Question: I have attached both the assignment and my progress thus far. The objective is to choose our own company and then calculate A, B, C,

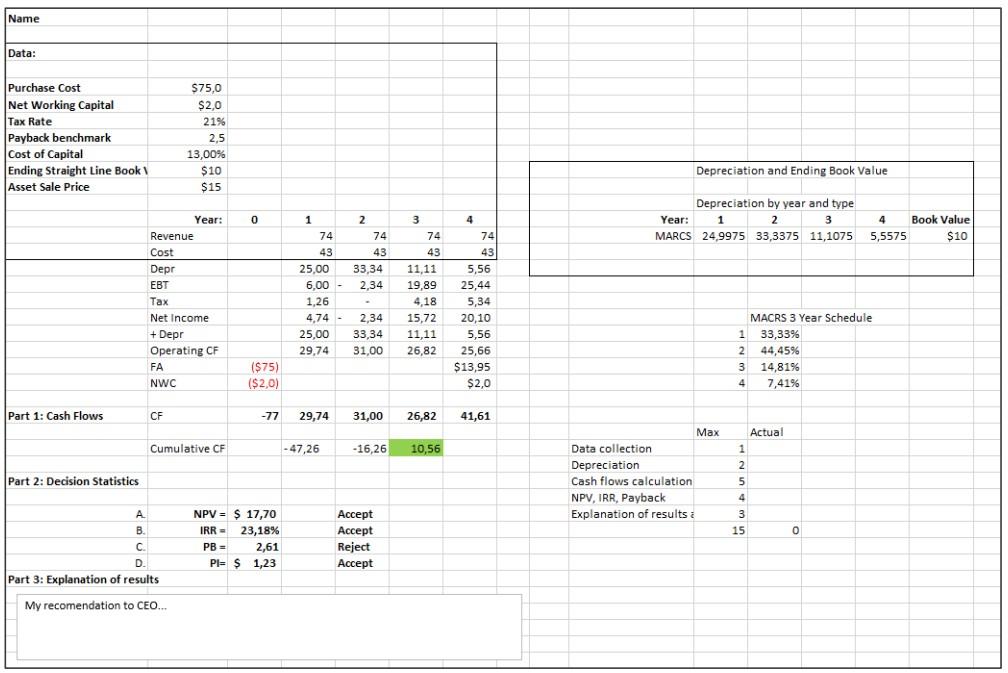

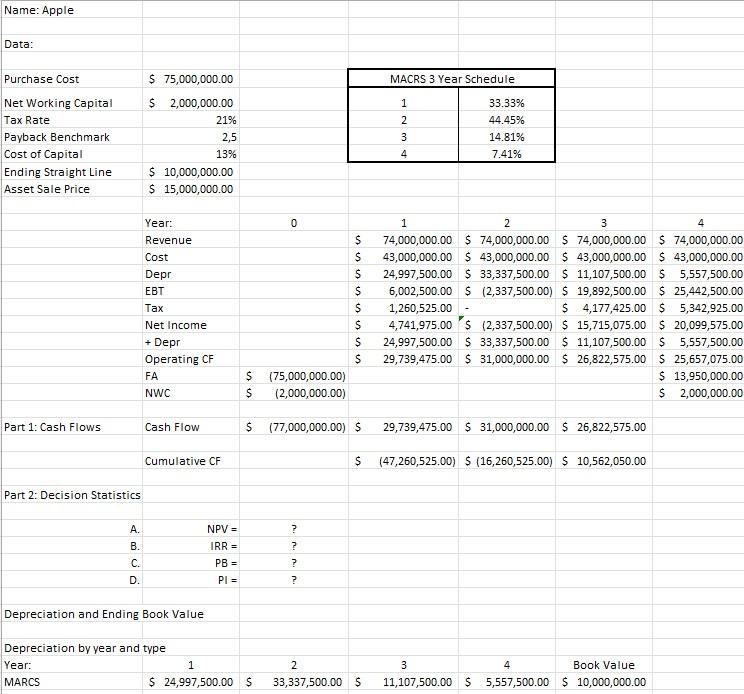

I have attached both the assignment and my progress thus far. The objective is to choose our own company and then calculate A, B, C, and D after correctly calculating everything else. I figured out how to do part A, B, and C but cannot for the life of me figure out what to do next. My strategy was to figure out how my teacher got his NPV, IRR, PB, and PI and then do the same exact thing for the company I end up choosing. The only problem is I cannot find out how to get any of the answers that he did for Apple. I know that he must use some sort of outside source such as Yahoo finance, but that's as far as I know. All I need is to figure out how my teacher got the numbers he did for A, B, C, and D.

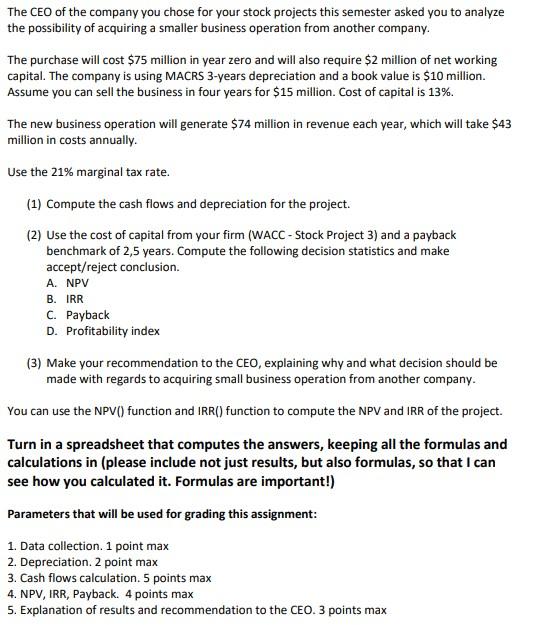

the possibility of acquiring a smaller business operation from another company. The purchase will cost $75 million in year zero and will also require $2 million of net working capital. The company is using MACRS 3-years depreciation and a book value is $10 million. Assume you can sell the business in four years for $15 million. Cost of capital is 13%. The new business operation will generate $74 million in revenue each year, which will take $43 million in costs annually. Use the 21% marginal tax rate. (1) Compute the cash flows and depreciation for the project. (2) Use the cost of capital from your firm (WACC - Stock Project 3) and a payback benchmark of 2,5 years. Compute the following decision statistics and make accept/reject conclusion. A. NPV B. IRR C. Payback D. Profitability index (3) Make your recommendation to the CEO, explaining why and what decision should be made with regards to acquiring small business operation from another company. You can use the NPV() function and IRR() function to compute the NPV and IRR of the project. Turn in a spreadsheet that computes the answers, keeping all the formulas and calculations in (please include not just results, but also formulas, so that I can see how you calculated it. Formulas are important!) Parameters that will be used for grading this assignment: 1. Data collection. 1 point max 2. Depreciation. 2 point max 3. Cash flows calculation. 5 points max 4. NPV, IRR, Payback. 4 points max 5. Explanation of results and recommendation to the CEO. 3 points max Name: Apple Data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts