Question: I have completed sections 2 and 4, and provided them to help with the other sections. I filed in the parts of the charts I

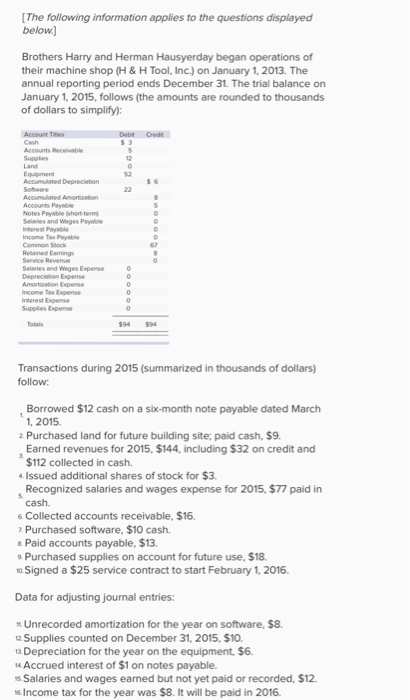

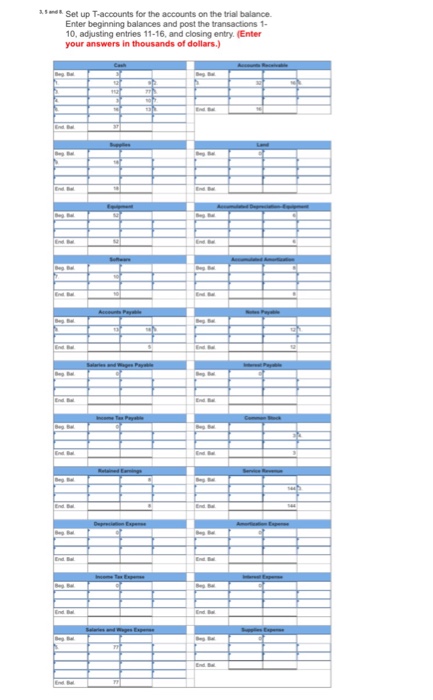

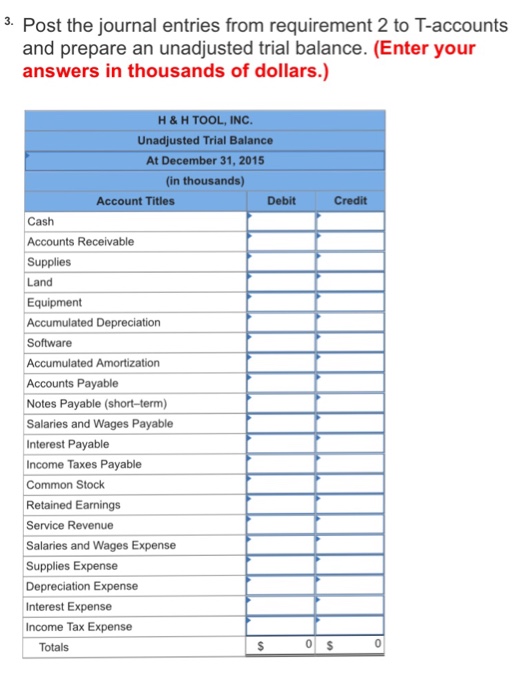

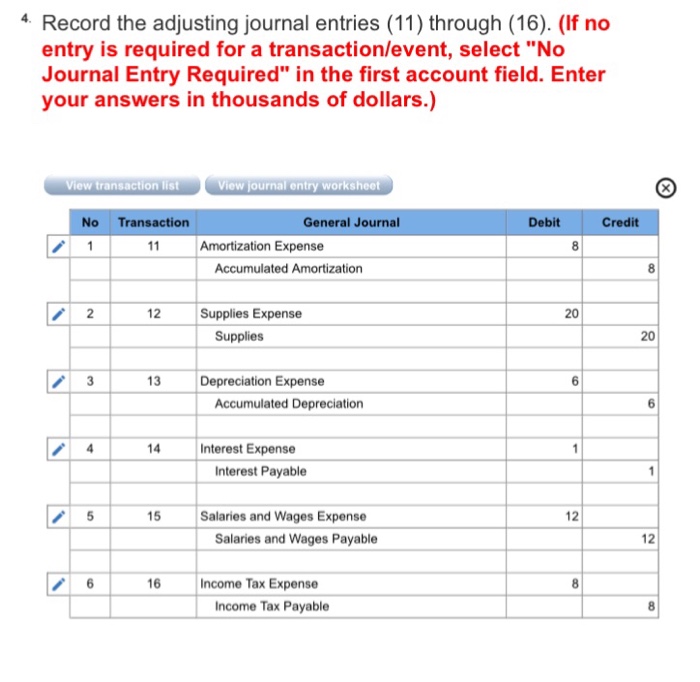

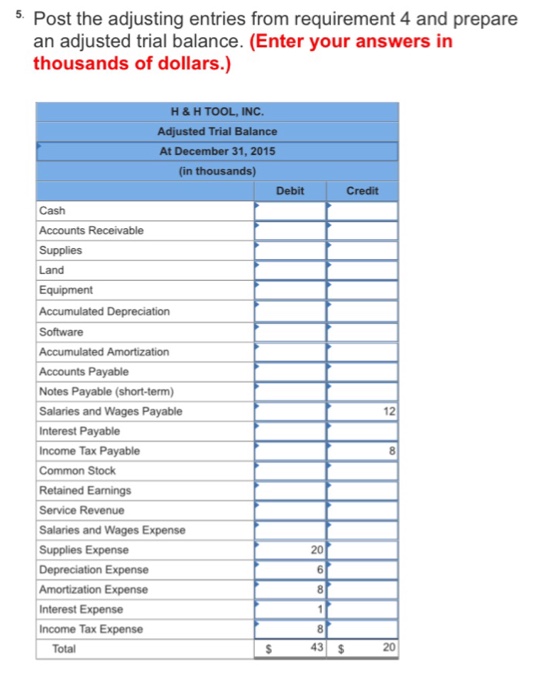

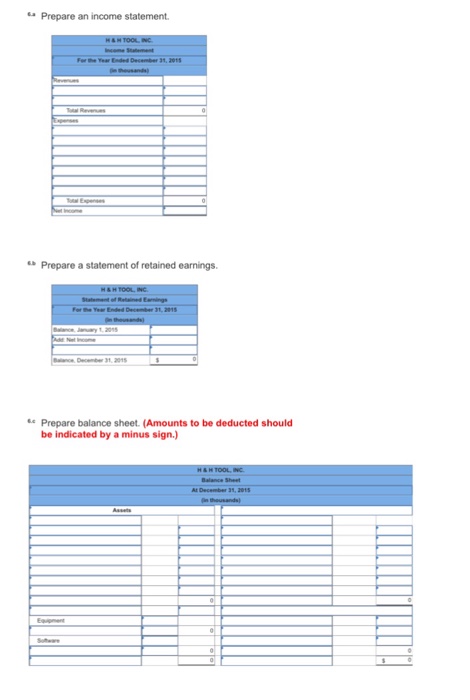

The following information applies to the questions displayed below Brothers Harry and Herman Hausyerday began operations of their machine shop (H &H Tool, Inc) on January 1, 2013. The annual reporting period ends December 31. The trial balance on January 1, 2015, follows (the amounts are rounded to thousands of dollars to simplify): Accounts Recelvable s 6 Accounts Payeble Payable ishort-tem Salaries and Wages Payable Tax Payable Retained Eamings Salaries and Weges Expense nterest Expense Supplies Expense $94 94 Transactions during 2015 (summarized in thousands of dollars) Borrowed $12 cash on a six-month note payable dated March 1, 2015 2 Purchased land for future building site; paid cash, $9. Earned revenues for 2015$144, including $32 on credit and $112 collected in cash. 4 Issued additional shares of stock for $3 Recognized salaries and wages expense for 2015$77 paid in s Collected accounts receivable, $16. z Purchased software, $10 cash. s Paid accounts payable, $13. Purchased supplies on account for future use, $18 o Signed a $25 service contract to start February 1, 2016. Data for adjusting journal entries: Unrecorded amortization for the year on software, $8. 2 Supplies counted on December 31, 2015, $10. 13 Depreciation for the year on the equipment, $6 Accrued interest of $1 on notes payable. s Salaries and wages earned but not yet paid or recorded, $12 Income tax for the year was $8. It will be paid in 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts