Question: I have a question and a solution to the question as in the 2 pictures below. Can you explain this solution (without using the Black

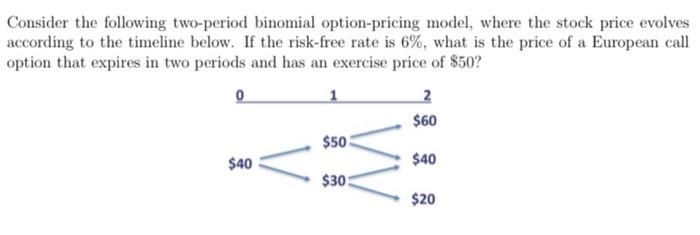

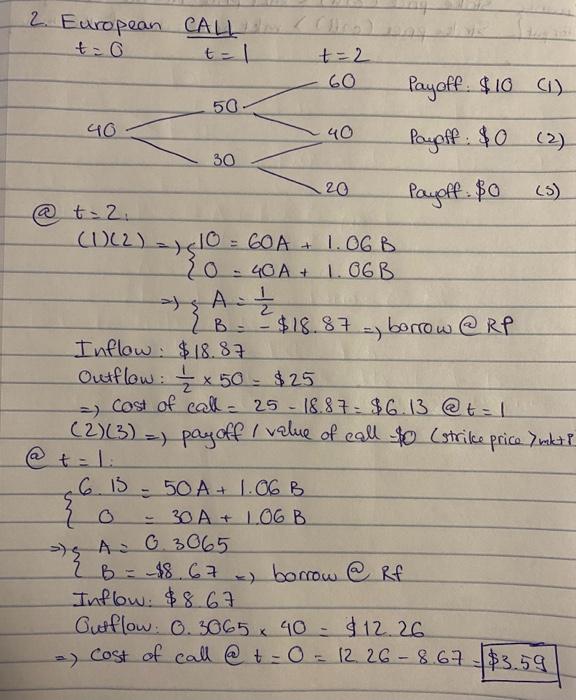

Consider the following two-period binomial option-pricing model, where the stock price evolves according to the timeline below. If the risk-free rate is 6%, what is the price of a European call option that expires in two periods and has an exercise price of $50 ? 2. European CALL t=0t11+2 Payoff: $10 (i) Payaff: $0 (2) Payoff: $0 (S) (a) t=2 : (1)(2){10=60A+1.06B0=40A+1.06B{A=21B=$18.87borrow@RP Inflow: $18.87 Outflow: 2150=$25 cost of call =2518.87=$6.13 @ t=1 (2)(3) pay off / value of eall $0 (strike price 7 mlt (a) t=1 : {6.B=50A+1.06B0=30A+1.06BA=0.3065B=$8.67borrow@Rf Inflow: $8.67 Outflow: 0.306540=$12.26 cost of call t=0=12.268.67=$3.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts