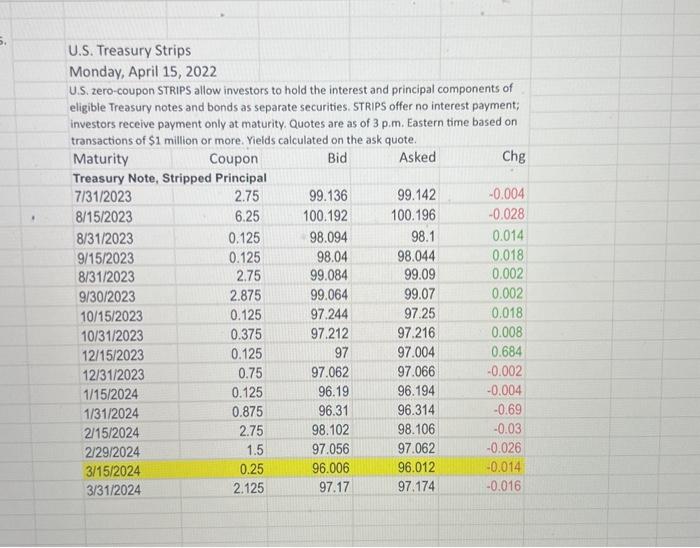

Question: I have highlighted a Treasury Note STRIP maturing on March 15, 2024 with its selling prices. What is the asked yield rate? Hint: Assume the

I have highlighted a Treasury Note STRIP maturing on March 15, 2024 with its selling prices. What is the asked yield rate? Hint: Assume the Settlement Date is April 19, 2023 and if using weeks in your formula, 47 weeks. Monday, April 15, 2022 U.S. zero-coupon STRIPS allow investors to hold the interest and principal components of eligible Treasury notes and bonds as separate securities. STRIPS offer no interest payment; investors receive payment only at maturity. Quotes are as of 3 p.m. Eastern time based on I have highlighted a Treasury Note STRIP maturing on March 15, 2024 with its selling prices. What is the asked yield rate? Hint: Assume the Settlement Date is April 19, 2023 and if using weeks in your formula, 47 weeks. Monday, April 15, 2022 U.S. zero-coupon STRIPS allow investors to hold the interest and principal components of eligible Treasury notes and bonds as separate securities. STRIPS offer no interest payment; investors receive payment only at maturity. Quotes are as of 3 p.m. Eastern time based on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts