Question: I have modified the formatting and added in my entries for part 2. My apologies on not noticing the new formatting course here did. Please

I have modified the formatting and added in my entries for part 2. My apologies on not noticing the new formatting course here did.

Please check below answers for accuracy. If something is incorrect please be specific in your answer if you are addressing a part of question 1 or 2.

Question 1 is a 10 part multiple choice question. I have left all relevant parts of the answers. My answer to each question is is underlined and bolded.

1. Choose the best answer for each multiple choice question below.

Property tax revenues recognized in the governmental fund operating statements often differ from the amount recognized in the government-wide statement of activities, because.

a. Property tax revenues are not recorded in the government-wide statements.

b. Availability to finance current expenditures is not a revenue recognition criterion under the accrual basis used at the government-wide level.

c. Bad debt expense is recognized at the government-wide level.

d. GASB standards preclude full recognition of property tax revenues in governmental funds.

2. Which of the following is an example of an imposed nonexchange transaction?

a. Sales taxes.

b. Personal income taxes.

c. Corporate income taxes.

d. Property taxes.

3. Budgetary comparison data can be presented

a. Within the basic financial statements.

b. As note disclosure in the basic financial statements.

c. As required supplementary information.

d. Both presentation within the basic financial statements and presentation as required supplementary information are acceptable methods of budgetary comparison data.

4. Internal balances

a. Represent activity between the governmental funds and enterprise funds.

b. Are reported on the government-wide statement of net position.

c. May have a debit or a credit balance.

d. All of the above are true

5. Which of the following items may appear on the governmental fund operating statement?

a. Expenditures.

b. Encumbrances.

c. Appropriations.

d. Net position

6. The Appropriations account of a government is debited when

a. The budget is recorded at the beginning of the year.

b. Expenditures are recorded.

c. The account is closed to budgetary fund balance at the end of the year.

d. Payment is made for an appropriated amount.

7. Which of the following is a program revenues classification used in the governmental activities journal and reported in the government-wide statement of activities?

a. Sales taxes.

b. Interest income.

c. Charges for services.

d. Other financing sources.

8. The earnings on the assets of a permanent fund are to be used to maintain the city's park benches (special revenue fund). How would the earnings be recorded?

a. Revenues by the permanent fund.

b. Revenues by the park bench special revenue fund.

c. Revenues by both the permanent fund and the park bench special revenue.

c. Other financing sources by the permanent fund.

9. Which of the following would be recorded in the same fashion in the General Fund and Governmental Activities general journals?

a. The purchase of a copier.

b. The issuance of a bond.

c. The collection of property taxes deferred from a prior year.

d. Borrowing through tax anticipation note.

10. Supplies recorded in the General Fund under the consumption method will initially include a

a. Debit to Inventory of Supplies.

b. Credit to Fund BalanceRestrictedInventory of Supplies.

c. Debit to Expenditures.

d. Debit to Fund BalanceRestrictedInventory of Supplies.

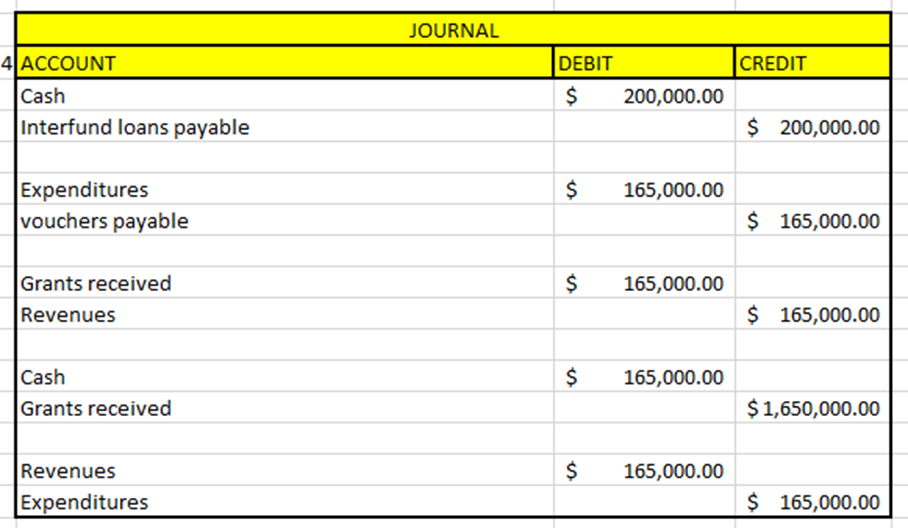

2. Special Revenue Fund, Voluntary Nonexchange Transactions. (LO4-1, LO4-4, LO4-7) The City of Waterville applied for a grant from the state government to build a pedestrian bridge over the river inside the city's park. On May 1, the city was notified that it had been awarded a grant of up to $200,000 for the project. The state will provide reimbursement for allowable expenditures. On May 5, the special revenue fund entered into a short-term loan with the General Fund for $200,000 so it could start bridge construction. During the year, the special revenue fund expended $165,000 for allowable bridge construction costs, for which it submitted documentation to the state. Reimbursement was received from the state on December 13.

: For the special revenue fund, provide the appropriate journal entries, if any, that would be made for the following. (Assume the city has a fiscal year-end of December 31.)

May 1, notification of grant approval.

May 5, loan from General Fund.

During the year, bridge expenditures and submission of reimbursement documentation.

December 13, receipt of the grant reimbursement funds.

December 31, adjusting and closing entries.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts