Question: I got these wrong please answer both The one-year interest rates for the USD and EUR are: rUSD=1% and rEUR=5%. The expected USD/EUR rate for

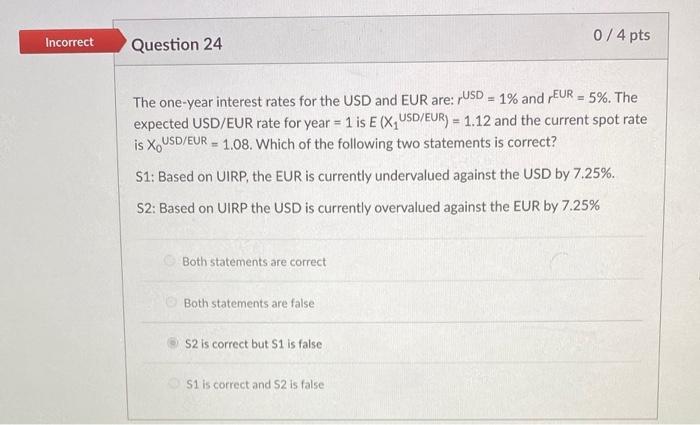

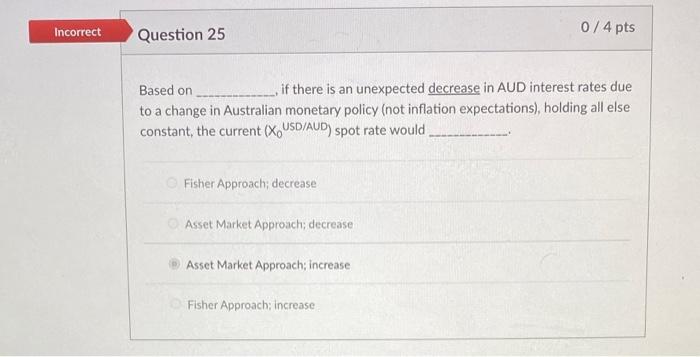

The one-year interest rates for the USD and EUR are: rUSD=1% and rEUR=5%. The expected USD/EUR rate for year =1 is E(X1 USD/EUR )=1.12 and the current spot rate is X0 USD/EUR =1.08. Which of the following two statements is correct? S1: Based on UIRP, the EUR is currently undervalued against the USD by 7.25%. S2: Based on UIRP the USD is currently overvalued against the EUR by 7.25% Both statements are correct Both statements are false S2 is correct but S1 is false S1 is correct and S2 is false Based on if there is an unexpected decrease in AUD interest rates due to a change in Australian monetary policy (not inflation expectations), holding all else constant, the current (X0 USD/AUD) spot rate would Fisher Approach; decrease Asset Market Approach; decrease Asset Market Approach; increase Fisher Approach; increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts