Question: I have having so many problems with understanding this, as deductables, understanding the differnet kinds of plans, and preimiums are. If anyone could help, I

I have having so many problems with understanding this, as deductables, understanding the differnet kinds of plans, and preimiums are. If anyone could help, I would greatly appreciate it!

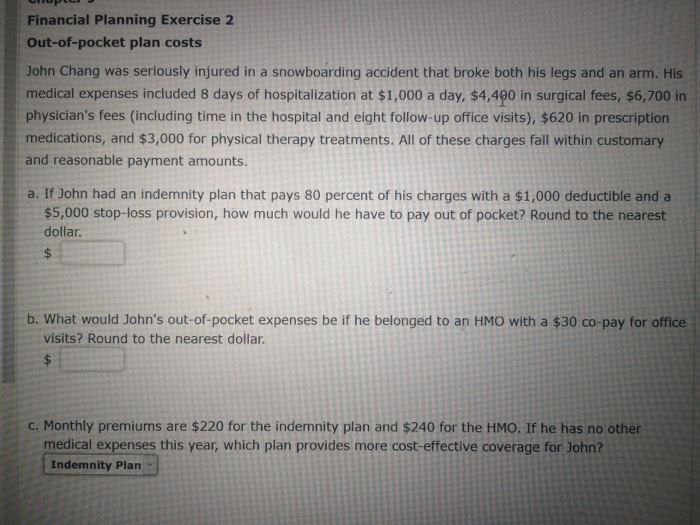

Financial Planning Exercise 2 Out-of-pocket plan costs John Chang was seriously injured in a snowboarding accident that broke both his legs and an arm. His medical expenses included 8 days of hospitalization at $1,000 a day, $4,490 in surgical fees, $6,700 in physician's fees (including time in the hospital and eight follow-up office visits), $620 in prescription medications, and $3,000 for physical therapy treatments. All of these charges fall within customary and reasonable payment amounts. a. If John had an indemnity plan that pays 80 percent of his charges with a $1,000 deductible and a $5,000 stop-loss provision, how much would he have to pay out of pocket? Round to the nearest dollar. b. What would John's out-of-pocket expenses be if he belonged to an HMO with a $30 co-pay for office visits? Round to the nearest dollar. c. Monthly premiums are $220 for the indemnity plan and $240 for the HMO. If he has no other medical expenses this year, which plan provides more cost-effective coverage for John? Indemnity Plan