Question: I have already answered Problem 1, I need Problem 2! Problem 1 Syndrome Co. began the month of June 2015 with 100 units in inventory

I have already answered Problem 1, I need Problem 2!

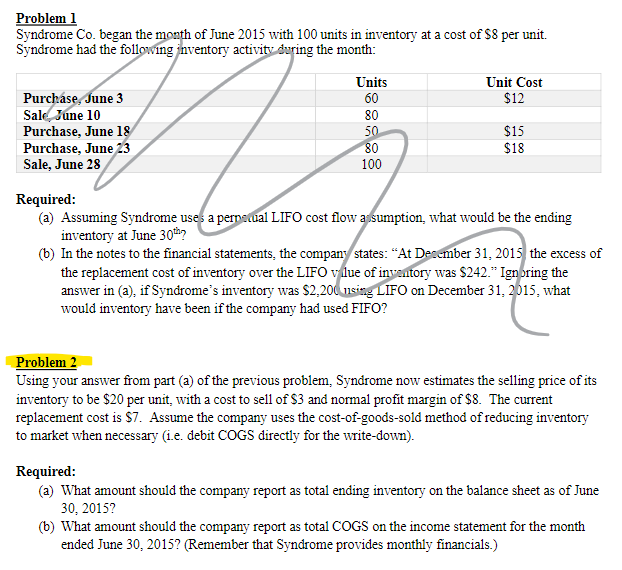

Problem 1 Syndrome Co. began the month of June 2015 with 100 units in inventory at a cost of $8 per unit. Syndrome had the following inventory activity during the month: Units Unit Cost 60 $12 Purchase, June 3 Sale, June 10 Purchase, June 18 Purchase, June 23 Sale, June 28 $15 $18 100 Required: (a) Assuming Syndrome usef a perpecual LIFO cost flow assumption, what would be the ending inventory at June 30th? (6) In the notes to the financial statements, the company states: "At December 31, 2015 the excess of the replacement cost of inventory over the LIFO vilue of inventory was $242." Ignoring the answer in (a), if Syndrome's inventory was $2,200 visiny LIFO on December 31, 2015, what would inventory have been if the company had used FIFO? Problem 2 Using your answer from part (a) of the previous problem, Syndrome now estimates the selling price of its inventory to be $20 per unit, with a cost to sell of $3 and normal profit margin of $8. The current replacement cost is $7. Assume the company uses the cost-of-goods-sold method of reducing inventory to market when necessary (1.e. debit COGS directly for the write-down). Required: (a) What amount should the company report as total ending inventory on the balance sheet as of June 30, 2015? (6) What amount should the company report as total COGS on the income statement for the month ended June 30, 2015? (Remember that Syndrome provides monthly financials.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts