Question: I have subscribed for this question, I will send it until I got a good answer, please chegg committee can you send it to an

I have subscribed for this question, I will send it until I got a good answer, please chegg committee can you send it to an expert in a financial mathematician who is good in stochastic differential equation for portfolio thoery.

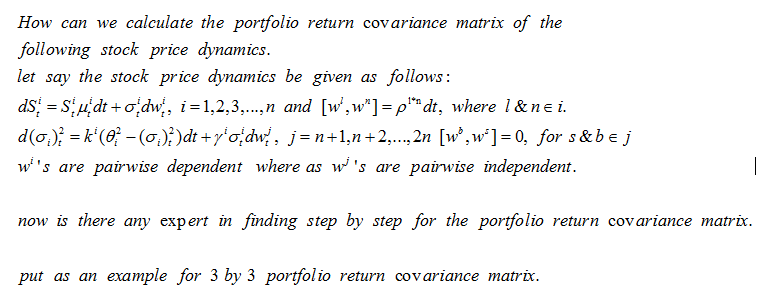

How can we calculate the portfolio return covariance matrix of the following stock price dynamics. let say the stock price dynamics be given as follows: ds = Sudt + odw, i=1,2,3,...,n and [w', w"]=plndt, where l&nei. d(0)? = k(0? -()})dt + yo dw, j=n+1,n +2,..., 2n [w, w"]=0, for s&bej wi's are pairwise dependent where as w's are pairwise independent. | now is there any expert in finding step by step for the portfolio return covariance matrix. put as an example for 3 by 3 portfolio return covariance matrix. How can we calculate the portfolio return covariance matrix of the following stock price dynamics. let say the stock price dynamics be given as follows: ds = Sudt + odw, i=1,2,3,...,n and [w', w"]=plndt, where l&nei. d(0)? = k(0? -()})dt + yo dw, j=n+1,n +2,..., 2n [w, w"]=0, for s&bej wi's are pairwise dependent where as w's are pairwise independent. | now is there any expert in finding step by step for the portfolio return covariance matrix. put as an example for 3 by 3 portfolio return covariance matrix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts