Question: I got the wrong answer. Please correct it using excel and show formulas! Thank you. Bells & Whistles is an all-equity company without any debt

I got the wrong answer. Please correct it using excel and show formulas! Thank you.

I got the wrong answer. Please correct it using excel and show formulas! Thank you.

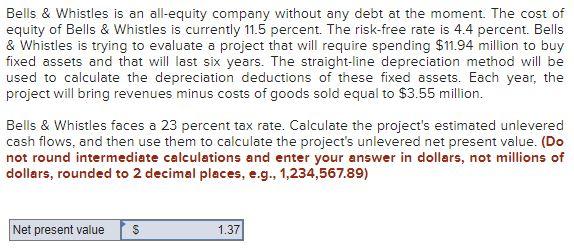

Bells & Whistles is an all-equity company without any debt at the moment. The cost of equity of Bells & Whistles is currently 11.5 percent. The risk-free rate is 4.4 percent. Bells & Whistles is trying to evaluate a project that will require spending $11.94 million to buy fixed assets and that will last six years. The straight-line depreciation method will be used to calculate the depreciation deductions of these fixed assets. Each year, the project will bring revenues minus costs of goods sold equal to $3.55 million. Bells & Whistles faces a 23 percent tax rate. Calculate the project's estimated unlevered cash flows, and then use them to calculate the project's unlevered net present value. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) Net present value s 1.37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts