Question: I have provided all the information required Question 4 (35 marks) An Australian government bond will mature exactly five years from today. The bond has

I have provided all the information required

I have provided all the information required

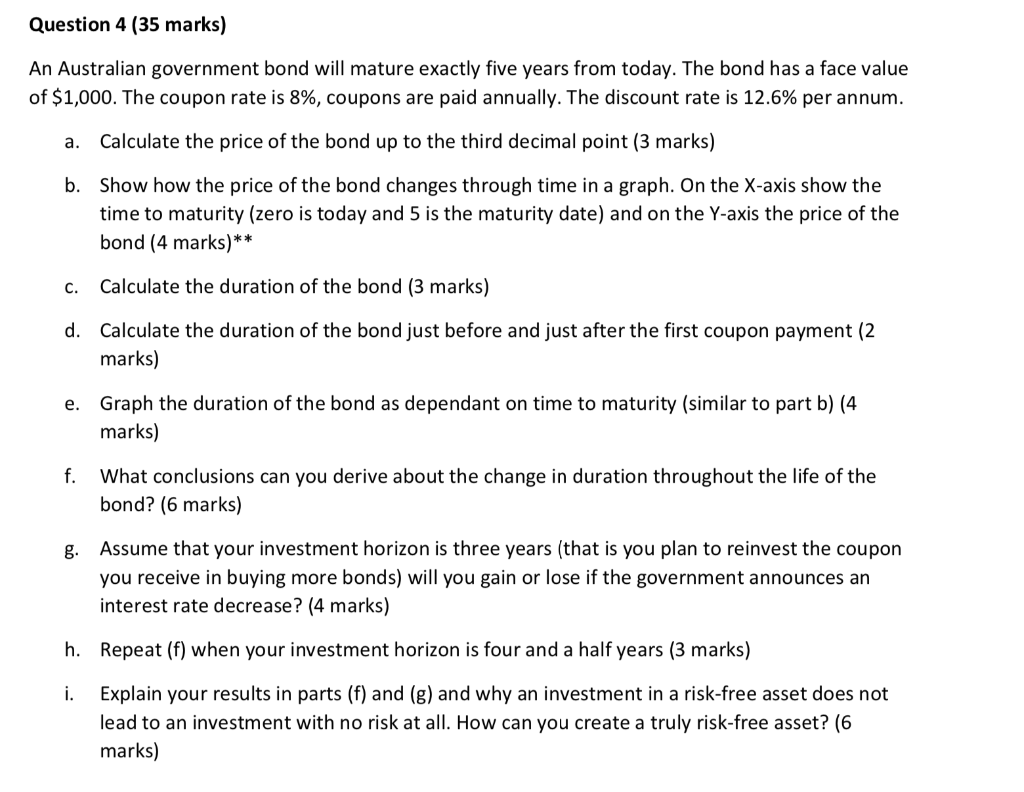

Question 4 (35 marks) An Australian government bond will mature exactly five years from today. The bond has a face value of $1,000. The coupon rate is 8%, coupons are paid annually. The discount rate is 12.6% per annum. a. Calculate the price of the bond up to the third decimal point (3 marks) b. Show how the price of the bond changes through time in a graph. On the X-axis show the time to maturity (zero is today and 5 is the maturity date) and on the Y-axis the price of the bond (4 marks)** c. Calculate the duration of the bond (3 marks) d. Calculate the duration of the bond just before and just after the first coupon payment (2 marks) e. Graph the duration of the bond as dependant on time to maturity (similar to part b) (4 marks) f. What conclusions can you derive about the change in duration throughout the life of the bond? (6 marks) g. Assume that your investment horizon is three years (that is you plan to reinvest the coupon you receive in buying more bonds) will you gain or lose if the government announces an interest rate decrease? (4 marks) h. Repeat (f) when your investment horizon is four and a half years (3 marks) i. Explain your results in parts (f) and (g) and why an investment in a risk-free asset does not lead to an investment with no risk at all. How can you create a truly risk-free asset? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts