Question: I have an answer sheet but I do not have calculations. Can you explain each journals(7-8-9-10) in detail? Question: Answers: EASY LTD Unadjusted Trial Balance

I have an answer sheet but I do not have calculations. Can you explain each journals(7-8-9-10) in detail? Question:

Answers:

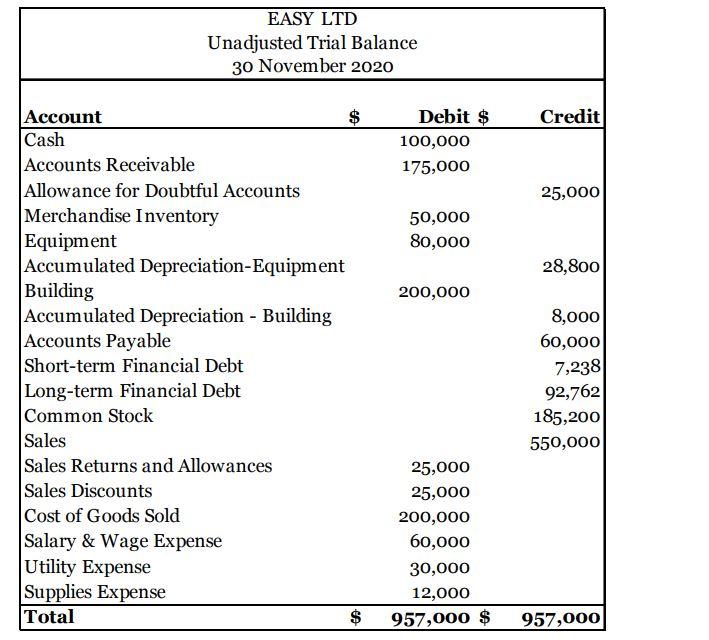

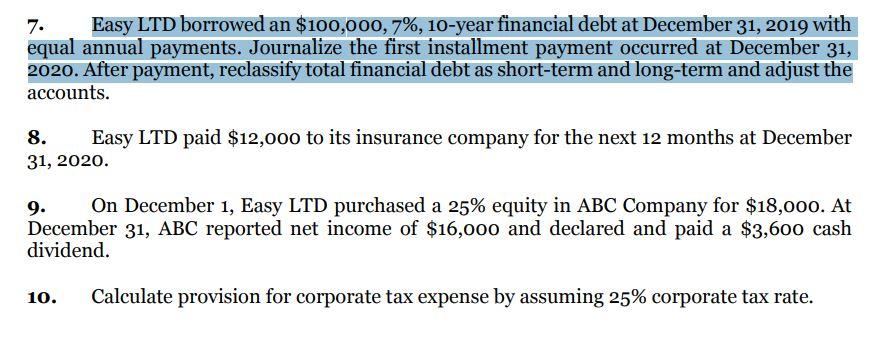

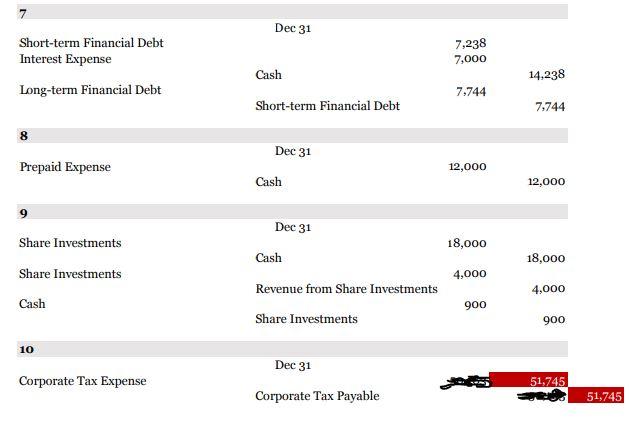

EASY LTD Unadjusted Trial Balance 30 November 2020 Account Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Equipment Accumulated Depreciation-Equipment Building Accumulated Depreciation - Building Accounts Payable Short-term Financial Debt Long-term Financial Debt Common Stock Sales Sales Returns and Allowances Sales Discounts Cost of Goods Sold Salary & Wage Expense Utility Expense Supplies Expense Total Debit $ Credit 100,000 175,000 25,000 50,000 80,000 28,800 200,000 8,000 60,000 7,238 92,762 185,200 550,000 25,000 25,000 200,000 60,000 30,000 12,000 $ 957,000 $ 957,000 7. Easy LTD borrowed an $100,000, 7%, 10-year financial debt at December 31, 2019 with equal annual payments. Journalize the first installment payment occurred at December 31, 2020. After payment, reclassify total financial debt as short-term and long-term and adjust the accounts. 8. Easy LTD paid $12,000 to its insurance company for the next 12 months at December 31, 2020. 9. On December 1, Easy LTD purchased a 25% equity in ABC Company for $18,000. At December 31, ABC reported net income of $16,000 and declared and paid a $3,600 cash dividend. 10. Calculate provision for corporate tax expense by assuming 25% corporate tax rate. Short-term Financial Debt Interest Expense Long-term Financial Debt 8 Prepaid Expense Share Investments Share Investments Cash 10 Corporate Tax Expense Dec 31 Cash Short-term Financial Debt Dec 31 Cash Dec 31 Cash Revenue from Share Investments Share Investments Dec 31 Corporate Tax Payable 7,238 7,000 7.744 12,000 18,000 4,000 900 14,238 7,744 12,000 18,000 4,000 900 51,745 51,745 EASY LTD Unadjusted Trial Balance 30 November 2020 Account Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Equipment Accumulated Depreciation-Equipment Building Accumulated Depreciation - Building Accounts Payable Short-term Financial Debt Long-term Financial Debt Common Stock Sales Sales Returns and Allowances Sales Discounts Cost of Goods Sold Salary & Wage Expense Utility Expense Supplies Expense Total Debit $ Credit 100,000 175,000 25,000 50,000 80,000 28,800 200,000 8,000 60,000 7,238 92,762 185,200 550,000 25,000 25,000 200,000 60,000 30,000 12,000 $ 957,000 $ 957,000 7. Easy LTD borrowed an $100,000, 7%, 10-year financial debt at December 31, 2019 with equal annual payments. Journalize the first installment payment occurred at December 31, 2020. After payment, reclassify total financial debt as short-term and long-term and adjust the accounts. 8. Easy LTD paid $12,000 to its insurance company for the next 12 months at December 31, 2020. 9. On December 1, Easy LTD purchased a 25% equity in ABC Company for $18,000. At December 31, ABC reported net income of $16,000 and declared and paid a $3,600 cash dividend. 10. Calculate provision for corporate tax expense by assuming 25% corporate tax rate. Short-term Financial Debt Interest Expense Long-term Financial Debt 8 Prepaid Expense Share Investments Share Investments Cash 10 Corporate Tax Expense Dec 31 Cash Short-term Financial Debt Dec 31 Cash Dec 31 Cash Revenue from Share Investments Share Investments Dec 31 Corporate Tax Payable 7,238 7,000 7.744 12,000 18,000 4,000 900 14,238 7,744 12,000 18,000 4,000 900 51,745 51,745

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts