Question: I have been doing this for hours. I don't know the problem. Please help me. Transactions for Fixed Assets, Including Sale The followina transactions and

I have been doing this for hours. I don't know the problem. Please help me.

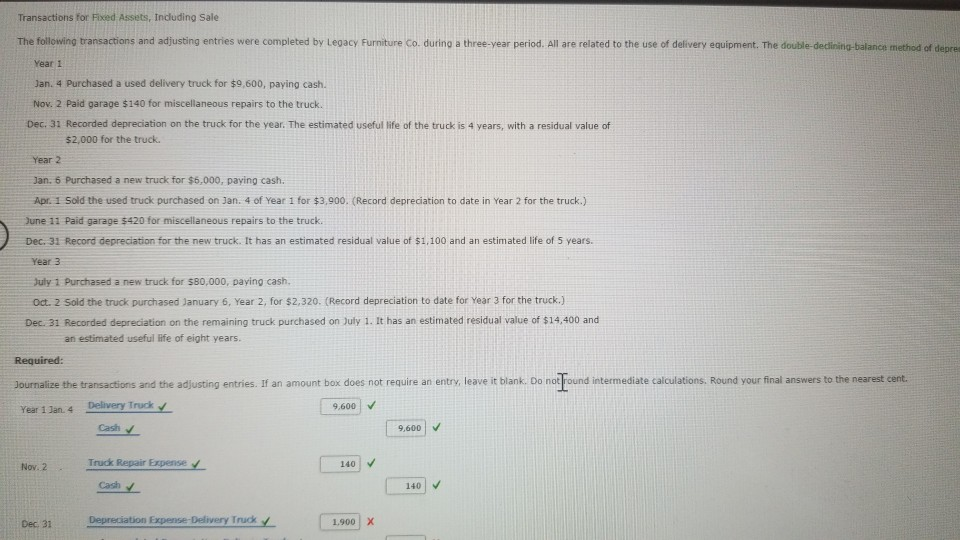

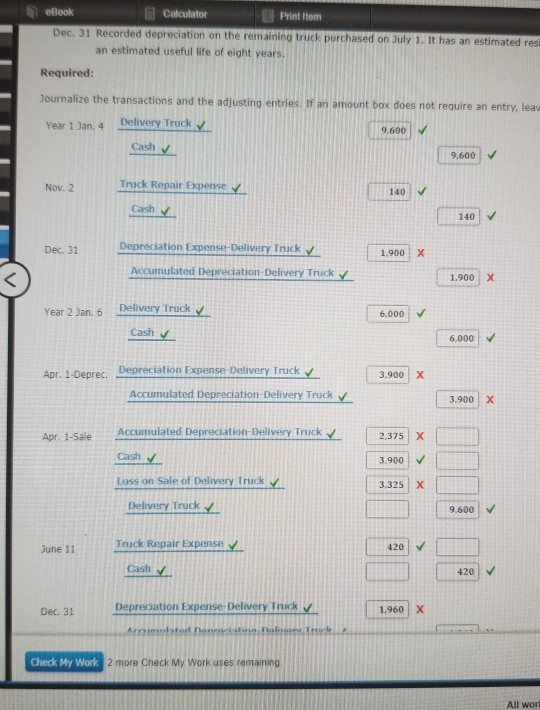

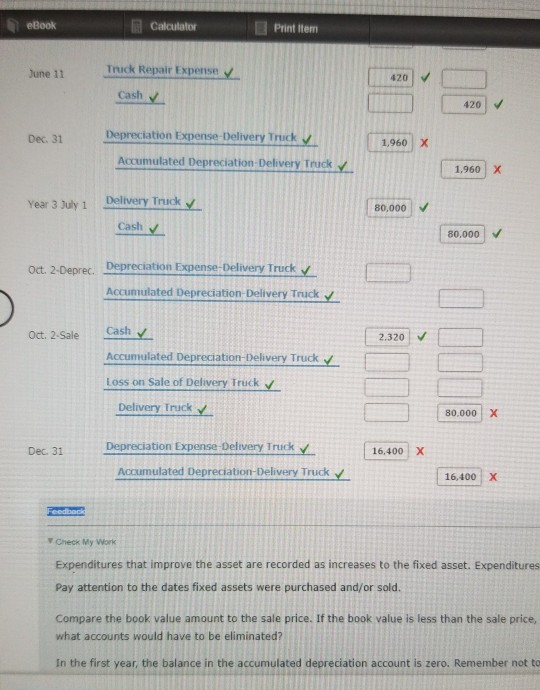

Transactions for Fixed Assets, Including Sale The followina transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-dedlining-balance method of denres Year 1 Jan. 4 Purchased a used delivery truck for $9,600, paying cash. Nov. 2 Paid garage $140 for miscellaneous repairs to the truck. Dec. 31 Recorded depreciation on the truck for the year. The estimated useful life of the truck is 4 years, with a residual value of $2,000 for the truck Year 2 Jan. 6 Purchased a new truck for $6,000, paying cash. Apr. 1 Sold the used truck purchased on Jan. 4 of Year 1 for $3,900. (Record depreciation to date in Year 2 for the truck.) June 11 Paid garage $420 for miscellaneous repairs to the truck. Dec. 31 Record depreciation for the new truck. It has an estimated residual value of $1,100 and an estimated life of 5 years. Year 3 July 1 Purchased a new truck for $80,000, paying cash. Oct. 2 Sold the truck purchased January 6, Year 2, for $2,320. (Record depreciation to date for Year 3 for the truck.) Dec. 31 Recorded depreciation on the remaining truck purchased on July 1. It has an estimated residual value of $14,400 and an estimated useful life of eight years. Required: Journalize the transactions and the adlusting entries. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Round your final answers to the nearest cent. Delivery Truck 9.600 Year 1 Jan. 4 Cash 9,600 Truck Repair Expense 140 Nov. 2 Cash 140 Depreciation Expense-Delivery Truck 1.900 X Dec. 31 eBook Calculator Print Item Dec. 31 Recorded depreciation on the remaining truck purchased on July 1. It has an estimated resi an estimated useful life of eight years Required: Journalize the transactions and the adjusting entries. If an amount box does not require an entry, leaw Delivery Truck Year 1 Jan. 4 9.600 Cash 9,600 Truck Repair Expense Nov. 2 140 Cash 140 Depreciation Expense-Delivery Iruck Dec. 31 X 1.900 Accumulated Depreciation-Delivery Truck 1,900 X Delivery Iruck Year 2 Jan. 6 6,000 Cash 6.000 Apr. 1-Deprec Depreciation Expense-Delivery Iruck 3.900 X Accumulated Depreciation-Delivery Truck X 3.900 Accumulated Depreciation-Delivery Truck X r. 1-Sale 2,375 Cash 3.900 Loss on Sale of Delivery Truck 3.325 X Delivery Truck 9.600 Truck Repair Expense 420 June 11 Cash 420 Depreciation Expense-Delivery Truck X 1.960 Dec. 31 Ancmulated nonnaciatinio Fialisev Truce Check My Work 2 more Check My Work uses remaining All wor he eBook Calculator Print Item Truck Repair Expense June 11 420 Cash 420 Depreciation Expense-Delivery Truck Dec. 31 1,960 Accumulated Depreciation-Delivery Truck X 1,960 Delivery Truck Year 3 July 1 80,000 Cash 80,000 Oct. 2-Depre. Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck Cash Oct, 2-Sale 2.320 Accumulated Depreciation-Delivery Truck Loss on Sale of Delivery Truck Delivery Truck 80.000 Depreciation Expense-Delivery Truck Dec. 31 16,400 X Accumulated Depreciation-Delivery Truck 16,400 X Feedback Check My work Expenditures that improve the asset are recorded as increases to the fixed asset. Expenditures Pay attention to the dates fixed assets were purchased and/or sold. Compare the book value amount to the sale price. If the book value is less than the sale price, what accounts would have to be eliminated? In the first year, the balance in the accumulated depreciation account is zero. Remember not to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock