Question: I had a answer, but I need the process to get those answer. FX Futures and Options (Chapter 5) Please answer the next three questions

I had a answer, but I need the process to get those answer.

FX Futures and Options (Chapter 5)

Please answer the next three questions based on the closing December futures contract prices for SF for four consecutive days in August. You sold two SF futures contract at the closing price on 8/01. Each SF futures contract requires the delivery of SF 125,000. Suppose the initial and maintenance margin for each SF futures contract are $1,500 and $1,000, respectively. Assume that you do not withdraw from your margin account during this period, but that you do meet your margin call if you get one.

Date 8/01 8/02 8/03 8/04

Closing SF Spot Price $0.7579 $0.7527 $0.7588 $0.7580

Closing December SF

Futures Contract Price $0.7750 $0.7782 $0.7827 $0.7713

1. The profit / loss posted to your account at the close of 8/02 is:.

A. $400

B. - $400

C. - $800

D. - $6,375

2. Assuming that you meet your margin calls, if you get any, please estimate how much money you will have in your margin account at the close of the trading day on 8/04:

A. $1,075

B. $3,925

C. $3,000

D. $5,850

3. On 8/02 you will ____ a margin call, on 8/03 you will ____ a margin call, and on 8/04 you will ____ a

margin call from the exchange

A. get; not get; get

B. not get; get; not get

C. get; get; not get

D. get; get; get

Please answer the next two questions below based on the closing spot and the December futures contract prices for euros for four consecutive days in August. No calculations are necessary.

Date 8/01 8/02 8/03 8/04

Closing euro Spot Price $1.1585 $1.1589 $1.1584 $1.1593

Closing December euro

Futures Contract Price $1.1850 $1.1812 $1.1823 $1.1820

4. If a person bought euro futures on _____ then he/she will post a profit on ____ :

A. 8/02; 8/03

B. 8/03; 8/04

5. Based on the closing price on 8/04, you should have taken a _____ on 8/03 in the futures contract:

A. long position

B. short position

6. Assume that an investor purchased a put option on BP with an exercise price of $1.900 for $0.0215 per unit. There are 31,250 units in a BP options contract.. At the time of the option expiration date, the spot price for BP was $1.885. What was the net profit/loss on this option to the investor?

A. -$203.125

B. -$671.875

C. $468.750

D. $1,140.625

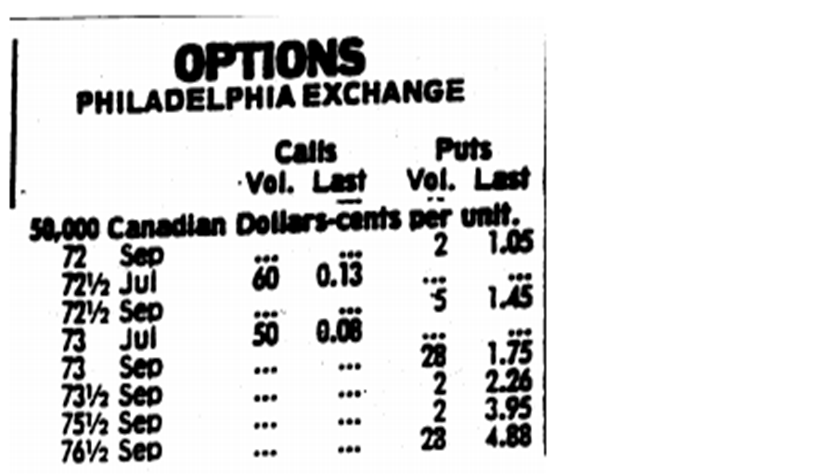

For the next three questions please refer to the attached quotes on currency options contracts for Canadian Dollars (CD). Each contract has 50,000 CDs.

7. If spot price for CD is $ 0.7275, which one of the following options is out-of-the-money?

A. 72 Jul Call

B. 73 Jul Call

C. 73 Sep Put

D. 73 Sep Put

8. The cost of buying one CD call options contract with an exercise price of $0.725 which expires on the 3rd Wednesday of July is:

A. $0.13

B. $50.00

C. $65.00

D. $6,500.00

9. For the buyer of one CD 76 Sep Put contract, calculate the net profit or loss on the expiration date, when the spot price for CD is $0.72

A. -$190

B. -$2,440

C. -$2,250

D. $2,250

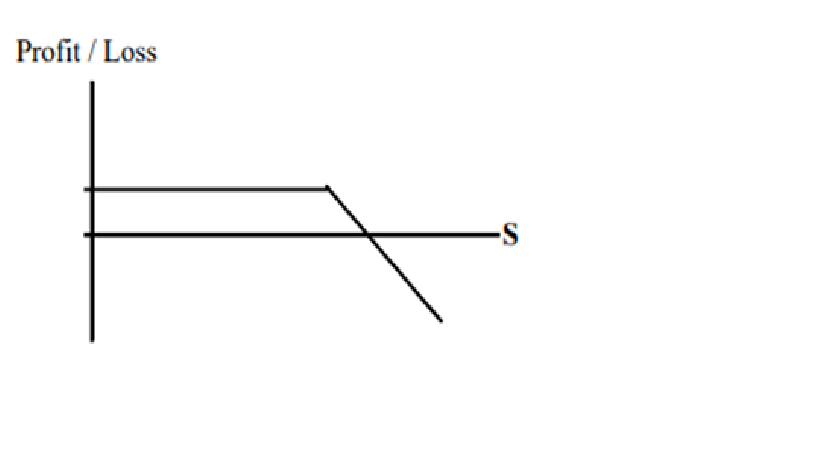

10. The above payoff diagram belongs to the

A. buyer of a call option

B. seller of a call option

C. buyer of a put option

D. seller of a put option

OPTIONS PHILADELPHIA EXCHANGE Calls PUts Vol. Last Vol. Last Sa00 Canadian Dollars cents per untt. 60 0.13 ...* 2 Sep 72 Jul 72% Sep 73 Jul 73 Seo 73'h Sep 75% Sep 76V2 Sep 0.08 234488 Profit/Loss OPTIONS PHILADELPHIA EXCHANGE Calls PUts Vol. Last Vol. Last Sa00 Canadian Dollars cents per untt. 60 0.13 ...* 2 Sep 72 Jul 72% Sep 73 Jul 73 Seo 73'h Sep 75% Sep 76V2 Sep 0.08 234488 Profit/Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts