Question: I have provided the fifo answer so I need lifo and avco excatly at this method. it's inventory valuation chapter. Joseph a sole proprietor, buys

I have provided the fifo answer so I need lifo and avco excatly at this method. it's inventory valuation chapter.

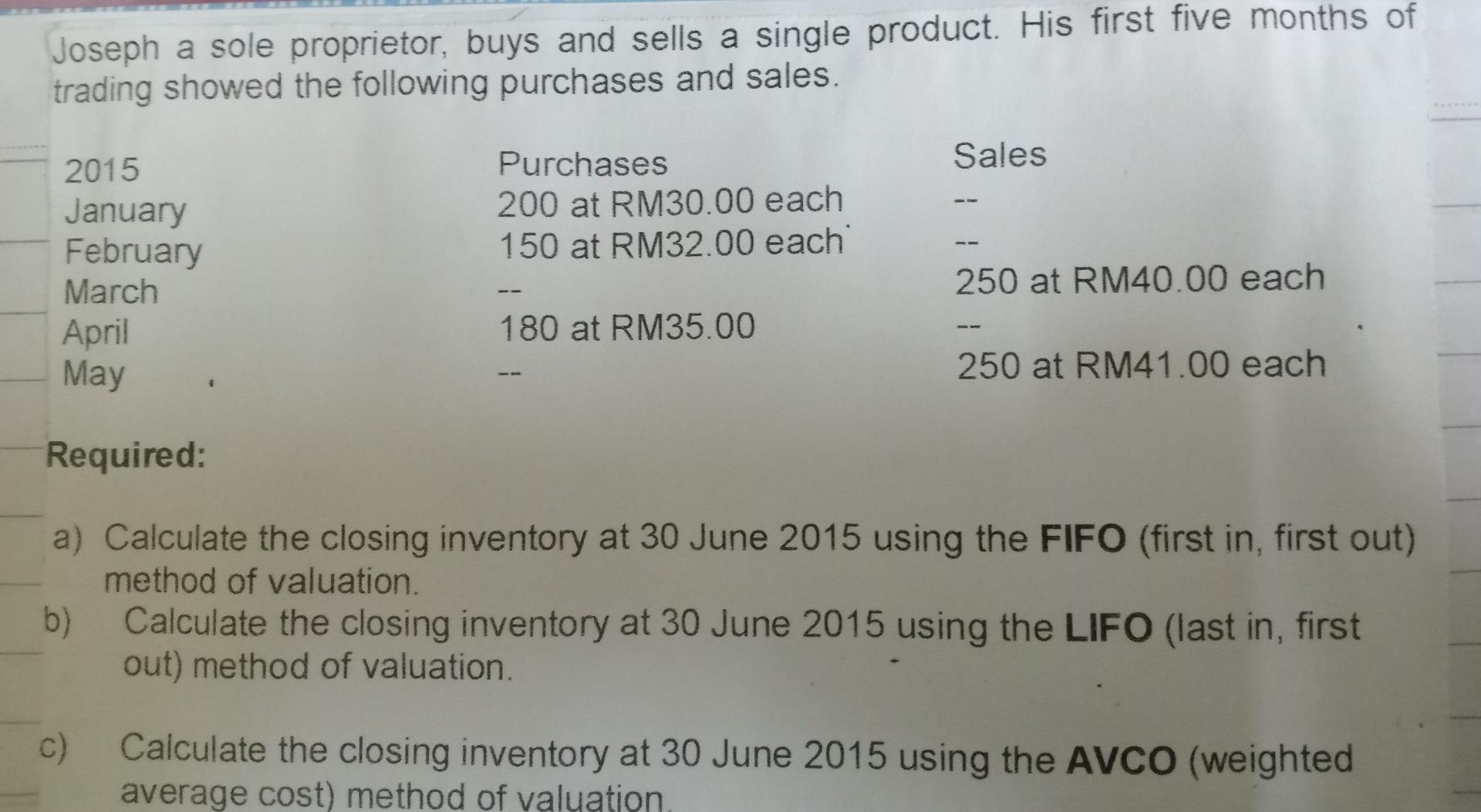

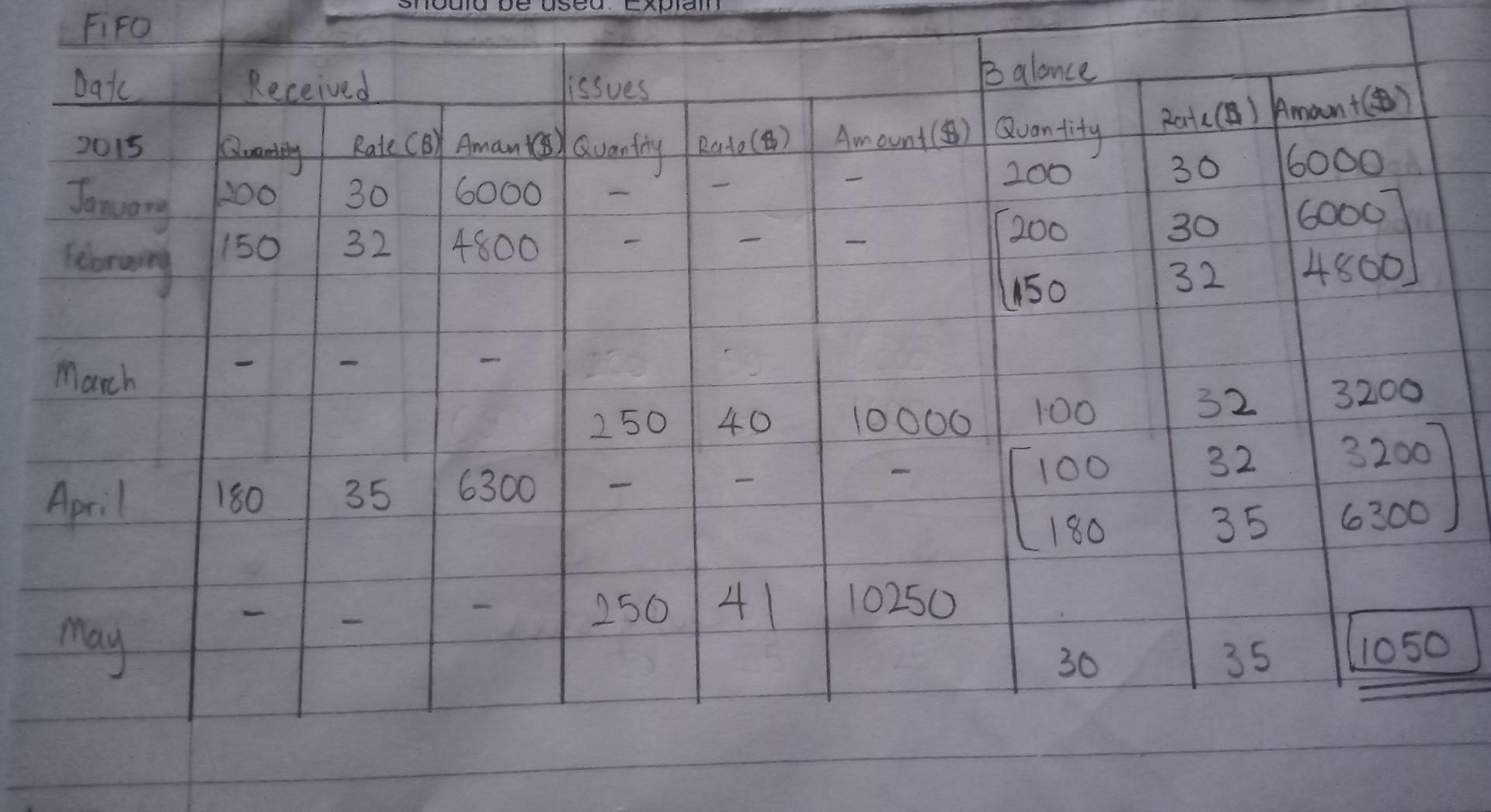

Joseph a sole proprietor, buys and sells a single product. His first five months of trading showed the following purchases and sales. Sales Purchases 200 at RM30.00 each 150 at RM32.00 each 2015 January February March April May 250 at RM40.00 each 180 at RM35.00 -- 250 at RM41.00 each Required: a) Calculate the closing inventory at 30 June 2015 using the FIFO (first in, first out) method of valuation. b) Calculate the closing inventory at 30 June 2015 using the LIFO (last in, first out) method of valuation. c) Calculate the closing inventory at 30 June 2015 using the AVCO (weighted average cost) method of valuation FIFO Date B alonce Amount ($) Quantity 2015 Rate($) Received lissues Quantity Rate (B) Amantes Rate (B) Amants) Quantity 30 6000 1150 32 4800 -- January Rate (6) Amount (B) 30 16000 30 6000 32 14800) 200 - februar 11150 - March 250 40 10000 3200 3200 32 32 100 100 1180 April 180 35 6300 6300 - 250 141 10250 may 30 35 1050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts