Question: i got this wrong and i dont know what i did At the beginning of 2022 , Robotics incorporated acquired a manufacturing facility for $12.3

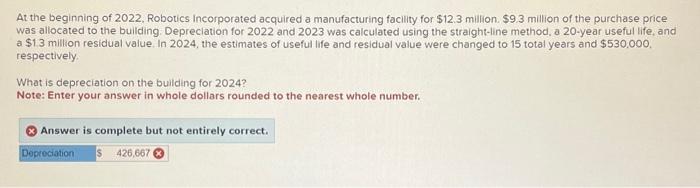

At the beginning of 2022 , Robotics incorporated acquired a manufacturing facility for $12.3 million. $9.3 million of the purchase price was allocated to the buliding. Depreclation for 2022 and 2023 was calculated using the straight-line method, a 20-year useful life, and a $1.3 million residual value. In 2024 , the estimates of useful life and residual value were changed to 15 total years and $530.000. respectively. What is depreciation on the building for 2024 ? Note: Enter your answer in whole dollars rounded to the nearest whole number. At the beginning of 2022 , Robotics incorporated acquired a manufacturing facility for $12.3 million. $9.3 million of the purchase price was allocated to the buliding. Depreclation for 2022 and 2023 was calculated using the straight-line method, a 20-year useful life, and a $1.3 million residual value. In 2024 , the estimates of useful life and residual value were changed to 15 total years and $530.000. respectively. What is depreciation on the building for 2024 ? Note: Enter your answer in whole dollars rounded to the nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts