Question: I got the equation for the first one, the text in red are the answers. The professor says he converts A and B to bond

I got the equation for the first one, the text in red are the answers. The professor says he converts A and B to bond yields, can you show the calculation for B please.

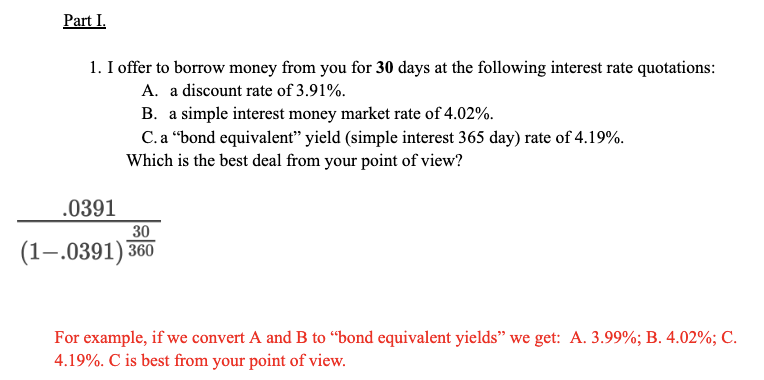

1. I offer to borrow money from you for 30 days at the following interest rate quotations: A. a discount rate of 3.91%. B. a simple interest money market rate of 4.02%. C. a "bond equivalent" yield (simple interest 365 day) rate of 4.19%. Which is the best deal from your point of view? (1.0391)36030.0391 For example, if we convert A and B to "bond equivalent yields" we get: A. 3.99%; B. 4.02\%; C. 4.19%. C is best from your point of view

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts