Question: I have had several problems with this particular question. I need help, please. both Problem 6-4 Secondary Mortgage Purchasing Company (SMPC) wants to buy your

I have had several problems with this particular question. I need help, please. both

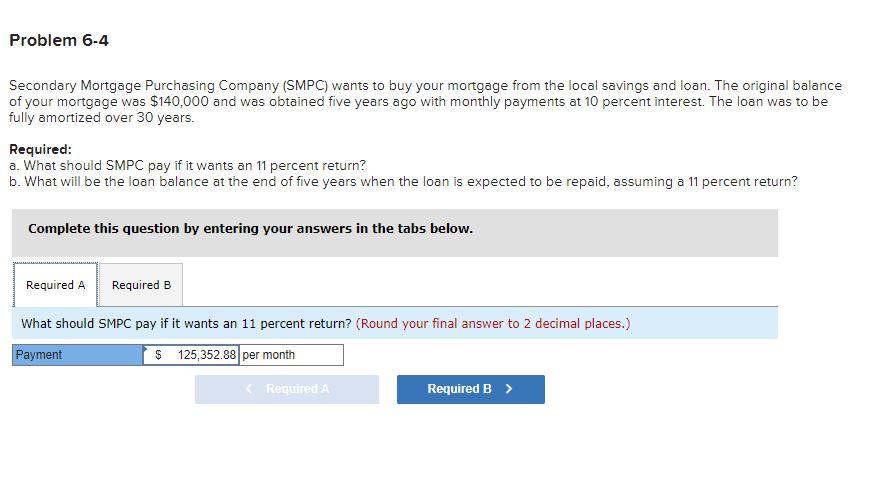

Problem 6-4 Secondary Mortgage Purchasing Company (SMPC) wants to buy your mortgage from the local savings and loan. The original balance of your mortgage was $140,000 and was obtained five years ago with monthly payments at 10 percent interest. The loan was to be fully amortized over 30 years. Required: a. What should SMPC pay if it wants an 11 percent return? b. What will be the loan balance at the end of five years when the loan is expected to be repaid, assuming a 11 percent return? Complete this question by entering your answers in the tabs below. Required A Required B What should SMPC pay if it wants an 11 percent return? (Round your final answer to 2 decimal places.) Payment $ 125,352.88 per month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts