Question: I have been trying and I cannot figure it out. The question and the two exhibts are in the photos.Present value of bonds payable; premium

I have been trying and I cannot figure it out. The question and the two exhibts are in the photos.Present value of bonds payable; premium

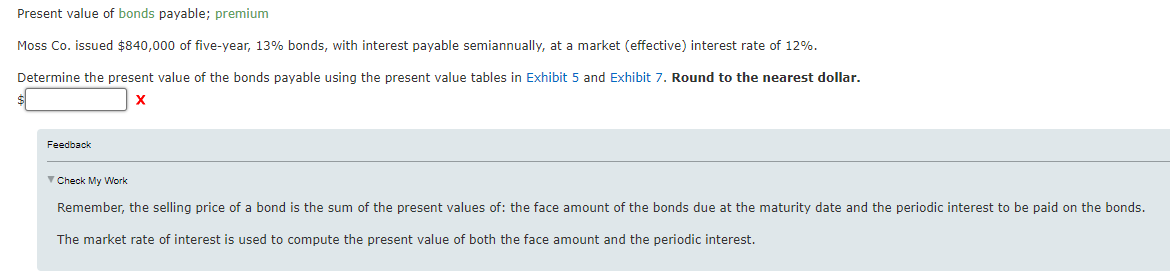

Moss Co issued $ of fiveyear, bonds, with interest payable semiannually, at a market effective interest rate of

Determine the present value of the bonds payable using the present value tables in Exhibit and Exhibit Round to the nearest dollar.

$

Check My Work

Remember, the selling price of a bond is the sum of the present values of: the face amount of the bonds due at the maturity date and the periodic interest to be paid on the bonds.

The market rate of interest is used to compute the present value of both the face amount and the periodic interest.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock