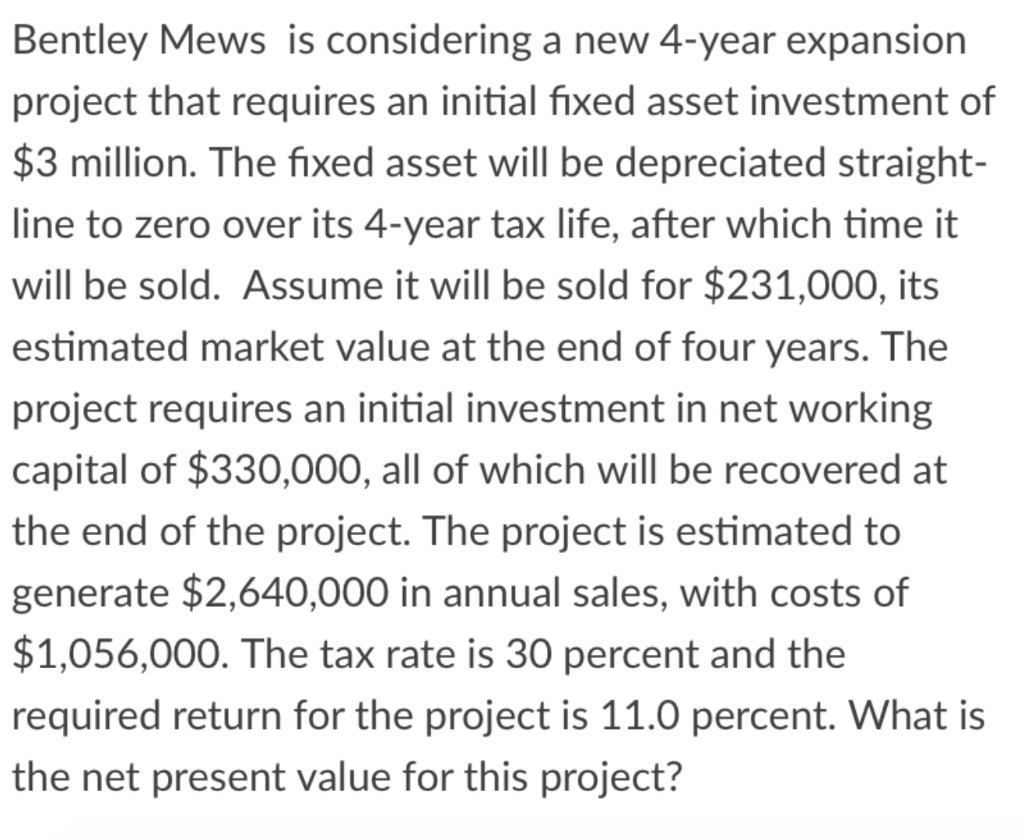

Bentley Mews is considering a new 4-year expansion project that requires an initial fixed asset investment of $3 million. The fixed asset will be depreciated straight- line to zero over its 4-year tax life, after which time it will be sold. Assume it will be sold for $231,000, its estimated market value at the end of four years. The project requires an initial investment in net working capital of $330,000, all of which will be recovered at the end of the project. The project is estimated to generate $2,640,000 in annual sales, with costs of $1,056,000. The tax rate is 30 percent and the required return for the project is 11.0 percent. What is the net present value for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts