Question: i got this question from a paper and not have other information about the question. Question No.5 (6 Marks) Suppose Habib Gulzar Ltd. had purchased

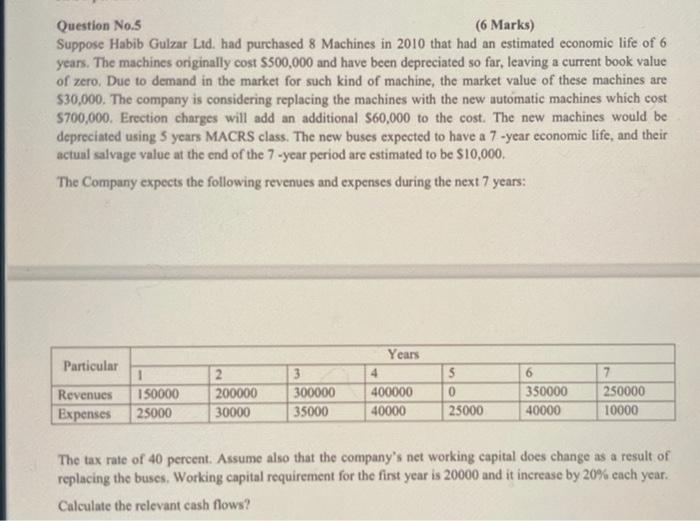

Question No.5 (6 Marks) Suppose Habib Gulzar Ltd. had purchased 8 Machines in 2010 that had an estimated economic life of 6. years. The machines originally cost $300,000 and have been depreciated so far, leaving a current book value of zero. Due to demand in the market for such kind of machine, the market value of these machines are $30,000. The company is considering replacing the machines with the new automatic machines which cost $700,000. Erection charges will add an additional $60,000 to the cost. The new machines would be depreciated using 5 years MACRS class. The new buses expected to have a 7 -year economic life, and their actual salvage value at the end of the 7 -year period arc estimated to be $10,000, The Company expects the following revenues and expenses during the next 7 years: Years Particular 4 Revenues Expenses 1 150000 25000 2 200000 30000 3 300000 35000 400000 40000 5 0 25000 6 350000 40000 7 250000 10000 The tax rate of 40 percent. Assume also that the company's net working capital does change as a result of replacing the buses. Working capital requirement for the first year is 20000 and it increase by 20% cach year. Calculate the relevant cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts