Question: I have everything completed on this question bit it tells me its incomplete. can someone look it over and see what I have to add?

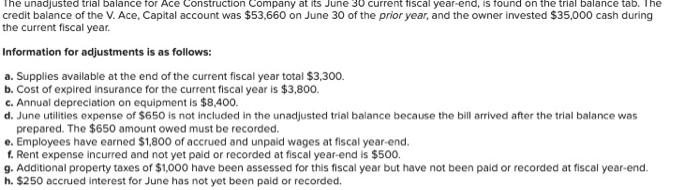

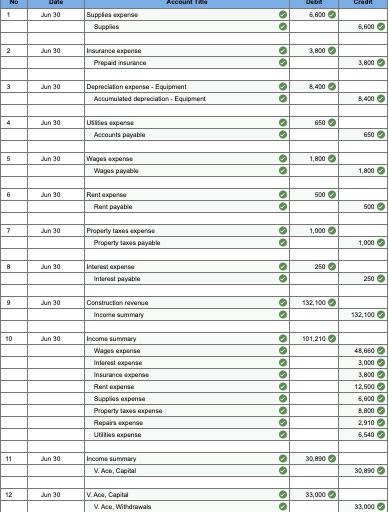

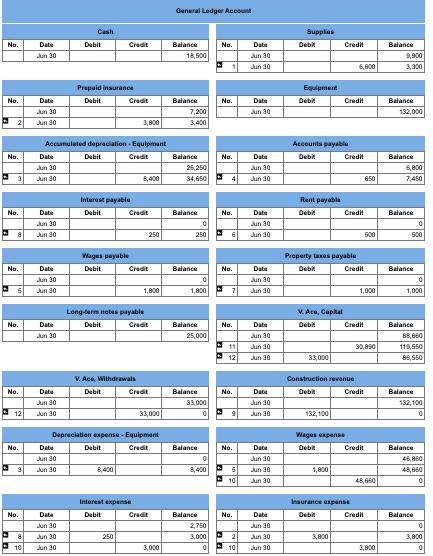

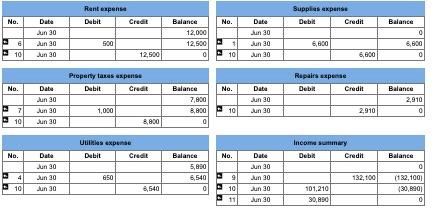

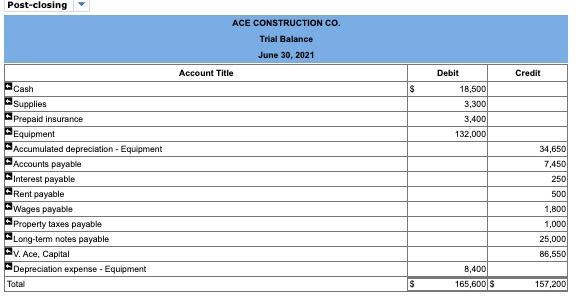

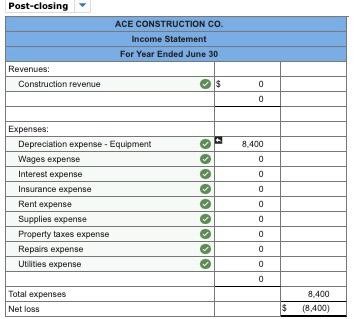

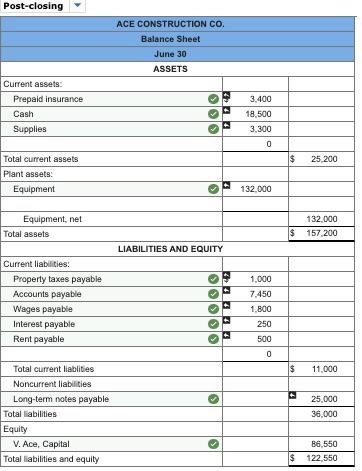

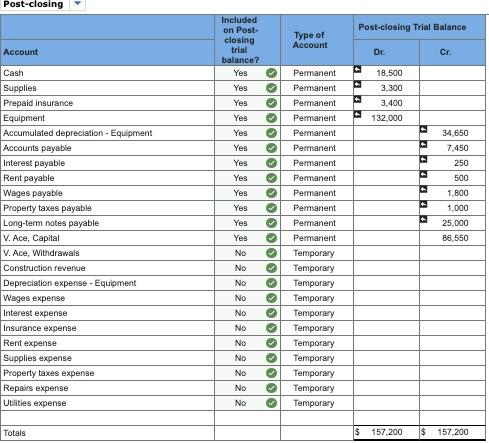

The unadjusted trial balance for Ace Construction Company at its June 30 current fiscal year-end, is found on the trial balance tab. The credit balance of the V. Ace, Capital account was $53,660 on June 30 of the prior year, and the owner invested $35,000 cash during the current fiscal year. Information for adjustments is as follows: a. Supplies available at the end of the current fiscal year total $3,300. b. Cost of expired insurance for the current fiscal year is $3,800. c. Annual depreciation on equipment is $8,400. d. June utilitles expense of $650 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $650 amount owed must be recorded. e. Employees have earned $1,800 of accrued and unpaid wages at fiscal year-end. 1. Rent expense incurred and not yet paid or recorded at fiscal year-end is $500, 9. Additional property taxes of $1,000 have been assessed for this fiscal year but have not been pald or recorded at fiscal year-end. h. $250 accrued interest for June has not yet been paid or recorded. Dute Account Credit DEDA 6,600 1 Jun 30 Supplies experts Supplies olol 6,600 2 Jun 30 3,800 Insurance expense Prepaid insurance lo 3,800 3 Jun 30 8,400 Depreciation expense - Equipment Accumulated depreciation Equipment O 6,400 Jun 30 650 U pense Accounts payable lolo 650 5 Jun 30 1,800 Wages expre Wages payable lolol 1,800 G Jun 30 500 Rent expense Rent payable olo 500 19 7 Jun 30 1,000 Property taxe expand Property taxes payable ol 1,000 8 Jun 30 Interexpose Interest payable lolo 250 250 9 Jun 30 132.100 Construction and Incontrary lolol 132,100 10 Jun 30 Income Summary 101,210 48,660 3,000 3.800 Wages pense Interesten Insurance Recompense Suppsexpense Property as expense Repairs experts ut expense 12,500 6,000 ooOOOOOOOO 8,800 2,910 6,540 11 Jun 30 30,00 come summary V. Ace, Capital 30,990 12 Jun 30 33,000 V. Ace, Capital V. Ace, Withdrawal OO 33,000 General Ledger Account Cash Supplies Debit No. Debit Credit Balance No. Credit Date Jun 30 1.500 Date Jun 30 Jun 30 Balance 9,900 3,300 6,000 Prepaid insurance Debit Credit Equipment Deba No. No. Credit Date Jun 30 Jun 30 Balance 7,200 3,400 Date Jun 30 Balance 132,000 - 2 3,800 Accounts payable Debil Credit No. No. Accumulated depreciation Equipment Date Debit Credit Jun 30 Jun 30 8,400 Balance 26,250 34,650 Dabe Jun 30 Jun 30 Balance 6,800 7.450 4 650 Interest payable Debit Credit Rent payable Debit No. Balance No. Credit Balance Date Jun 30 Jun 30 0 Jun 30 Jun 30 a 250 250 6 500 500 Wages payable Debit Credit Property taxes payable Debit Credit No. Balance No. Date Date Jun 30 Jun 30 0 Balance O 1,000 Jun 20 Jun 30 5 1,800 1,800 7 1.000 Long-term nebes payable Debit Credit V. Ace, Capital Debit Credit No. No. Date Jun 30 Balance 25,000 Date Jun 30 Jun 30 Jun 30 30,690 Balance 38,660 119.550 88,550 11 12 33,000 V. Ace. Withdrawals Debit Credit Construction revenue Debit Credit No. No. Date Jun 30 Jun 30 Balance 33,000 0 Data Jun 30 Jun 30 Balance 132,100 12 33,000 9 132,100 Wages expense Debit Credit No. Balance No. Depreciation expense - Equipment Data Debit Credit Jun 30 Jun 30 8,400 Date Jun 30 Jun 30 Jun 30 0 8,400 45,850 4805 3 1,800 5 10 48,650 0 Interest expense Debit Credit Insurance expense Debit Credit No. No. Data Jun 30 Jun 30 Jun 30 Balance 2,750 3,000 0 Data Jun 30 An 30 Jun 30 Balance 0 3,000 0 250 3.800 8 10 2 10 3,000 3,800 Rent expense Debit Credit Supplies expense Debit Credit No. No. Balance Data Jun 30 Jun 30 Jun 30 500 Balance 12,000 12,500 0 Date Jun 30 Jun 30 Jun 30 6,600 6,600 6. 10 12,500 10 6,600 Property taxus expense Debit Credit Repairs expense Debit Credit No. No Date Jun 30 Jun 30 Jun 30 Balance 7,800 8,800 0 Date Jun 30 Jun 30 Balance 2,910 1,000 10 2,910 10 8,800 Ulles experte Debit Credit Income stry Debil Credit No. No. Balance Date Jun 30 Jun 30 Jun 30 Balance 5,850 6,540 4 650 Date Jun 30 Jun 30 Jun 30 Jun 30 132,100 9 10 11 (132,1001 (30,8901 10 6,540 101,210 30,950 Post-closing ACE CONSTRUCTION CO. Trial Balance June 30, 2021 Account Title Debit Credit Cash $ 18,500 3,300 3,400 132,000 Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable Interest payable Rent payable Wages payable Property taxes payable Long-term notes payable V. Ace, Capital Depreciation expense - Equipment Total 34,650 7.450 250 500 1,800 1,000 25,000 86,550 8,400 165,600 S S 157,200 Post-closing ACE CONSTRUCTION CO. Income Statement For Year Ended June 30 Revenues: Construction revenue $ $ 0 0 8.400 0 0 0 Expenses. Depreciation expense - Equipment Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Repairs expense Utilities expense 0 0 0 0 0 0 Total expenses Net loss 8.400 (8,400) $ Post-closing ACE CONSTRUCTION CO. Balance Sheet June 30 ASSETS Current assets: Prepaid insurance Cash Supplies 3,400 18,500 3,300 0 $ 25 200 Total current assets Plant assets: Equipment 132.000 Equipment, net Total assets 132.000 $ 157 200 LIABILITIES AND EQUITY Current liabilities: Property taxes payable Accounts payable Wages payable Interest payable Rent payable EELT 1.000 7.450 1.800 250 500 0 $ 11,000 Total current liablities Noncurrent liabilities Long-term notes payable Total liabilities Equity V. Ace, Capital Total liabilities and equity 25,000 36,000 36,550 $ 122,550 Post.closing Post-closing Trial Balance Type of Account Account Dr. Cr. Included on Post- closing trial balance? Yes Yes Yes Yes Yes 44 18.500 3,300 3,400 132,000 Yes 34,650 7.450 250 Yes Yes 500 4 4 Yes Yes Cash Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable Interest payable Rent payable Wages payable Property taxes payable Long-term notes payable V. Ace, Capital V. Ace, Withdrawals Construction revenue Depreciation expense - Equipment Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Repairs expense Utilities expense Yes 1.800 1.000 25.000 86.550 Yes OOOOOOOOOOOOOOOOOOOOOOO Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Permanent Temporary Temporary Temporary Temporary Temporary Temporary Temporary Temporary Temporary Temporary Temporary No No No No No No No No No No No Totals $ 157 200 $ 157 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts