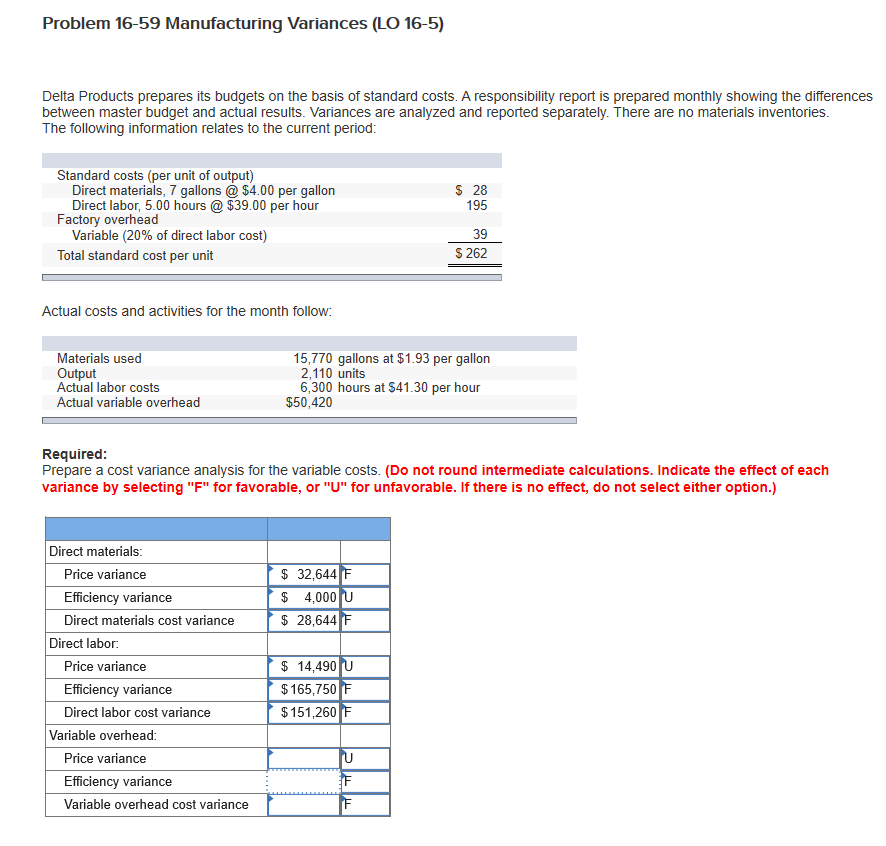

Question: I have everything completed but the variable overhead. Please provide explanation on how you got the variable overhead section. Problem 16-59 Manufacturing Variances (LO 16-5)

I have everything completed but the variable overhead. Please provide explanation on how you got the variable overhead section.

Problem 16-59 Manufacturing Variances (LO 16-5) Delta Products prepares its budgets on the basis of standard costs. A responsibility report is prepared monthly showing the differences between master budget and actual results. Variances are analyzed and reported separately. There are no materials inventories. The following information relates to the current period: $ 28 195 Standard costs (per unit of output) Direct materials, 7 gallons @ $4.00 per gallon Direct labor, 5.00 hours @ $39.00 per hour Factory overhead Variable (20% of direct labor cost) Total standard cost per unit 39 $ 262 Actual costs and activities for the month follow: Materials used Output Actual labor costs Actual variable overhead 15,770 gallons at $1.93 per gallon 2,110 units 6,300 hours at $41.30 per hour $50,420 Required: Prepare a cost variance analysis for the variable costs. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) $ 32,644 F $ 4,000 U | $ 28,644 F Direct materials: Price variance Efficiency variance Direct materials cost variance Direct labor: Price variance Efficiency variance Direct labor cost variance Variable overhead: Price variance Efficiency variance Variable overhead cost variance $ 14,490 $ 165,750 F $ 151,260 F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts