Question: I had a question about why r was divided by 2 and n was multiplied by 2. Is it because the problem says semiannual? Thank

I had a question about why r was divided by 2 and n was multiplied by 2. Is it because the problem says semiannual? Thank you in advance.

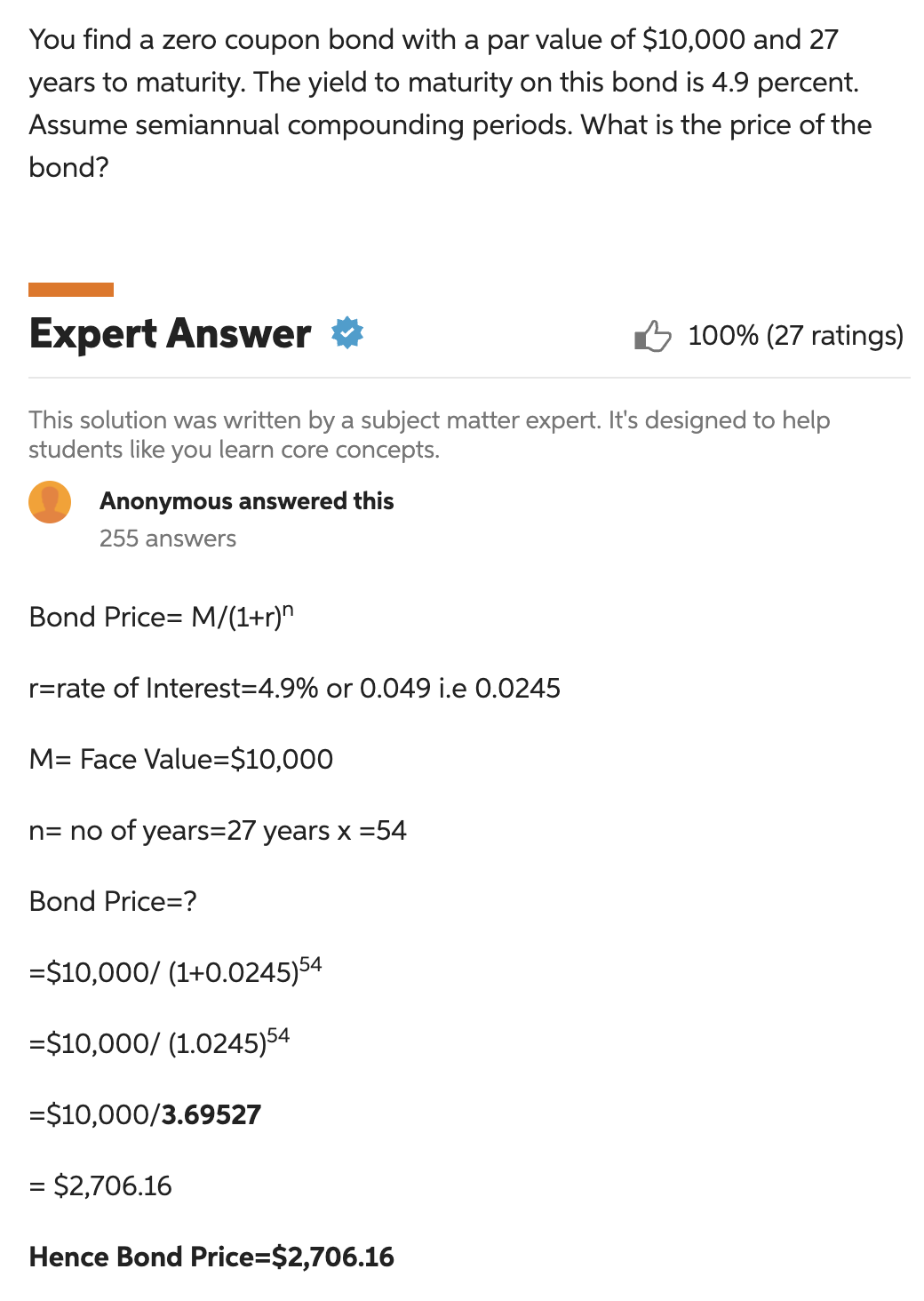

You find a zero coupon bond with a par value of $10,000 and 27 years to maturity. The yield to maturity on this bond is 4.9 percent. Assume semiannual compounding periods. What is the price of the bond? Expert Answer 100% (27 ratings This solution was written by a subject matter expert. It's designed to help students like you learn core concepts. Anonymous answered this 255 answers Bond Price =M/(1+r)n r= rate of Interest =4.9% or 0.049 i.e 0.0245 M= Face Value =$10,000 n= no of years =27 years x=54 Bond Price = ? =$10,000/(1+0.0245)54 =$10,000/(1.0245)54 =$10,000/3.69527 =$2,706.16 Hence Bond Price =$2,706.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts