Question: I have an assignment which is called Article Discussion. I will attached you the sample of this assignment below please follow the same format ?

I have an assignment which is called Article Discussion. I will attached you the sample of this assignment below please follow the same format ? 1. Can you please find a tax article which is related to ethics for tax accountants, and can you please summarize and well organized the article and please mention the name of the Article ? 2. Can you please choose article from a professional publication, such as Journal of Accountancy, TaxAdviser, TaxJournal, or the IRS articles ? 3. Can you please mention a references in APA format which includes a URL ? 4. Can you please provide any graphics or tables of that article ?

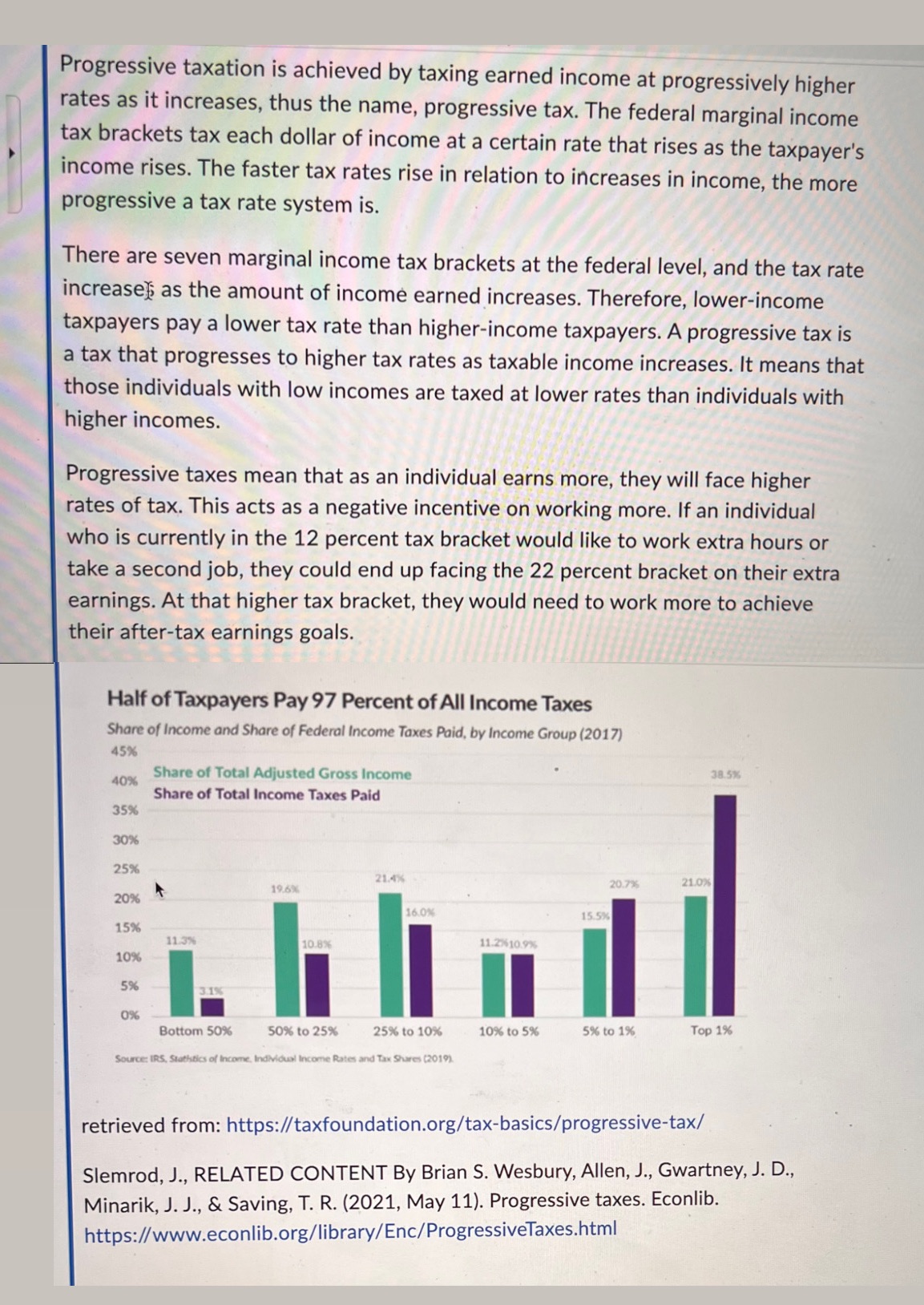

Progressive taxation is achieved by taxing earned income at progressively higher rates as it increases, thus the name, progressive tax. The federal marginal income tax brackets tax each dollar of income at a certain rate that rises as the taxpayer's income rises. The faster tax rates rise in relation to increases in income, the more progressive a tax rate system is. There are seven marginal income tax brackets at the federal level, and the tax rate increase as the amount of income earned increases. Therefore, lower-income taxpayers pay a lower tax rate than higher-income taxpayers. A progressive tax is a tax that progresses to higher tax rates as taxable income increases. It means that those individuals with low incomes are taxed at lower rates than individuals with higher incomes. Progressive taxes mean that as an individual earns more, they will face higher rates of tax. This acts as a negative incentive on working more. If an individual who is currently in the 12 percent tax bracket would like to work extra hours or take a second job, they could end up facing the 22 percent bracket on their extra earnings. At that higher tax bracket, they would need to work more to achieve their after-tax earnings goals. Half of Taxpayers Pay 97 Percent of All Income Taxes Share of Income and Share of Federal Income Taxes Paid, by Income Group (2017) 45%% 40% Share of Total Adjusted Gross Income 38.5% Share of Total Income Taxes Paid 35% 30% 25% 21.4% 20.7% 21.0 19.6% 20% 16.0% 15 5 15% 11.3% 10.8%% 11.2%610.9% 10% 5% 3.1% 0% Bottom 50% 50% to 25% 25% to 10% 10% to 5% 5% to 1% Top 1% Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares (2019). retrieved from: https://taxfoundation.org/tax-basics/progressive-tax/ Slemrod, J., RELATED CONTENT By Brian S. Wesbury, Allen, J., Gwartney, J. D., Minarik, J. J., & Saving, T. R. (2021, May 11). Progressive taxes. Econlib. https://www.econlib.org/library/Enc/ProgressiveTaxes.html