Question: I have an assignment which is called a Technology Project ? I will attached you the sample paper can you please go through that and

I have an assignment which is called a Technology Project ? I will attached you the sample paper can you please go through that and follow the same instructions :1. In this assignment, Can you please consider as the owner of the CPA firm and recommend AIS products to the customer and can you please compose a proposal for utopia ? After that can you please develop or compose this paper using the following layout : Section 1 (Business Problem): Can you please give a narrative regarding the current business problem and how automation may or may not address the problem ?

Section 2 (Core System Requirements): Can you please provide the specific requirements (input, output, & control) as required for each of the respective functions (billing, collections, and payments) ?

Section 3 (Outsourcing Considerations): Can you please identify functions, besides payroll, that may be prime candidates for outsourcing. For those functions selected for outsourcing, can you please explain why they are, the possible benefits, and potential concerns ?

Section 4 (Recommended System Selection): Can you please recommend a PC-based accounting system to support your new system. In developing your recommendation, start with a general overview of the systems. Next, you will discuss the system's relative strengths & weaknesses and why you recommend it. Also, you will guide a migration plan (direct cutover migration, parallel migration, or pilot/phase migration) for implementing the solution ? Section 5 (Use of Microsoft Office and Other Tools): Can you please go through that link and provide how the use of tools such as Microsoft 365 (https://www.microsoft.com/en-us/microsoft-365/business/compare-all-microsoft-365-business-products?&activetab=tab:primaryr2) can be used to supplement the billing, collections, payments, and reporting activities for the HOA ?

Section 6 (Impact of Technology Advances): Can you please share how advances in technology, such as robotic processing automation (RPA), blockchain, artificial intelligence (Al), or data analytics, may be used in conjunction with your recommended AIS. Be sure that you identify the technologies being recommended ?

Section 7 (Challenges to Automation): Can you please identify and discuss at least three challenges in migrating to a new automated system ?

Section 8 : Can you please explain why is your recommendation is best for Utopia ?

3. Can you please compose at least eight literary references and in-text citations to support the paper ?

4.Can you please preferred APA7 writing style regarding formatting this paper and references via APA7?

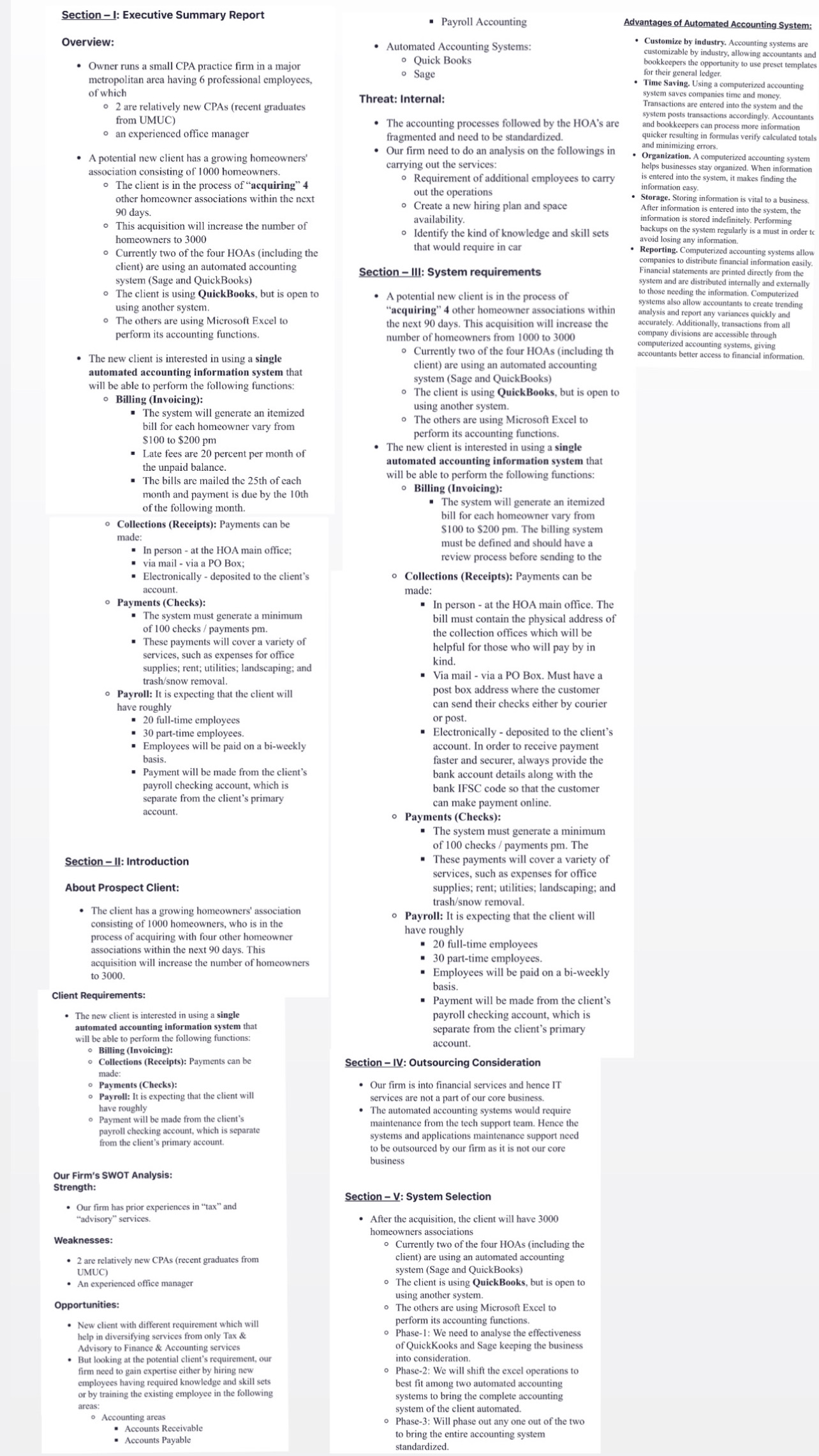

Section - 1: Executive Summary Report " Payroll Accounting Advantages of Automated Accounting System: Overview: Automated Accounting Systems: Customize by industry. Accounting systems are o Quick Books customizable by industry, allowing accountants an . Owner runs a small CPA practice firm in a major bookkeepers the opportunity to use preset templates o Sage for their general ledger. metropolitan area having 6 professional employees, . Time Saving. Using a computerized accounting of which Threat: Internal: system saves companies time and money. . 2 are relatively new CPAS (recent graduates Transactions are entered into the system and the from UMUC) system posts transactions accordingly. Accountants . The accounting processes followed by the HOA's are and bookkeepers can process more information o an experienced office manager fragmented and need to be standardized. quicker resulting in formulas verify calculated totals and minimizing errors. . A potential new client has a growing homeowners' . Our firm need to do an analysis on the followings in carrying out the services: Organization. A computerized accounting system association consisting of 1000 homeowners. helps businesses stay organized. When information s entered into the system, it makes finding the The client is in the process of "acquiring" 4 . Requirement of additional employees to carry other homeowner associations within the next out the operations information easy. Storage. Storing information is vital to a business. . Create a new hiring plan and space 90 days. After information is entered into the system, the This acquisition will increase the number of availability. information is stored indefinitely. Performing o Identify the kind of knowledge and skill sets backups on the system regularly is a must in order to homeowners to 3000 avoid losing any information. . Currently two of the four HOAs (including the that would require in car Reporting. Computerized accounting systems allow client) are using an automated accounting companies to distribute financial information easily Section - III: System requirements Financial statements are printed directly from the system (Sage and QuickBooks) system and are distributed internally and externally The client is using QuickBooks, but is open to . A potential new client is in the process of to those needing the information. Computerized using another system. systems also "acquiring" 4 other homeowner associations within untants to create trending analysis and report any variances quickly and The others are using Microsoft Excel to the next 90 days. This acquisition will increase the accurately. Additionally, transactions from all perform its accounting functions. number of homeowners from 1000 to 3000 company divisions are accessible through computerized accounting systems, giving . The new client is interested in using a single . Currently two of the four HOAs (including th accountants better access to financial information. automated accounting information system that client) are using an automated accounting will be able to perform the following functions: system (Sage and QuickBooks) o Billing (Invoicing): . The client is using Quick Books, but is open to . The system will generate an itemized using another system. bill for each homeowner vary from o The others are using Microsoft Excel to $100 to $200 pm perform its accounting functions. Late fees are 20 percent per month of . The new client is interested in using a single the unpaid balance. automated accounting information system that . The bills are mailed the 25th of each will be able to perform the following functions: month and payment is due by the 10th o Billing (Invoicing): of the following month. . The system will generate an itemized bill for each homeowner vary from . Collections (Receipts): Payments can be $100 to $200 pm. The billing system made: " In person - at the HOA main office; must be defined and should have a via mail - via a PO Box; review process before sending to the . Electronically - deposited to the client's o Collections (Receipts): Payments can be account. made: o Payments (Checks): In person - at the HOA main office. The . The system must generate a minimum bill must contain the physical address of of 100 checks / payments pm. the collection offices which will be . These payments will cover a variety of helpful for those who will pay by in services, such as expenses for office kind. supplies; rent; utilities; landscaping; and trash/snow removal. . Via mail - via a PO Box. Must have a o Payroll: It is expecting that the client will post box address where the customer have roughly can send their checks either by courier 20 full-time employees or post. 30 part-time employees. " Electronically - deposited to the client's . Employees will be paid on a bi-weekly account. In order to receive payment basis. faster and securer, always provide the . Payment will be made from the client's bank account details along with the payroll checking account, which is bank IFSC code so that the customer separate from the client's primary can make payment online account. o Payments (Checks): . The system must generate a minimum of 100 checks / payments pm. The Section - II: Introduction . These payments will cover a variety of services, such as expenses for office About Prospect Client: supplies; rent; utilities; landscaping; and trash/snow removal. . The client has a growing homeowners' association o Payroll: It is expecting that the client will consisting of 1000 homeowners, who is in the have roughly process of acquiring with four other homeowner associations within the next 90 days. This . 20 full-time employees acquisition will increase the number of homeowners . 30 part-time employees. to 3000. . Employees will be paid on a bi-weekly basis. Client Requirements: " Payment will be made from the client's . The new client is interested in using a single payroll checking account, which is automated accounting information system that separate from the client's primary will be able to perform the following functions: account. o Billing (Invoicing): . Collections (Receipts): Payments can be Section - IV: Outsourcing Consideration o Payments (Checks): . Our firm is into financial services and hence IT o Payroll: It is expecting that the client will services are not a part of our core business. have roughly . The automated accounting systems would require o Payment will be made from the client's maintenance from the tech support team. Hence the payroll checking account, which is separate from the client's primary account. systems and applications maintenance support need to be outsourced by our firm as it is not our core business Our Firm's SWOT Analysis: Strength: Section - V: System Selection Our firm has prior experiences in "tax" and "advisory" services. . After the acquisition, the client will have 3000 homeowners associations Weaknesses: . Currently two of the four HOAs (including the 2 are relatively new CPAs (recent graduates from client) are using an automated accounting UMUC) system (Sage and QuickBooks) An experienced office manager . The client is using QuickBooks, but is open to using another system. Opportunities: . The others are using Microsoft Excel to New client with different requirement which will perform its accounting functions. help in diversifying services from only Tax & Phase-1: We need to analyse the effectiveness Advisory to Finance & Accounting services of QuickKooks and Sage keeping the business . But looking at the potential client's requirement, our into consideration. firm need to gain expertise either by hiring new o Phase-2: We will shift the excel operations to employees having required knowledge and skill sets best fit among two automated accounting or by training the existing employee in the following systems to bring the complete accounting areas: system of the client automated. . Accounting areas . Phase-3: Will phase out any one out of the two Accounts Receivable to bring the entire accounting system Accounts Payable standardized

Section - 1: Executive Summary Report " Payroll Accounting Advantages of Automated Accounting System: Overview: Automated Accounting Systems: Customize by industry. Accounting systems are o Quick Books customizable by industry, allowing accountants an . Owner runs a small CPA practice firm in a major bookkeepers the opportunity to use preset templates o Sage for their general ledger. metropolitan area having 6 professional employees, . Time Saving. Using a computerized accounting of which Threat: Internal: system saves companies time and money. . 2 are relatively new CPAS (recent graduates Transactions are entered into the system and the from UMUC) system posts transactions accordingly. Accountants . The accounting processes followed by the HOA's are and bookkeepers can process more information o an experienced office manager fragmented and need to be standardized. quicker resulting in formulas verify calculated totals and minimizing errors. . A potential new client has a growing homeowners' . Our firm need to do an analysis on the followings in carrying out the services: Organization. A computerized accounting system association consisting of 1000 homeowners. helps businesses stay organized. When information s entered into the system, it makes finding the The client is in the process of "acquiring" 4 . Requirement of additional employees to carry other homeowner associations within the next out the operations information easy. Storage. Storing information is vital to a business. . Create a new hiring plan and space 90 days. After information is entered into the system, the This acquisition will increase the number of availability. information is stored indefinitely. Performing o Identify the kind of knowledge and skill sets backups on the system regularly is a must in order to homeowners to 3000 avoid losing any information. . Currently two of the four HOAs (including the that would require in car Reporting. Computerized accounting systems allow client) are using an automated accounting companies to distribute financial information easily Section - III: System requirements Financial statements are printed directly from the system (Sage and QuickBooks) system and are distributed internally and externally The client is using QuickBooks, but is open to . A potential new client is in the process of to those needing the information. Computerized using another system. systems also "acquiring" 4 other homeowner associations within untants to create trending analysis and report any variances quickly and The others are using Microsoft Excel to the next 90 days. This acquisition will increase the accurately. Additionally, transactions from all perform its accounting functions. number of homeowners from 1000 to 3000 company divisions are accessible through computerized accounting systems, giving . The new client is interested in using a single . Currently two of the four HOAs (including th accountants better access to financial information. automated accounting information system that client) are using an automated accounting will be able to perform the following functions: system (Sage and QuickBooks) o Billing (Invoicing): . The client is using Quick Books, but is open to . The system will generate an itemized using another system. bill for each homeowner vary from o The others are using Microsoft Excel to $100 to $200 pm perform its accounting functions. Late fees are 20 percent per month of . The new client is interested in using a single the unpaid balance. automated accounting information system that . The bills are mailed the 25th of each will be able to perform the following functions: month and payment is due by the 10th o Billing (Invoicing): of the following month. . The system will generate an itemized bill for each homeowner vary from . Collections (Receipts): Payments can be $100 to $200 pm. The billing system made: " In person - at the HOA main office; must be defined and should have a via mail - via a PO Box; review process before sending to the . Electronically - deposited to the client's o Collections (Receipts): Payments can be account. made: o Payments (Checks): In person - at the HOA main office. The . The system must generate a minimum bill must contain the physical address of of 100 checks / payments pm. the collection offices which will be . These payments will cover a variety of helpful for those who will pay by in services, such as expenses for office kind. supplies; rent; utilities; landscaping; and trash/snow removal. . Via mail - via a PO Box. Must have a o Payroll: It is expecting that the client will post box address where the customer have roughly can send their checks either by courier 20 full-time employees or post. 30 part-time employees. " Electronically - deposited to the client's . Employees will be paid on a bi-weekly account. In order to receive payment basis. faster and securer, always provide the . Payment will be made from the client's bank account details along with the payroll checking account, which is bank IFSC code so that the customer separate from the client's primary can make payment online account. o Payments (Checks): . The system must generate a minimum of 100 checks / payments pm. The Section - II: Introduction . These payments will cover a variety of services, such as expenses for office About Prospect Client: supplies; rent; utilities; landscaping; and trash/snow removal. . The client has a growing homeowners' association o Payroll: It is expecting that the client will consisting of 1000 homeowners, who is in the have roughly process of acquiring with four other homeowner associations within the next 90 days. This . 20 full-time employees acquisition will increase the number of homeowners . 30 part-time employees. to 3000. . Employees will be paid on a bi-weekly basis. Client Requirements: " Payment will be made from the client's . The new client is interested in using a single payroll checking account, which is automated accounting information system that separate from the client's primary will be able to perform the following functions: account. o Billing (Invoicing): . Collections (Receipts): Payments can be Section - IV: Outsourcing Consideration o Payments (Checks): . Our firm is into financial services and hence IT o Payroll: It is expecting that the client will services are not a part of our core business. have roughly . The automated accounting systems would require o Payment will be made from the client's maintenance from the tech support team. Hence the payroll checking account, which is separate from the client's primary account. systems and applications maintenance support need to be outsourced by our firm as it is not our core business Our Firm's SWOT Analysis: Strength: Section - V: System Selection Our firm has prior experiences in "tax" and "advisory" services. . After the acquisition, the client will have 3000 homeowners associations Weaknesses: . Currently two of the four HOAs (including the 2 are relatively new CPAs (recent graduates from client) are using an automated accounting UMUC) system (Sage and QuickBooks) An experienced office manager . The client is using QuickBooks, but is open to using another system. Opportunities: . The others are using Microsoft Excel to New client with different requirement which will perform its accounting functions. help in diversifying services from only Tax & Phase-1: We need to analyse the effectiveness Advisory to Finance & Accounting services of QuickKooks and Sage keeping the business . But looking at the potential client's requirement, our into consideration. firm need to gain expertise either by hiring new o Phase-2: We will shift the excel operations to employees having required knowledge and skill sets best fit among two automated accounting or by training the existing employee in the following systems to bring the complete accounting areas: system of the client automated. . Accounting areas . Phase-3: Will phase out any one out of the two Accounts Receivable to bring the entire accounting system Accounts Payable standardized Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts