Question: I have completed to homework except for one question, it is looking for a journal entry to record the optional accumulated depreciation consolidation entry. I

I have completed to homework except for one question, it is looking for a journal entry to record the optional accumulated depreciation consolidation entry. I am sooo turned around of this, I think my brain quit on me. I have done all part on this homework but I just cannot get that last entry. If you can please explain to me as well, I just don't want the answer I would like to understand it as well. Thank you so much in advance.

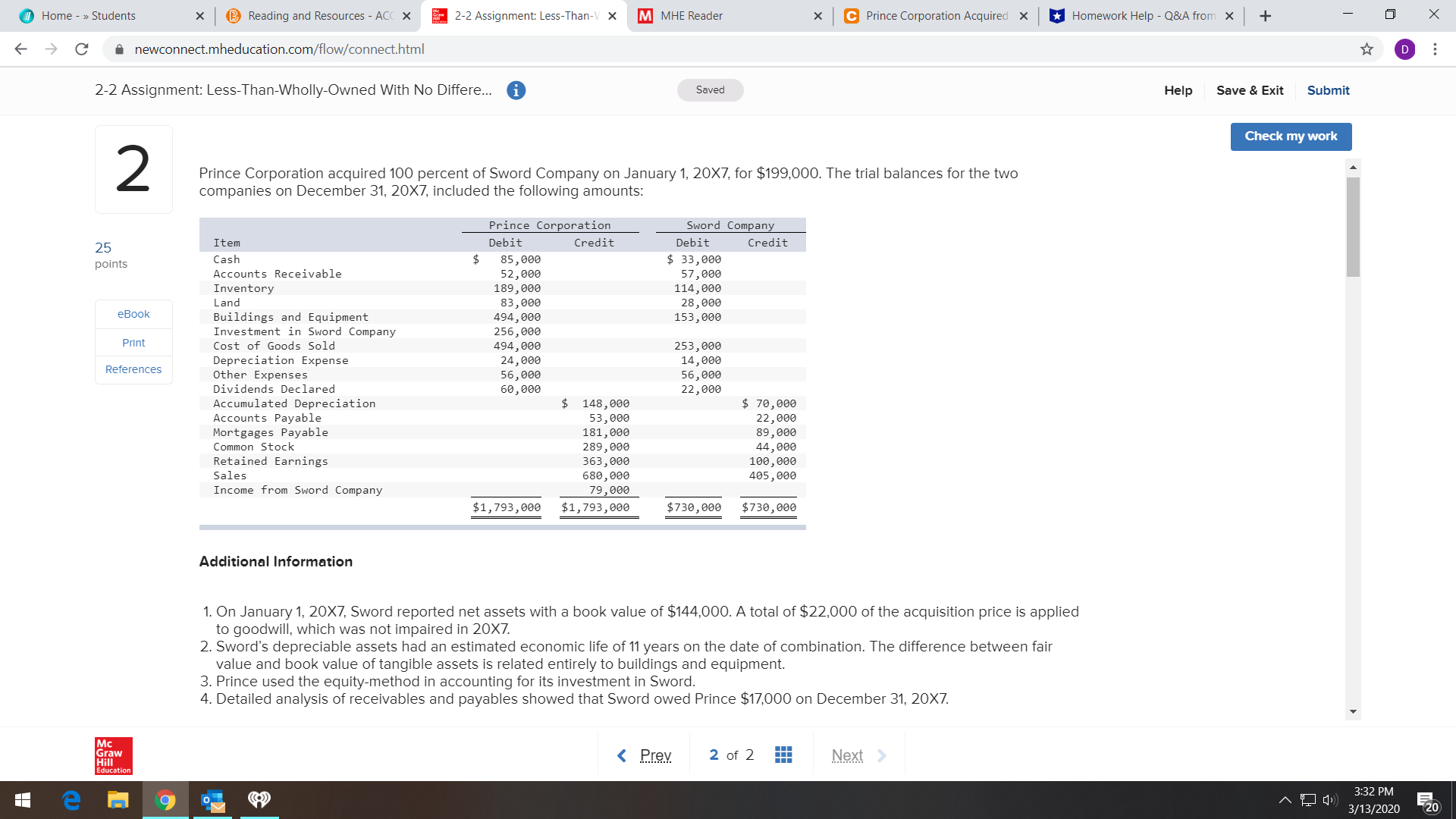

1 Home - > Students C a newconnect.mheducation.com/flow/connect.html 2-2 Assignment: Less-Than-Wholly-Owned With No Differe... Saved Help Save & Exit Submit Check my work 2 Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $199,000. The trial balances for the two companies on December 31, 20X7, included the following amounts: Prince Corporation Sword Company 25 Item Debit Credit Debit Credit points Cash $ 85, 000 $ 33,000 Accounts Receivable 52, 000 57, 000 Inventory 000 '68T 114, 000 Land 83 , 000 28, 000 eBook Buildings and Equipment 494, 000 153, 000 Investment in Sword Company 256, 000 Print Cost of Goods Sold 000 '16t 253, 000 References Depreciation Expense 24, 006 14, 000 Other Expenses 56, 000 56,000 Dividends Declared 60, 000 22,000 Accumulated Depreciation $ 148, 000 $ 70,000 Accounts Payable 53 , 000 22, 000 Mortgages Payable 181, 000 89, 000 Common Stock 289, 000 44, 000 Retained Earnings 363, 000 100, 000 Sales 000 '089 405, 000 Income from Sword Company 79, 000 $1, 793, 000 $1, 793, 000 $730, 000 $730, 000 Additional Information 1. On January 1, 20X7, Sword reported net assets with a book value of $144,000. A total of $22,000 of the acquisition price is applied to goodwill, which was not impaired in 20X7. 2. Sword's depreciable assets had an estimated economic life of 11 years on the date of combination. The difference between fair value and book value of tangible assets is related entirely to buildings and equipment. 3. Prince used the equity-method in accounting for its investment in Sword. 4. Detailed analysis of receivables and payables showed that Sword owed Prince $17,000 on December 31, 20X7. Mc Graw Hill 2 of 2 Education e 3:32 PM 3/13/2020 E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts