Question: I have a question regarding Problem #2 b). inal S File Insert Draw Design Layout References Mailings Review View Help Home Times New Roman 10

I have a question regarding Problem #2 b).

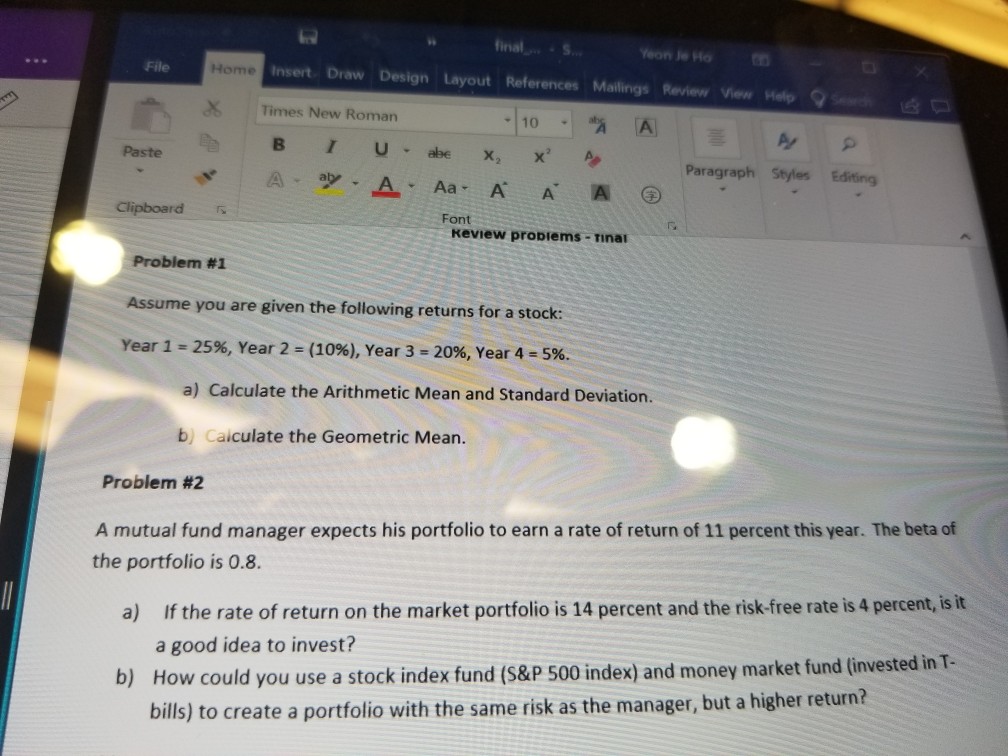

inal S File Insert Draw Design Layout References Mailings Review View Help Home Times New Roman 10 A Paste Paragraph Styles Editing Clipboard Font Keview propiems-Tinai Problem #1 Assume you are given the following returns for a stock: 25%, Year 2 = (10%), Year 3-20%, Year 4-5%. a) Calculate the Arithmetic Mean and Standard Deviation. b) Calculate the Geometric Mean. Year 1 Problem #2 A mutual fund manager expects his portfolio to earn a rate of return of 11 percent this year. The beta of the portfolio is 0.8. a) If the rate of return on the market portfolio is 14 percent and the risk-free rate is 4 percent, is it a good idea to invest? How could you use a stock index fund (S&P 500 index) and money market fund (invested in T- bills) to create a portfolio with the same risk as the manager, but a higher returni? b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts