Question: i have added the case study already CASE STUDY FRIENDS INVESTMENT BANK LTD The Case of a friendly Board This case is about an imaginary

i have added the case study already

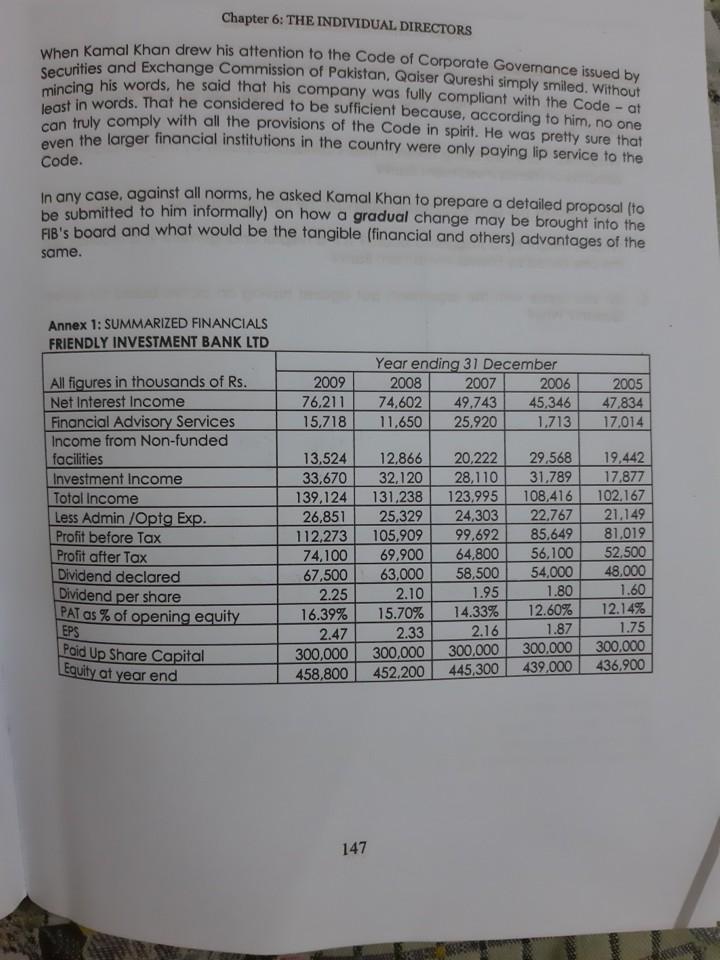

CASE STUDY FRIENDS INVESTMENT BANK LTD The Case of a friendly Board This case is about an imaginary bank, using imaginary data and characters. It has been prepared for classroom discussion on such areas as the role of non-executive directors, the impact of a dominant personality on performance of a company and the pitfalls of having one person hold both the top positions in a company. Any resemblance of details given in this case to any real company or person is purely coincidental and unintended. It took Kamal Khan over five hours of intense thinking and research to come up with a six line memo for his bank's chairman. After reading the memo for umpteenth time, he finally decided not to submit a memo at all. He was aware that Qaiser Qureshi, chairman and chief executive officer of Friends Investment Bank Ltd (FIB) was allergic to having papers in his files that showed dissent, however well intentioned it may be. Talking to Qaiser Qureshi was easy: opposing his views at a one-to-one meeting didn't pose much of a problem either, but writing him a memo stating that you differ from him on a given issue was not something that particularly pleased the chairman Three of the bank's directors were retiring at the end of the next quarter. Ahmad Ali. Dilawar Dar and Haji Habib were decent people but held no more than 500 shares in the bank. Their appointment to the board of Friends Investment Bank was largely due to their close friendship with Qaiser Qureshi. Ahmad Ali was a retired civil servant, Dilawar Dar was a retired engineer and Haji riabib was a property developer based in Dubai who seldom attended any board meetings, As far as Kamal Khan, the Chief Operating Officer and Executive Director of Friends Investment Bank was concerned, these gentlemen made no contribution whatsoever to the affairs of the bank. They came to the meetings when invited, always agreed with whatever was proposed by the management, or more particularly by Qaiser Qureshi. and never took any meaningful part in the board's discussions. In fact, it was Kamal Khan's observation that average duration of FIB's board meetings was around 30 minutes, excluding the time for tea break which was often longer than the meeting itself FIB's board was what is known commonly as a staggered board. It had nine members: each held office for three years at a time. Each year three directors retired, and were almost always reelected. Kamal Khan was elected a director a year ago when the previous COQ left to join another bank. Kamal Khan was of the opinion that Messrs Ahmad Ali. Dilawer Bar and Haji Habib did not deserve re-election. He had very good reasons to support his view point, but the real problem was to convey that view point to Qaiser Qureshi without offending him i.e. without jeopardizing Kamal's own employment with FIB. 143 Cheif openely office History of Friends Investment Bank Friends Investment Bank was founded in mid eighties. It was not hugely successful. Its promoters, an industrial group, expected to get it converted into a commercial bork within five years. When they found out that this was not likely to happen, they los interest in it. By end 1991, the bank's Profit & Loss showed a small accumulated los. that time, the sponsors held only 52% of the bank's shares, the rest were held in smal numbers by a large number of individual investors. Only NIT held a sizeable percentage of its shares and but even they were not interested in nominating a director on Files board. In 1992. Qaiser Qureshi, the then SEVP of the bank, bought all the 52% shares from the bank's original owners. He was assisted in this takeover by a Middle East based friend. The bank's president was asked to resign and Qaiser Qureshi assumed the office of the CEO and vice chairman of the board. In mid-1995, he was able to buy back the shares from his Middle East friend and became the chairman of the bank. In 1992, the bank's share sold at Rs 9.85 at the KSE, in 1995 it had risen to Rs. 10.50 and in June 2007 it was quoted at Rs. 14.50. Financial Performance of the Bank Over the past eight or so years, the bank had made modest profits but was regular in paying dividends. The volume of trading in FIB's shares at the KSE was generally not large. At end 2007, the bank's paid up share capital consisted of Rs 300 million, divided into 30 million shares. 57% of the bank's shares were held by Qaiser Qureshi and his family while NIT held 8% and the rest were distributed among some 1.520 shareholders. The book value of the bank's share was Rs 16.12 at the end of 2007. One of the reasons that had prompted Kamal Khan to accept an employment with Friends Investment Bank was his opinion of the bank's tremendous growth potential He remarkably consistent. A small but steady growth was maintained in both profits and dividend payments. Yet in his 16 months stay in the bank, he had noticed no desire on the part of the bank's management to expand its operations and seek new avenues of earning revenue. The main sources of income to the bank were net interest/mark up, financial advisory services. underwritings and related services (called non-funded facilities), and return ost financial statements was the fact that while the Profit Before Tax and Return on Equity figures were fairty cansistent over the years, the composition of bank's PBT differes significantly from year to year. For example, income from financial advisory services, 2006. On his inquiry, Malik Majid, the bank's CFO, had told him in a meaningful tone that Mr Qureshi does not like to inflict surprises on his shareholders and depositors. Board's Structure who were all classified as independent directors. The chief executive officer (Qaiser The board had nine members: three executive directors and six non-executive directors Qureshi). the chief operating officer (Kamal Khan) and chief financial officer (Majid Malik) were the executive directors. Kamal Khan had joined this bank only last year after serving another investment bank for over 10 years. At 43, Kamal Khan was the youngest member of the board. Malik Majid had been promoted as CFO when Qaiser Qureshi assumed the presidency of the bank in 1992. He was a chartered accountant with over 35 years banking and finance experience. However, now at 63 years of age. he was neither active nor very efficient. He was able to retain his job mainly because he enjoyed the trust of the chairman and CEO. bank's equity and required the approval of the board. The proposal had been hastily and unverified information. Again, spinning was not exactly the hottest sector of the by the board; but to his surprise it was approved without any discussion. Kamal had Textile industry at the time. Kamal was quite certain that the proposal will be shot down leared that this guarantee will soon be called, exposing the bank to serious Cashflow Droblems. This happened within three months. The bank ended up creating a forced Chapter 6: THE INDIVIDUAL DIRECTORS in addition to three directors who were deve the tice at the end of the next quarter, the other three "independent" directors were Bashir Baig, Jamil Jaffri and Dr Nasima Naqvi. Bashir Baig was a building contractor who had served for about two years as a cashier in a nationalized bank at the early stage of his career. This fact was prominently splashed in his bio-data as comprehensive exposure to banking at operational level. Jamil Jaffri was a now-not-so-famous actor who was more interested in narrating tales of his female conquests than to pay any attention to the agenda items at board meetings. Dr Nasima Naqvi, a distant cousin of Mr Qureshi, was a professor of chemistry at a government college. Board Proceedings The board was run single-handedly by Qaiser Qureshi. He did not believe in bothering the board with any information that in his opinion did not concern them. Board meetings were generally of less than one hour duration. With the change in SECP regulations, FIB had started holding quarterly meetings, yet there was no change in the manner of the meetings' conduct. Proceedings were strictly regulated. Kamal Khan had noticed none of the six so called independent directors took any pain to engage in any discussion whatsoever. And he didn't really blame them either. These directors were paid a fee of only Rs 1,000 for the attending the meeting. Perhaps, they were justified in thinking that their views and professional advice merited a payment much larger than the measly fee being paid to them. be funt board meeting that was attended by Kamal Khan had a proposal for issuing a bank guarantee to a spinning mill. The amount of guarantee was quite close to 20% of 145 Chapter 6: THE INDIVIDUAL DIRECTORS loan account against very inadequate security. While technically the Bonk die suffer a loss and the loan was now being regularly serviced by the client, it was Qalser Qureshi firmly believed that as long as he was showing a profit, keeping party had any right to pry into the affairs of the bank. He did not think much of the assets of the bank safe and paying a decent dividend each year, no investor of ou colber of his board members - neither did he want them to have any real abilities person and board members found it difficult to differ with him. It was his philosophy that He was essentially an honest and hard working man. He was also a very persuasive success requires hormony at decision-making forums. While he was prepared to discus any issue in a one-to-one meeting, he was not tolerant of dissent memos or opposing When Kamal Khan finally gathered courage to put forward his views to Qaiser Qureshi he was pleasantly surprised. He was told by Qaiser Qureshi that he was already aware of all the points enumerated by Kamal in favor of an active board, but on balance he considered such a board more of a burden than a help. "First of all," said the chairman was futile to expect any real contribution from directors when they were being paid only Rs. 1.000 per meeting. Paying them huge salary would simply curtail the bank's profits while the benefits will arrive much, much later." He was also of the view that it would be very difficult, if not impossible, to find suitable applicants. had handpicked oll the six "independent" directors to ensure that he faced no duet transaction to have entered into. Qalser Qureshi's Stye of Management at the board meeting views being put forward at formal meetings. Kamal Khan's Dilemma Kamal Khan had an MBA in finance and had attended several courses in bank management as well as corporate governance. He believed in a greater and more effective role of the board. He had no doubts about the personal integrity and intentions of his chairman, but he differed with his attitude towards the board. He was convinced that a better selection of directors could greatly assist the bank in expanding its operations and improving its profits. He wanted to use the up-coming elections to bring in three truly independent directors who had the right blend of experience, knowledge and connections to promote the bank's business. He had spent five hours drafting a proposal, outlining the advantages of a truly independent and effective board, but in his attempt to ensure that the contents were politicaly correct he had ended up with only a six line memo. After reading that memo for several times, he decided to bring the matter up with the chairman in a personal meeting. The Meeting 146 Securities and Exchange Commission of Pakistan, Qaiser Qureshi simply smiled. Without mincing his words, he said that his company was fully compliant with the Code - at Chapter 6: THE INDIVIDUAL DIRECTORS least in words. That he considered to be sufficient because, according to him, no one even the larger financial institutions in the country were only paying lip service to the Code. in any case against all norms, he asked Kamal Khan to prepare a detailed proposal (to be submitted to him informally) on how a gradual change may be brought into the FIB's board and what would be the tangible (financial and others) advantages of the same. Annex 1: SUMMARIZED FINANCIALS FRIENDLY INVESTMENT BANK LTD 2009 76,211 15.718 Year ending 31 December 2008 2007 2006 74,602 49.743 45.346 11.650 25.920 1.713 2005 47.834 17.014 All figures in thousands of Rs. Net Interest Income Financial Advisory Services Income from Non-funded facilities Investment income Total Income Less Admin/Optg Exp. Profit before Tax Profit after Tax Dividend declared Dividend per share PAT as % of opening equity EPS Poid Up Share Capital Equity at year end 13.524 33,670 139.124 26,851 112,273 74,100 67,500 2.25 16.39% 2.47 300,000 458,800 12.866 32.120 131,238 25,329 105,909 69,900 63,000 2.10 15.70% 2.33 300,000 452,200 20,222 28.110 123.995 24,303 99,692 64,800 58,500 1.95 14.33% 2.16 300.000 445,300 29,568 31,789 108.416 22.767 85.649 56,100 54,000 1.80 12.60% 1.87 300.000 439.000 19,442 17.877 102.167 21.149 81,019 52.500 48.000 1.60 12.14% 1.75 300,000 436,900 147 B Chapter 6: THE INDIVIDUAL DIRECTORS Questions for discussion 1. Prepare the informal memo that Kamal Khan has been asked to submit to Qaiser Qureshi. 2. What risks, if any, are being taken in their individual capacity by the six independent directors of Friends Investment Bank 3. Where would you place the responsibility for the ineffectiveness of the Board? Why? 4. What is meant by a staggered board Is it a helpful arrangement in a situation like the one faced by Friends Investment Bank 5. Do you agree with the arguments put against having an active board by Qaiser Qureshi? Why? CASE STUDY FRIENDS INVESTMENT BANK LTD The Case of a friendly Board This case is about an imaginary bank, using imaginary data and characters. It has been prepared for classroom discussion on such areas as the role of non-executive directors, the impact of a dominant personality on performance of a company and the pitfalls of having one person hold both the top positions in a company. Any resemblance of details given in this case to any real company or person is purely coincidental and unintended. It took Kamal Khan over five hours of intense thinking and research to come up with a six line memo for his bank's chairman. After reading the memo for umpteenth time, he finally decided not to submit a memo at all. He was aware that Qaiser Qureshi, chairman and chief executive officer of Friends Investment Bank Ltd (FIB) was allergic to having papers in his files that showed dissent, however well intentioned it may be. Talking to Qaiser Qureshi was easy: opposing his views at a one-to-one meeting didn't pose much of a problem either, but writing him a memo stating that you differ from him on a given issue was not something that particularly pleased the chairman Three of the bank's directors were retiring at the end of the next quarter. Ahmad Ali. Dilawar Dar and Haji Habib were decent people but held no more than 500 shares in the bank. Their appointment to the board of Friends Investment Bank was largely due to their close friendship with Qaiser Qureshi. Ahmad Ali was a retired civil servant, Dilawar Dar was a retired engineer and Haji riabib was a property developer based in Dubai who seldom attended any board meetings, As far as Kamal Khan, the Chief Operating Officer and Executive Director of Friends Investment Bank was concerned, these gentlemen made no contribution whatsoever to the affairs of the bank. They came to the meetings when invited, always agreed with whatever was proposed by the management, or more particularly by Qaiser Qureshi. and never took any meaningful part in the board's discussions. In fact, it was Kamal Khan's observation that average duration of FIB's board meetings was around 30 minutes, excluding the time for tea break which was often longer than the meeting itself FIB's board was what is known commonly as a staggered board. It had nine members: each held office for three years at a time. Each year three directors retired, and were almost always reelected. Kamal Khan was elected a director a year ago when the previous COQ left to join another bank. Kamal Khan was of the opinion that Messrs Ahmad Ali. Dilawer Bar and Haji Habib did not deserve re-election. He had very good reasons to support his view point, but the real problem was to convey that view point to Qaiser Qureshi without offending him i.e. without jeopardizing Kamal's own employment with FIB. 143 Cheif openely office History of Friends Investment Bank Friends Investment Bank was founded in mid eighties. It was not hugely successful. Its promoters, an industrial group, expected to get it converted into a commercial bork within five years. When they found out that this was not likely to happen, they los interest in it. By end 1991, the bank's Profit & Loss showed a small accumulated los. that time, the sponsors held only 52% of the bank's shares, the rest were held in smal numbers by a large number of individual investors. Only NIT held a sizeable percentage of its shares and but even they were not interested in nominating a director on Files board. In 1992. Qaiser Qureshi, the then SEVP of the bank, bought all the 52% shares from the bank's original owners. He was assisted in this takeover by a Middle East based friend. The bank's president was asked to resign and Qaiser Qureshi assumed the office of the CEO and vice chairman of the board. In mid-1995, he was able to buy back the shares from his Middle East friend and became the chairman of the bank. In 1992, the bank's share sold at Rs 9.85 at the KSE, in 1995 it had risen to Rs. 10.50 and in June 2007 it was quoted at Rs. 14.50. Financial Performance of the Bank Over the past eight or so years, the bank had made modest profits but was regular in paying dividends. The volume of trading in FIB's shares at the KSE was generally not large. At end 2007, the bank's paid up share capital consisted of Rs 300 million, divided into 30 million shares. 57% of the bank's shares were held by Qaiser Qureshi and his family while NIT held 8% and the rest were distributed among some 1.520 shareholders. The book value of the bank's share was Rs 16.12 at the end of 2007. One of the reasons that had prompted Kamal Khan to accept an employment with Friends Investment Bank was his opinion of the bank's tremendous growth potential He remarkably consistent. A small but steady growth was maintained in both profits and dividend payments. Yet in his 16 months stay in the bank, he had noticed no desire on the part of the bank's management to expand its operations and seek new avenues of earning revenue. The main sources of income to the bank were net interest/mark up, financial advisory services. underwritings and related services (called non-funded facilities), and return ost financial statements was the fact that while the Profit Before Tax and Return on Equity figures were fairty cansistent over the years, the composition of bank's PBT differes significantly from year to year. For example, income from financial advisory services, 2006. On his inquiry, Malik Majid, the bank's CFO, had told him in a meaningful tone that Mr Qureshi does not like to inflict surprises on his shareholders and depositors. Board's Structure who were all classified as independent directors. The chief executive officer (Qaiser The board had nine members: three executive directors and six non-executive directors Qureshi). the chief operating officer (Kamal Khan) and chief financial officer (Majid Malik) were the executive directors. Kamal Khan had joined this bank only last year after serving another investment bank for over 10 years. At 43, Kamal Khan was the youngest member of the board. Malik Majid had been promoted as CFO when Qaiser Qureshi assumed the presidency of the bank in 1992. He was a chartered accountant with over 35 years banking and finance experience. However, now at 63 years of age. he was neither active nor very efficient. He was able to retain his job mainly because he enjoyed the trust of the chairman and CEO. bank's equity and required the approval of the board. The proposal had been hastily and unverified information. Again, spinning was not exactly the hottest sector of the by the board; but to his surprise it was approved without any discussion. Kamal had Textile industry at the time. Kamal was quite certain that the proposal will be shot down leared that this guarantee will soon be called, exposing the bank to serious Cashflow Droblems. This happened within three months. The bank ended up creating a forced Chapter 6: THE INDIVIDUAL DIRECTORS in addition to three directors who were deve the tice at the end of the next quarter, the other three "independent" directors were Bashir Baig, Jamil Jaffri and Dr Nasima Naqvi. Bashir Baig was a building contractor who had served for about two years as a cashier in a nationalized bank at the early stage of his career. This fact was prominently splashed in his bio-data as comprehensive exposure to banking at operational level. Jamil Jaffri was a now-not-so-famous actor who was more interested in narrating tales of his female conquests than to pay any attention to the agenda items at board meetings. Dr Nasima Naqvi, a distant cousin of Mr Qureshi, was a professor of chemistry at a government college. Board Proceedings The board was run single-handedly by Qaiser Qureshi. He did not believe in bothering the board with any information that in his opinion did not concern them. Board meetings were generally of less than one hour duration. With the change in SECP regulations, FIB had started holding quarterly meetings, yet there was no change in the manner of the meetings' conduct. Proceedings were strictly regulated. Kamal Khan had noticed none of the six so called independent directors took any pain to engage in any discussion whatsoever. And he didn't really blame them either. These directors were paid a fee of only Rs 1,000 for the attending the meeting. Perhaps, they were justified in thinking that their views and professional advice merited a payment much larger than the measly fee being paid to them. be funt board meeting that was attended by Kamal Khan had a proposal for issuing a bank guarantee to a spinning mill. The amount of guarantee was quite close to 20% of 145 Chapter 6: THE INDIVIDUAL DIRECTORS loan account against very inadequate security. While technically the Bonk die suffer a loss and the loan was now being regularly serviced by the client, it was Qalser Qureshi firmly believed that as long as he was showing a profit, keeping party had any right to pry into the affairs of the bank. He did not think much of the assets of the bank safe and paying a decent dividend each year, no investor of ou colber of his board members - neither did he want them to have any real abilities person and board members found it difficult to differ with him. It was his philosophy that He was essentially an honest and hard working man. He was also a very persuasive success requires hormony at decision-making forums. While he was prepared to discus any issue in a one-to-one meeting, he was not tolerant of dissent memos or opposing When Kamal Khan finally gathered courage to put forward his views to Qaiser Qureshi he was pleasantly surprised. He was told by Qaiser Qureshi that he was already aware of all the points enumerated by Kamal in favor of an active board, but on balance he considered such a board more of a burden than a help. "First of all," said the chairman was futile to expect any real contribution from directors when they were being paid only Rs. 1.000 per meeting. Paying them huge salary would simply curtail the bank's profits while the benefits will arrive much, much later." He was also of the view that it would be very difficult, if not impossible, to find suitable applicants. had handpicked oll the six "independent" directors to ensure that he faced no duet transaction to have entered into. Qalser Qureshi's Stye of Management at the board meeting views being put forward at formal meetings. Kamal Khan's Dilemma Kamal Khan had an MBA in finance and had attended several courses in bank management as well as corporate governance. He believed in a greater and more effective role of the board. He had no doubts about the personal integrity and intentions of his chairman, but he differed with his attitude towards the board. He was convinced that a better selection of directors could greatly assist the bank in expanding its operations and improving its profits. He wanted to use the up-coming elections to bring in three truly independent directors who had the right blend of experience, knowledge and connections to promote the bank's business. He had spent five hours drafting a proposal, outlining the advantages of a truly independent and effective board, but in his attempt to ensure that the contents were politicaly correct he had ended up with only a six line memo. After reading that memo for several times, he decided to bring the matter up with the chairman in a personal meeting. The Meeting 146 Securities and Exchange Commission of Pakistan, Qaiser Qureshi simply smiled. Without mincing his words, he said that his company was fully compliant with the Code - at Chapter 6: THE INDIVIDUAL DIRECTORS least in words. That he considered to be sufficient because, according to him, no one even the larger financial institutions in the country were only paying lip service to the Code. in any case against all norms, he asked Kamal Khan to prepare a detailed proposal (to be submitted to him informally) on how a gradual change may be brought into the FIB's board and what would be the tangible (financial and others) advantages of the same. Annex 1: SUMMARIZED FINANCIALS FRIENDLY INVESTMENT BANK LTD 2009 76,211 15.718 Year ending 31 December 2008 2007 2006 74,602 49.743 45.346 11.650 25.920 1.713 2005 47.834 17.014 All figures in thousands of Rs. Net Interest Income Financial Advisory Services Income from Non-funded facilities Investment income Total Income Less Admin/Optg Exp. Profit before Tax Profit after Tax Dividend declared Dividend per share PAT as % of opening equity EPS Poid Up Share Capital Equity at year end 13.524 33,670 139.124 26,851 112,273 74,100 67,500 2.25 16.39% 2.47 300,000 458,800 12.866 32.120 131,238 25,329 105,909 69,900 63,000 2.10 15.70% 2.33 300,000 452,200 20,222 28.110 123.995 24,303 99,692 64,800 58,500 1.95 14.33% 2.16 300.000 445,300 29,568 31,789 108.416 22.767 85.649 56,100 54,000 1.80 12.60% 1.87 300.000 439.000 19,442 17.877 102.167 21.149 81,019 52.500 48.000 1.60 12.14% 1.75 300,000 436,900 147 B Chapter 6: THE INDIVIDUAL DIRECTORS Questions for discussion 1. Prepare the informal memo that Kamal Khan has been asked to submit to Qaiser Qureshi. 2. What risks, if any, are being taken in their individual capacity by the six independent directors of Friends Investment Bank 3. Where would you place the responsibility for the ineffectiveness of the Board? Why? 4. What is meant by a staggered board Is it a helpful arrangement in a situation like the one faced by Friends Investment Bank 5. Do you agree with the arguments put against having an active board by Qaiser Qureshi? WhyStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock