Question: I got the answer but I dont know where does this data coming from 9) On January 1, 2021 Big Lion Corporation leased equipment from

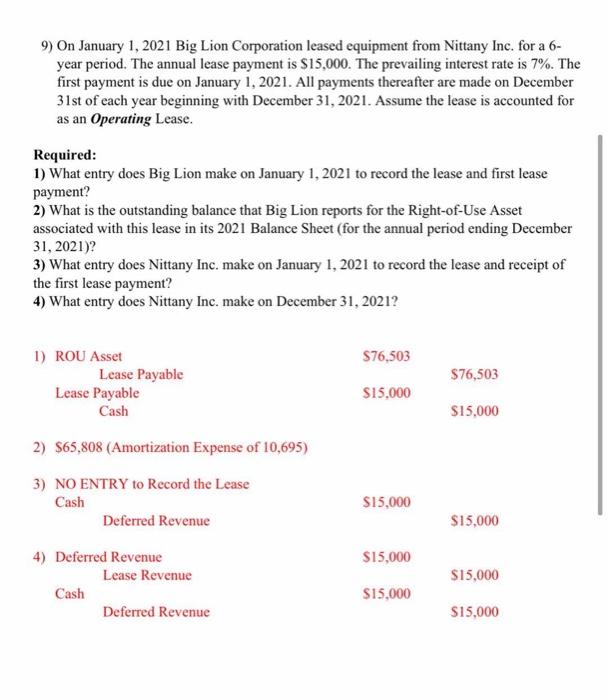

9) On January 1, 2021 Big Lion Corporation leased equipment from Nittany Inc. for a 6- year period. The annual lease payment is $15,000. The prevailing interest rate is 7%. The first payment is due on January 1, 2021. All payments thereafter are made on December 31st of each year beginning with December 31, 2021. Assume the lease is accounted for as an Operating Lease. Required: 1) What entry does Big Lion make on January 1, 2021 to record the lease and first lease payment? 2) What is the outstanding balance that Big Lion reports for the Right-of-Use Asset associated with this lease in its 2021 Balance Sheet (for the annual period ending December 31, 2021)? 3) What entry does Nittany Inc. make on January 1, 2021 to record the lease and receipt of the first lease payment? 4) What entry does Nittany Inc. make on December 31, 2021? S76,503 $76,503 1) ROU Asset Lease Payable Lease Payable Cash $15.000 $15,000 2) $65,808 (Amortization Expense of 10,695) 3) NO ENTRY to Record the Lease Cash Deferred Revenue $15,000 $15,000 $15,000 $15,000 4) Deferred Revenue Lease Revenue Cash Deferred Revenue $15,000 $15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts