Question: I have done everything else on this problem, but I need to close the income summary to retained earnings and I cannot figure out how

I have done everything else on this problem, but I need to close the income summary to retained earnings and I cannot figure out how to calculate it.

My work so far:

Background:

The equity sections from Austin Groups 2016 and 2017 year-end balance sheets follow.

| Stockholders Equity (December 31, 2016) | ||

| Common stock$6 par value, 110,000 shares authorized, 40,000 shares issued and outstanding | $ | 240,000 |

| Paid-in capital in excess of par value, common stock | 36,000 | |

| Retained earnings | 200,000 | |

| Total stockholders equity | $ | 476,000 |

| Stockholders Equity (December 31, 2017) | |||

| Common stock$6 par value, 110,000 shares authorized, 45,600 shares issued, 5,000 shares in treasury | $ | 273,600 | |

| Paid-in capital in excess of par value, common stock | 80,800 | ||

| Retained earnings ($60,000 restricted by treasury stock) | 360,000 | ||

| 714,400 | |||

| Less cost of treasury stock | (60,000 | ) | |

| Total stockholders equity | $ | 654,400 | |

The following transactions and events affected its equity during year 2017.

| Jan. | 5 | Declared a $1.60 per share cash dividend, payable on January 10. | ||

| Mar. | 20 | Purchased treasury stock for cash. | ||

| Apr. | 5 | Declared a $1.60 per share cash dividend, payable on April 10. | ||

| July | 5 | Declared a $1.60 per share cash dividend, payable on July 10. | ||

| July | 31 | Declared a 16% stock dividend when the stocks market value was $14 per share. | ||

| Aug. | 14 | Issued the stock dividend that was declared on July 31. | ||

| Oct. | 5 | Declared a $1.60 per share cash dividend, date of record October 10. |

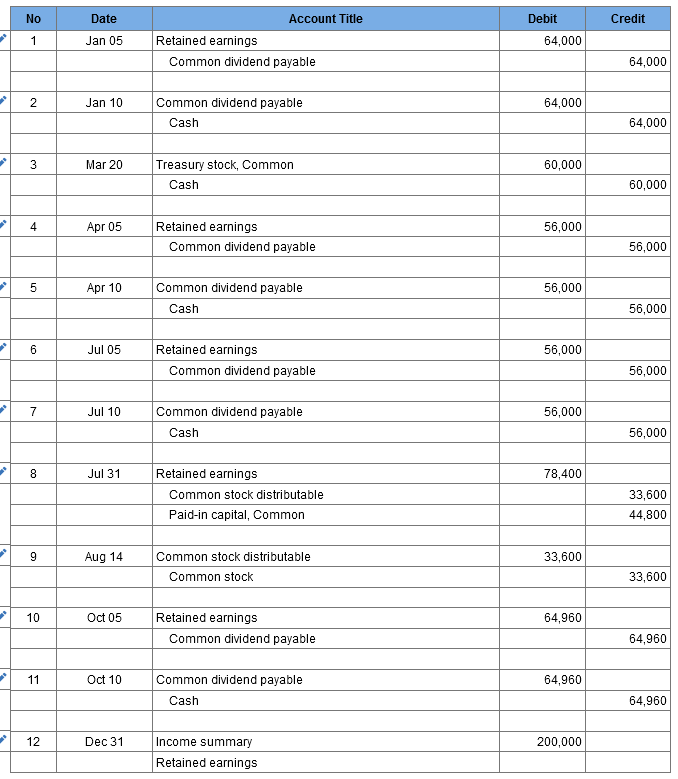

No Date Account Title Debit Credit 1 Jan 05 64,000 Retained earnings Common dividend payable 64,000 N Jan 10 64,000 Common dividend payable Cash 64,000 3 Mar 20 60,000 Treasury stock, Common Cash 60,000 4 Apr 05 56,000 Retained earnings Common dividend payable 56,000 5 Apr 10 56,000 Common dividend payable Cash 56,000 6 Jul 05 56,000 Retained earnings Common dividend payable 56,000 7 Jul 10 56,000 Common dividend payable Cash 56,000 8 Jul 31 78,400 Retained earnings Common stock distributable Paid-in capital, Common 33,600 44,800 9 Aug 14 33,600 Common stock distributable Common stock 33,600 10 Oct 05 64,960 Retained earnings Common dividend payable 64,960 11 Oct 10 64,960 Common dividend payable Cash 64,960 12 Dec 31 200,000 Income summary Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts