Question: i have completed A B and C please only do D and E You are given the following set of data: Year Historical Rates of

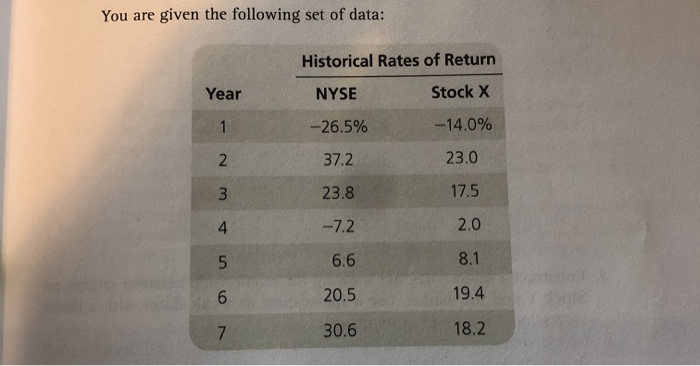

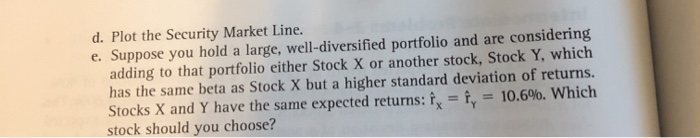

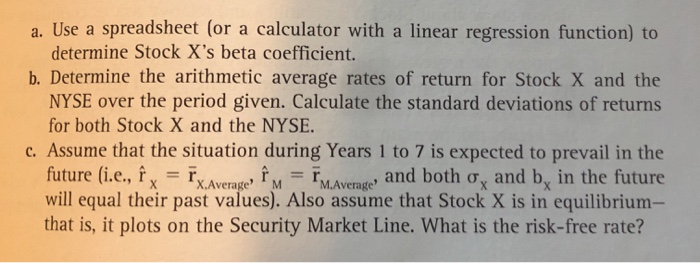

You are given the following set of data: Year Historical Rates of Return NYSE Stock X -26.5% -14.0% 37.2 23.0 23.8 17.5 -7.2 2.0 uw N- 6.6 8.1 20.5 19.4 30.6 18.2 d. Plot the Security Market Line. e. Suppose you hold a large, well-diversified portfolio and are considering adding to that portfolio either Stock X or another stock, Stock Y, which has the same beta as Stock X but a higher standard deviation of returns. Stocks X and Y have the same expected returns: f = f. = 10.6%. Which stock should you choose? a. Use a spreadsheet (or a calculator with a linear regression function) to determine Stock X's beta coefficient. b. Determine the arithmetic average rates of return for Stock X and the NYSE over the period given. Calculate the standard deviations of returns for both Stock X and the NYSE. c. Assume that the situation during Years 1 to 7 is expected to prevail in the future (i.e., f x = ix Avenge F = Fm Average and both o, and b, in the future will equal their past values). Also assume that Stock X is in equilibrium- that is, it plots on the Security Market Line. What is the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts