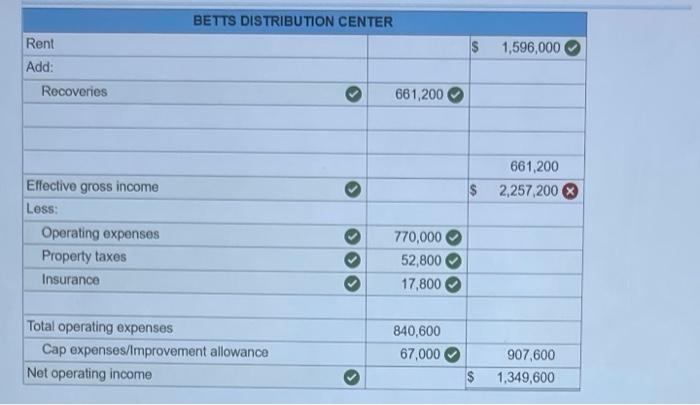

Question: i have everything correct except the Effecrive gross income. Can someone help me find what im missing? You have been asked to develop a pro

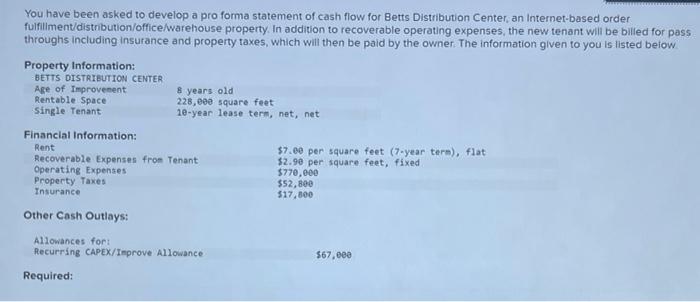

You have been asked to develop a pro forma statement of cash flow for Betts Distribution Center, an Internet-based order fulfillment/distribution/office/warehouse property. In addition to recoverable operating expenses, the new tenant will be billed for pass throughs including insurance and property taxes, which will then be paid by the owner. The information given to you is listed below Property Information: BETTS DISTRIBUTION CENTER Age of Improvement 8 years old Rentable Space 228,000 square feet Single Tenant 18-year lease term, net, net Financial Information: $7.00 per square feet (7-year term), flat Recoverable Expenses from Tenant $2.90 per square feet, fixed Operating Expenses $770,000 Property Taxes $52,800 Insurance 317.800 Rent Other Cash Outlays: Allowances for: Recurring CAPEX/Improve Allowance 567.ee Required: BETTS DISTRIBUTION CENTER $ Rent Add: 1,596,000 Recoveries 661,200 661,200 $ 2,257 200 Effective gross income Less: Operating expenses Property taxes Insurance 770,000 52,800 17,800 Total operating expenses Cap expenses/Improvement allowance Net operating income 840,600 67,000 907,600 1,349,600 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts