Question: I have calculated part a) already and it is correct but I need help with part d). Question 3 Life Corp. is considering expanding its

I have calculated part a) already and it is correct but I need help with part d).

I have calculated part a) already and it is correct but I need help with part d).

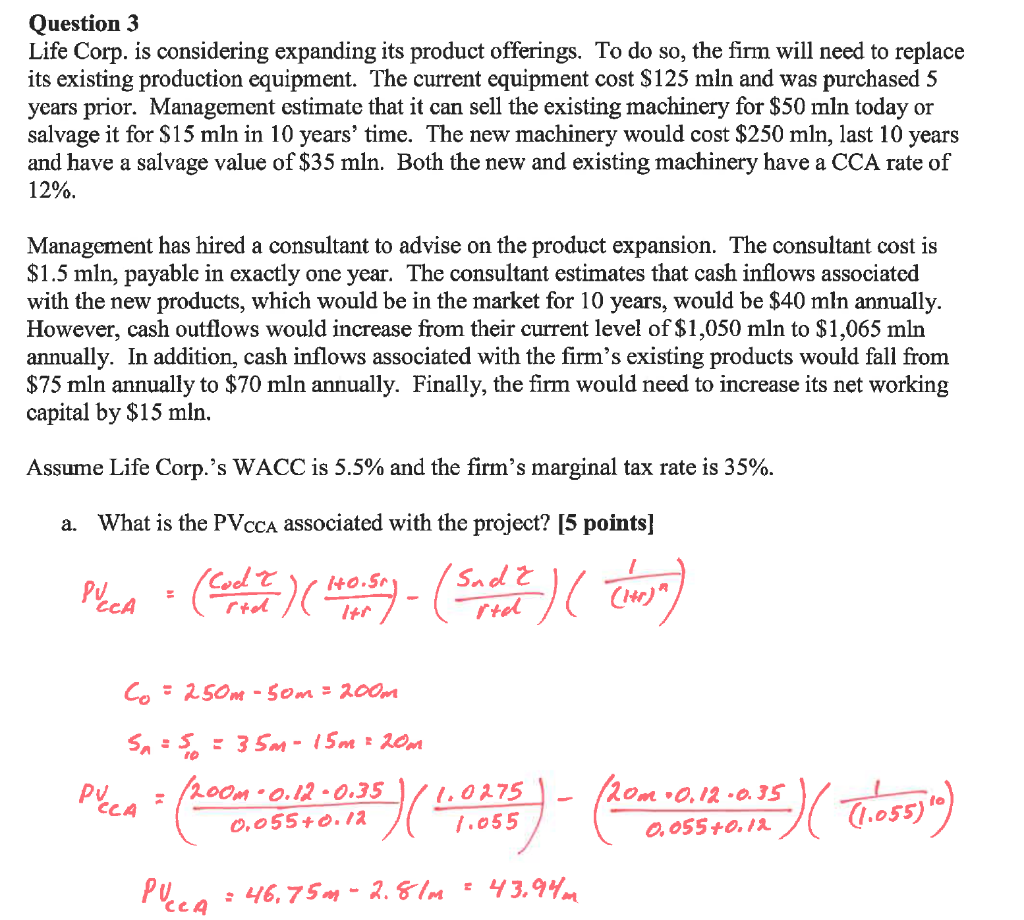

Question 3 Life Corp. is considering expanding its product offerings. To do so, the firm will need to replace its existing production equipment. The current equipment cost $125 mln and was purchased 5 years prior. Management estimate that it can sell the existing machinery for $50 mln today or salvage it for $15 mln in 10 years' time. The new machinery would cost $250 mln, last 10 years and have a salvage value of $35 mln. Both the new and existing machinery have a CCA rate of 12%. Management has hired a consultant to advise on the product expansion. The consultant cost is $1.5 mln, payable in exactly one year. The consultant estimates that cash inflows associated with the new products, which would be in the market for 10 years, would be $40 mln annually. However, cash outflows would increase from their current level of $1,050 mln to $1,065 mln annually. In addition, cash inflows associated with the firm's existing products would fall from $75 mln annually to $70 mln annually. Finally, the firm would need to increase its net working capital by $15 mln. Assume Life Corp.'s WACC is 5.5% and the firm's marginal tax rate is 35%. a. What is the PVCCA associated with the project? [5 points] Placa u centre hosten - ( Son olemas ) ( Chosa) Co : 250m - 50m - 200m PUCCA Sn = 5o = 35m - 15m = 20m (200m - 0.12 -0.35 1.0275 0,055 +0.12 1.055 (20m "0,12 -0.35 0.055 +0.12 PUCCA : 46,75m-2.8lm : 43.94 d. Briefly explain what the value of the PVcca found in part a. above represents and why it comes about. (5 points] Question 3 Life Corp. is considering expanding its product offerings. To do so, the firm will need to replace its existing production equipment. The current equipment cost $125 mln and was purchased 5 years prior. Management estimate that it can sell the existing machinery for $50 mln today or salvage it for $15 mln in 10 years' time. The new machinery would cost $250 mln, last 10 years and have a salvage value of $35 mln. Both the new and existing machinery have a CCA rate of 12%. Management has hired a consultant to advise on the product expansion. The consultant cost is $1.5 mln, payable in exactly one year. The consultant estimates that cash inflows associated with the new products, which would be in the market for 10 years, would be $40 mln annually. However, cash outflows would increase from their current level of $1,050 mln to $1,065 mln annually. In addition, cash inflows associated with the firm's existing products would fall from $75 mln annually to $70 mln annually. Finally, the firm would need to increase its net working capital by $15 mln. Assume Life Corp.'s WACC is 5.5% and the firm's marginal tax rate is 35%. a. What is the PVCCA associated with the project? [5 points] Placa u centre hosten - ( Son olemas ) ( Chosa) Co : 250m - 50m - 200m PUCCA Sn = 5o = 35m - 15m = 20m (200m - 0.12 -0.35 1.0275 0,055 +0.12 1.055 (20m "0,12 -0.35 0.055 +0.12 PUCCA : 46,75m-2.8lm : 43.94 d. Briefly explain what the value of the PVcca found in part a. above represents and why it comes about. (5 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts