Question: i have one problem wrong on these 3 questions (3 different problems, help) Keep-or-Drop Decision Charlevoix Company produces three products: Torch, Elk, and Walloon. A

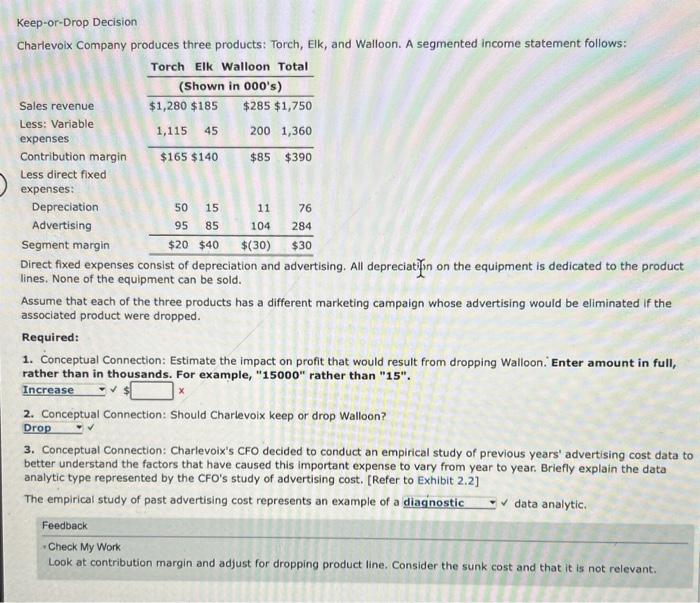

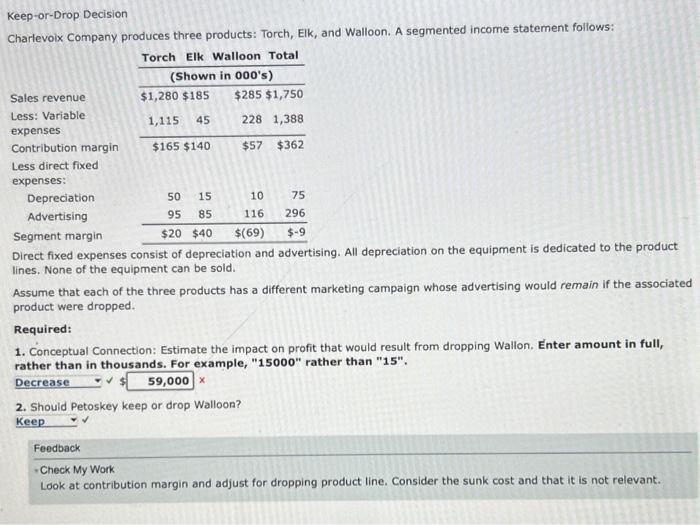

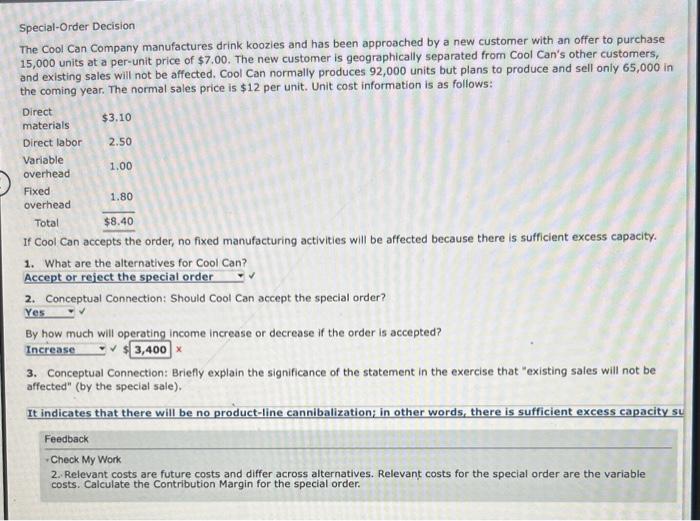

Keep-or-Drop Decision Charlevoix Company produces three products: Torch, Elk, and Walloon. A segmented income statement follows: Direct fixed expenses consist of depreciation and advertising. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that each of the three products has a different marketing campaign whose advertising would be eliminated if the associated product were dropped. Required: 1. Conceptual Connection: Estimate the impact on profit that would result from dropping Walloon. Enter amount in full, rather than in thousands. For example, "15000" rather than "15". 2. Conceptual Connection: Should Charlevoix keep or drop Walloon? 3. Conceptual Connection: Charlevoix's CFO decided to conduct an empirical study of previous years' advertising cost data to better understand the factors that have caused this important expense to vary from year to year. Briefly explain the data analytic type represented by the CFO's study of advertising cost. [Refer to Exhibit 2.2] The empirical study of past advertising cost represents an example of a data analytic. Feedback - Check My Work Look at contribution margin and adjust for dropping product line. Consider the sunk cost and that it is not relevant. Keep-or-Drop Decision Charlevoix Company produces three products: Torch, Elk, and Walloon. A segmented income statement follows: Direct fixed expenses consist of depreciation and advertising. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that each of the three products has a different marketing campaign whose advertising would remain if the associated product were dropped. Required: 1. Conceptual Connection: Estimate the impact on profit that would result from dropping Wallon. nter amount in full, rather than in thousands. For example, "15000" rather than "15". 2. Should Petoskey keep or drop Walloon? Feedback - Check My Work Look at contribution margin and adjust for dropping product line. Consider the sunk cost and that it is not relevant. Special-Order Decision The Cool Can Company manufactures drink koozies and has been approached by a new customer with an offer to purchase 15,000 units at a per-unit price of $7.00. The new customer is geographically separated from Cool Can's other customers, and existing sales will not be affected. Cool Can normally produces 92,000 units but plans to produce and sell only 65,000 in the coming year. The normal sales price is $12 per unit. Unit cost information is as follows: If Cool Can accepts the order, no fixed manufacturing activities will be affected because there is sufficient excess capacity. 1. What are the alternatives for Cool Can? Accept or reject the special order 2. Conceptual Connection: Should Cool Can accept the special order? By how much will operating income increase or decrease if the order is accepted? 3. Conceptual Connection: Briefly explain the significance of the statement in the exercise that "existing sales will not be affected" (by the special sale). It indicates that there will be no product-line cannibalization; in other words, there is sufficient excess capacity Feedback - Check My Work 2. Relevant costs are future costs and differ across alternatives. Relevant costs for the special order are the variable costs. Calculate the Contribution Margin for the special order. Keep-or-Drop Decision Charlevoix Company produces three products: Torch, Elk, and Walloon. A segmented income statement follows: Direct fixed expenses consist of depreciation and advertising. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that each of the three products has a different marketing campaign whose advertising would be eliminated if the associated product were dropped. Required: 1. Conceptual Connection: Estimate the impact on profit that would result from dropping Walloon. Enter amount in full, rather than in thousands. For example, "15000" rather than "15". 2. Conceptual Connection: Should Charlevoix keep or drop Walloon? 3. Conceptual Connection: Charlevoix's CFO decided to conduct an empirical study of previous years' advertising cost data to better understand the factors that have caused this important expense to vary from year to year. Briefly explain the data analytic type represented by the CFO's study of advertising cost. [Refer to Exhibit 2.2] The empirical study of past advertising cost represents an example of a data analytic. Feedback - Check My Work Look at contribution margin and adjust for dropping product line. Consider the sunk cost and that it is not relevant. Keep-or-Drop Decision Charlevoix Company produces three products: Torch, Elk, and Walloon. A segmented income statement follows: Direct fixed expenses consist of depreciation and advertising. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that each of the three products has a different marketing campaign whose advertising would remain if the associated product were dropped. Required: 1. Conceptual Connection: Estimate the impact on profit that would result from dropping Wallon. nter amount in full, rather than in thousands. For example, "15000" rather than "15". 2. Should Petoskey keep or drop Walloon? Feedback - Check My Work Look at contribution margin and adjust for dropping product line. Consider the sunk cost and that it is not relevant. Special-Order Decision The Cool Can Company manufactures drink koozies and has been approached by a new customer with an offer to purchase 15,000 units at a per-unit price of $7.00. The new customer is geographically separated from Cool Can's other customers, and existing sales will not be affected. Cool Can normally produces 92,000 units but plans to produce and sell only 65,000 in the coming year. The normal sales price is $12 per unit. Unit cost information is as follows: If Cool Can accepts the order, no fixed manufacturing activities will be affected because there is sufficient excess capacity. 1. What are the alternatives for Cool Can? Accept or reject the special order 2. Conceptual Connection: Should Cool Can accept the special order? By how much will operating income increase or decrease if the order is accepted? 3. Conceptual Connection: Briefly explain the significance of the statement in the exercise that "existing sales will not be affected" (by the special sale). It indicates that there will be no product-line cannibalization; in other words, there is sufficient excess capacity Feedback - Check My Work 2. Relevant costs are future costs and differ across alternatives. Relevant costs for the special order are the variable costs. Calculate the Contribution Margin for the special order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts