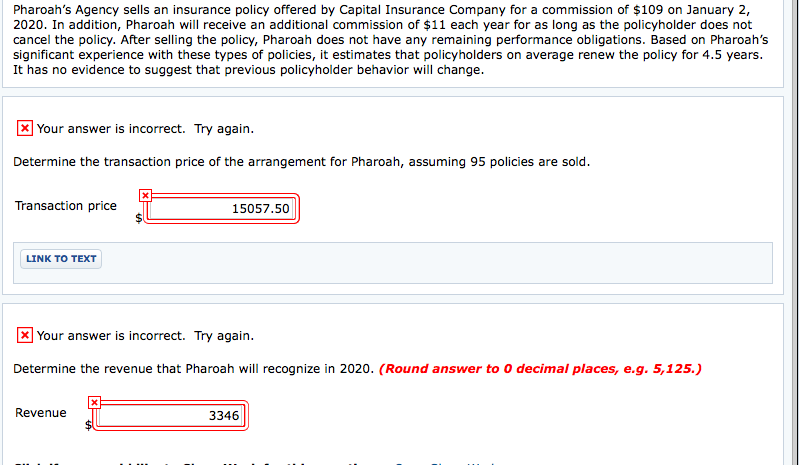

Question: I got the wrong answer and I'm not sure why. What I did was: Transaction price= ($109*95)+($11*95*4.5)=$15,057.50 Revenue recognized in 2020= ($15,057.50 / 4.5 =$3,346

I got the wrong answer and I'm not sure why. What I did was:

I got the wrong answer and I'm not sure why. What I did was:

Transaction price= ($109*95)+($11*95*4.5)=$15,057.50

Revenue recognized in 2020= ($15,057.50 / 4.5 =$3,346

I tried it rounding the transaction price to $15,058 and it was also wrong. Please show work, thank you!

Pharoah's Agency sells an insurance policy offered by Capital Insurance Company for a commission of $109 on January 2, 2020. In addition, Pharoah will receive an additional commission of $11 each year for as long as the policyholder does not cancel the policy. After selling the policy, Pharoah does not have any remaining performance obligations. Based on Pharoah's significant experience with these types of policies, it estimates that policyholders on average renew the policy for 4.5 years. It has no evidence to suggest that previous policyholder behavior will change. X Your answer is incorrect. Try again. Determine the transaction price of the arrangement for Pharoah, assuming 95 policies are sold. Transaction price 15057.50 LINK TO TEXT X your answer is incorrect. Try again. Determine the revenue that Pharoah will recognize in 2020. (Round answer to O decimal places, e.g. 5,125.) Revenue - 3346 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts