Question: I have four questions and I need their formulas or procedures inside excel. Thank you please show me the function!!! not just words yo explain.

I have four questions and I need their formulas or procedures inside excel. Thank you

please show me the function!!!

not just words yo explain.

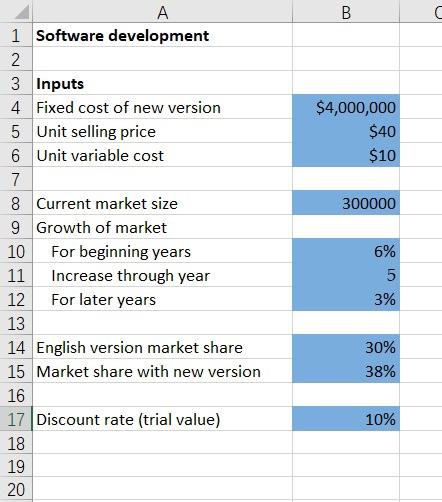

A software company sells a program at $40 each and incurs a variable cost of $10 to produce it. Currently, the size of the market for the product is 300,000 units per year, and the English version of the software has a 30% share of the market. The company estimates that the market size will grow by 6% a year for the next 5 years, and at 3% per year after that. The company is considering translating its program into Chinese. It will cost the company $4 million to create a Chinese version of the program. The translation will increase the market share of the program to 38%. Assuming a 10-year planning horizon, find out how the discount rate affects the profitability of creating the Chinese version of the software. You are required to do the following.

Question:

2. Assume that all variable costs and revenues are incurred at the ends of the respective years. Construct a model to calculate the change in the net present value after introducing the Chinese version. Hint: To calculate the NPV for the cases without and with the Chinese version, you can first do the following: For each year in the planning horizon, calculate the market size as well as the sales volume and profit for each case.

3. Use a one-way data table to analyze how the discount rate impacts the change in the net present value. Use the discount rate from 10% to 26% in increments of 2%.

4. Based on your result in question (3), create a scatter chart with smooth lines and markers to demonstrate the relationship between the change in the net present value and the discount rate (from 10% to 26%). Include in the chart a chart title and axes titles.

5. Highlight the range of NPVs so that the company will not consider the Chinese version

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock