Question: I got the first part done. I need help with the rest. PSa 1-5 Complete Form W-4 Assist a friend in completing Form W-4. David

I got the first part done. I need help with the rest.

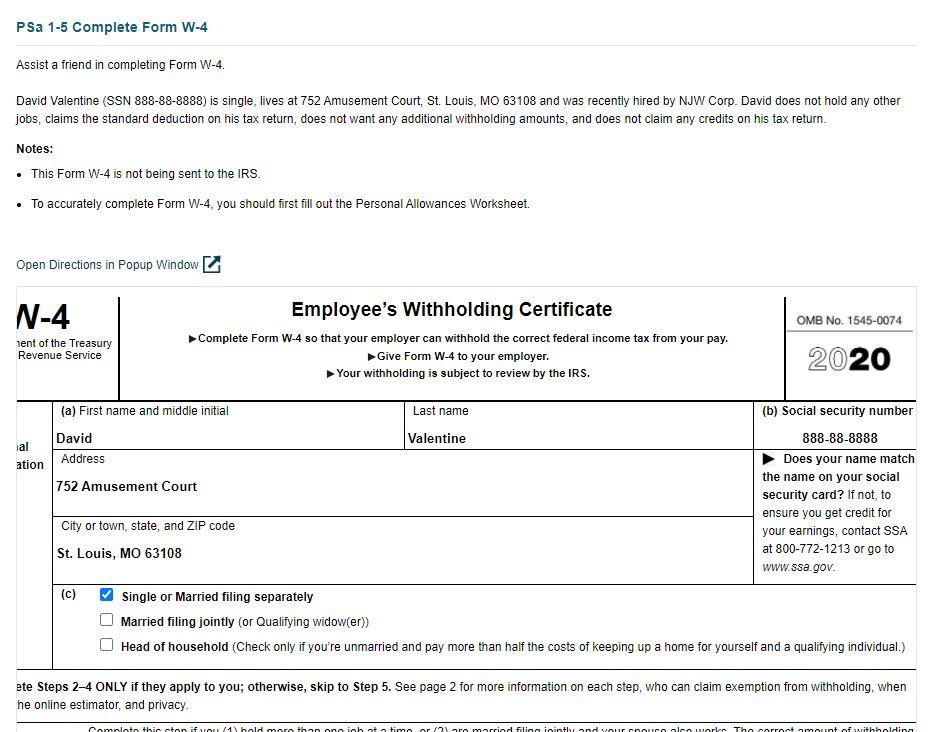

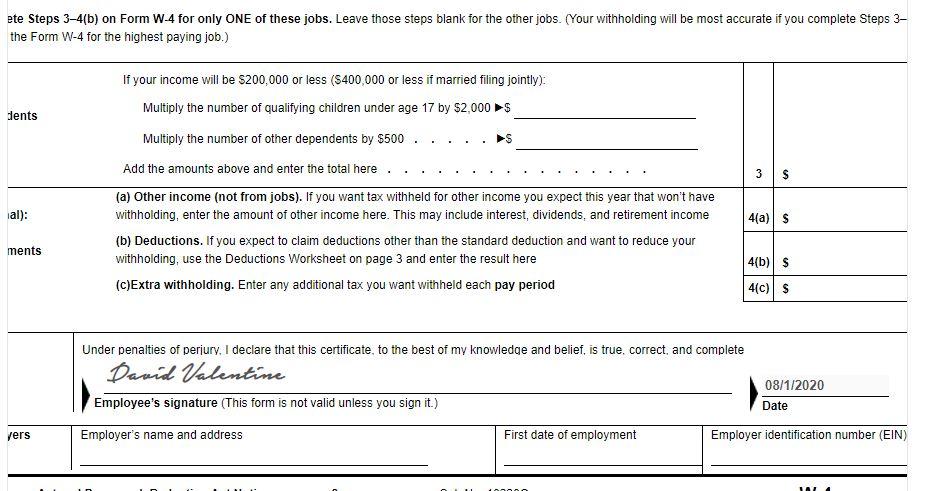

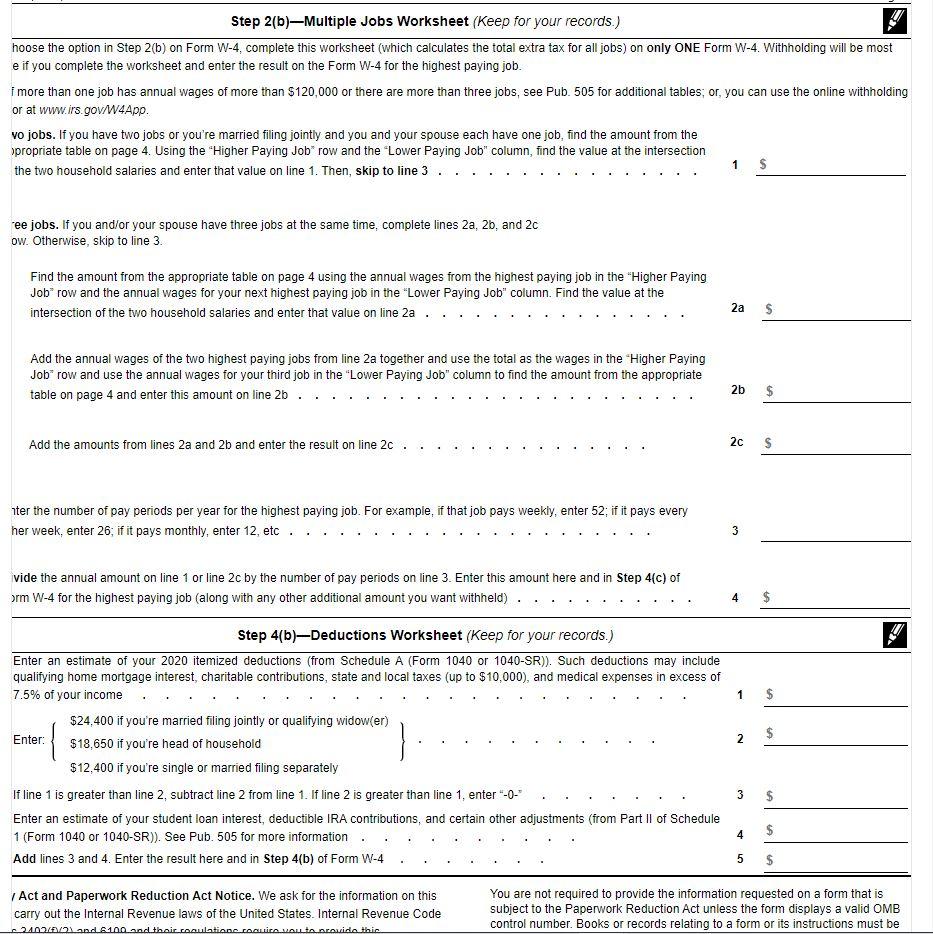

PSa 1-5 Complete Form W-4 Assist a friend in completing Form W-4. David Valentine (SSN 888-88-8888) is single, lives at 752 Amusement Court, St. Louis, MO 63108 and was recently hired by NJW Corp. David does not hold any other jobs, claims the standard deduction on his tax return, does not want any additional withholding amounts, and does not claim any credits on his tax return Notes: This Form W-4 is not being sent to the IRS. To accurately complete Form W-4, you should first fill out the Personal Allowances Worksheet. Open Directions in Popup Window N-4 OMB No. 1545-0074 nent of the Treasury Revenue Service Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. 2020 ial ation (a) First name and middle initial Last name (b) Social security number David Valentine 888-88-8888 Address Does your name match the name on your social 752 Amusement Court security card? If not, to ensure you get credit for City or town, state, and ZIP code your earnings, contact SSA St. Louis, MO 63108 at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly (or Qualifying widow(er)) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) ete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when he online estimator and privacy. amolote this ton if you hold more than one intimo araro married filin iointly and our ou lework The correct amount of withholding ete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3- the Form W-4 for the highest paying job.) dents 3 $ If your income will be $200,000 or less (5400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ Multiply the number of other dependents by $500 Add the amounts above and enter the total here (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here (c)Extra withholding. Enter any additional tax you want withheld each pay period al): 4(a) $ ments 4(b) $ 4(0) $ Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete David Valentine 08/1/2020 Employee's signature (This form is not valid unless you sign it.) Date Employer's name and address First date of employment Employer identification number (EIN) yers an Step 2(b)Multiple Jobs Worksheet (Keep for your records.) hoose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most e if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. f more than one job has annual wages of more than $120,000 or there are more than three jobs, see Pub. 505 for additional tables; or, you can use the online withholding or at www.irs.gov/W4App. vo jobs. If you have two jobs or you're married filing jointly and you and your spouse each have one job, find the amount from the spropriate table on page 4. Using the "Higher Paying Job row and the Lower Paying Job" column, find the value at the intersection 1 s the two household salaries and enter that value on line 1. Then, skip to line 3 ee jobs. If you and/or your spouse have three jobs at the same time, complete lines 2a, 2b, and 2c ow. Otherwise, skip to line 3. Find the amount from the appropriate table on page 4 using the annual wages from the highest paying job in the "Higher Paying Job row and the annual wages for your next highest paying job in the "Lower Paying Job" column. Find the value at the intersection of the two household salaries and enter that value on line 2a .. 2a $ Add the annual wages of the two highest paying jobs from line 2a together and use the total as the wages in the "Higher Paying Job row and use the annual wages for your third job in the "Lower Paying Job" column to find the amount from the appropriate table on page 4 and enter this amount on line 2b. 2b Add the amounts from lines 2a and 2b and enter the result on line 20 2c A iter the number of pay periods per year for the highest paying job. For example, if that job pays weekly, enter 52; if it pays every her week, enter 26; if it pays monthly, enter 12, etc .. 3 vide the annual amount on line 1 or line 2c by the number of pay periods on line 3. Enter this amount here and in Step 4(c) of orm W-4 for the highest paying job (along with any other additional amount you want withheld). . 4 $ 1 Enter: 2 Step 4(b)-Deductions Worksheet (Keep for your records.) Enter an estimate of your 2020 itemized deductions (from Schedule A (Form 1040 or 1040-SR)). Such deductions may include qualifying home mortgage interest, charitable contributions, state and local taxes (up to $10,000), and medical expenses in excess of 7.5% of your income $24.400 if you're married filing jointly or qualifying widow(er) $18,650 if you're head of household $12.400 if you're single or married filing separately If line 1 is greater than line 2, subtract line 2 from line 1. If line 2 is greater than line 1, enter --0- Enter an estimate of your student loan interest, deductible IRA contributions, and certain other adjustments (from Part II of Schedule 1 (Form 1040 or 1040-SR)). See Pub. 505 for more information: Add lines 3 and 4. Enter the result here and in Step 4(b) of Form W-4 3 3 $ 4 $ 5 $ Act and Paperwork Reduction Act Notice. We ask for the information on this carry out the Internal Revenue laws of the United States. Internal Revenue Code 2402/land 6100 and their coculations contra volta nrouido this You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be PSa 1-5 Complete Form W-4 Assist a friend in completing Form W-4. David Valentine (SSN 888-88-8888) is single, lives at 752 Amusement Court, St. Louis, MO 63108 and was recently hired by NJW Corp. David does not hold any other jobs, claims the standard deduction on his tax return, does not want any additional withholding amounts, and does not claim any credits on his tax return Notes: This Form W-4 is not being sent to the IRS. To accurately complete Form W-4, you should first fill out the Personal Allowances Worksheet. Open Directions in Popup Window N-4 OMB No. 1545-0074 nent of the Treasury Revenue Service Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. 2020 ial ation (a) First name and middle initial Last name (b) Social security number David Valentine 888-88-8888 Address Does your name match the name on your social 752 Amusement Court security card? If not, to ensure you get credit for City or town, state, and ZIP code your earnings, contact SSA St. Louis, MO 63108 at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly (or Qualifying widow(er)) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) ete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when he online estimator and privacy. amolote this ton if you hold more than one intimo araro married filin iointly and our ou lework The correct amount of withholding ete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3- the Form W-4 for the highest paying job.) dents 3 $ If your income will be $200,000 or less (5400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ Multiply the number of other dependents by $500 Add the amounts above and enter the total here (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here (c)Extra withholding. Enter any additional tax you want withheld each pay period al): 4(a) $ ments 4(b) $ 4(0) $ Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete David Valentine 08/1/2020 Employee's signature (This form is not valid unless you sign it.) Date Employer's name and address First date of employment Employer identification number (EIN) yers an Step 2(b)Multiple Jobs Worksheet (Keep for your records.) hoose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most e if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. f more than one job has annual wages of more than $120,000 or there are more than three jobs, see Pub. 505 for additional tables; or, you can use the online withholding or at www.irs.gov/W4App. vo jobs. If you have two jobs or you're married filing jointly and you and your spouse each have one job, find the amount from the spropriate table on page 4. Using the "Higher Paying Job row and the Lower Paying Job" column, find the value at the intersection 1 s the two household salaries and enter that value on line 1. Then, skip to line 3 ee jobs. If you and/or your spouse have three jobs at the same time, complete lines 2a, 2b, and 2c ow. Otherwise, skip to line 3. Find the amount from the appropriate table on page 4 using the annual wages from the highest paying job in the "Higher Paying Job row and the annual wages for your next highest paying job in the "Lower Paying Job" column. Find the value at the intersection of the two household salaries and enter that value on line 2a .. 2a $ Add the annual wages of the two highest paying jobs from line 2a together and use the total as the wages in the "Higher Paying Job row and use the annual wages for your third job in the "Lower Paying Job" column to find the amount from the appropriate table on page 4 and enter this amount on line 2b. 2b Add the amounts from lines 2a and 2b and enter the result on line 20 2c A iter the number of pay periods per year for the highest paying job. For example, if that job pays weekly, enter 52; if it pays every her week, enter 26; if it pays monthly, enter 12, etc .. 3 vide the annual amount on line 1 or line 2c by the number of pay periods on line 3. Enter this amount here and in Step 4(c) of orm W-4 for the highest paying job (along with any other additional amount you want withheld). . 4 $ 1 Enter: 2 Step 4(b)-Deductions Worksheet (Keep for your records.) Enter an estimate of your 2020 itemized deductions (from Schedule A (Form 1040 or 1040-SR)). Such deductions may include qualifying home mortgage interest, charitable contributions, state and local taxes (up to $10,000), and medical expenses in excess of 7.5% of your income $24.400 if you're married filing jointly or qualifying widow(er) $18,650 if you're head of household $12.400 if you're single or married filing separately If line 1 is greater than line 2, subtract line 2 from line 1. If line 2 is greater than line 1, enter --0- Enter an estimate of your student loan interest, deductible IRA contributions, and certain other adjustments (from Part II of Schedule 1 (Form 1040 or 1040-SR)). See Pub. 505 for more information: Add lines 3 and 4. Enter the result here and in Step 4(b) of Form W-4 3 3 $ 4 $ 5 $ Act and Paperwork Reduction Act Notice. We ask for the information on this carry out the Internal Revenue laws of the United States. Internal Revenue Code 2402/land 6100 and their coculations contra volta nrouido this You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts