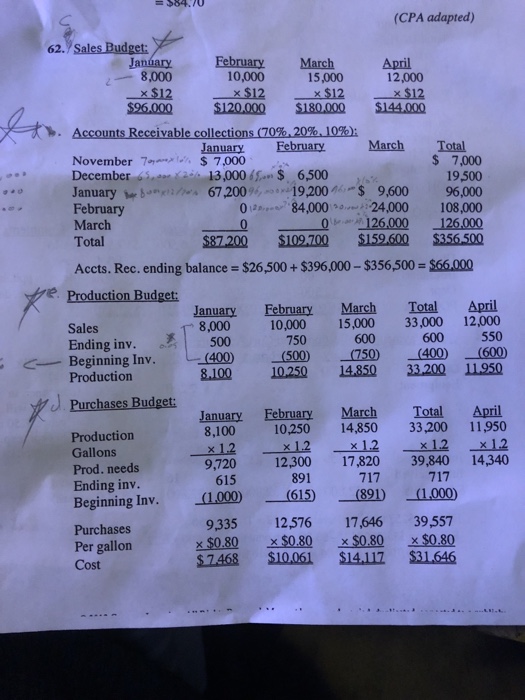

Question: I have the answer, but I need help with the production Budget. In the Ending Ind how do I calculate it? Thank you 10.5 (Master

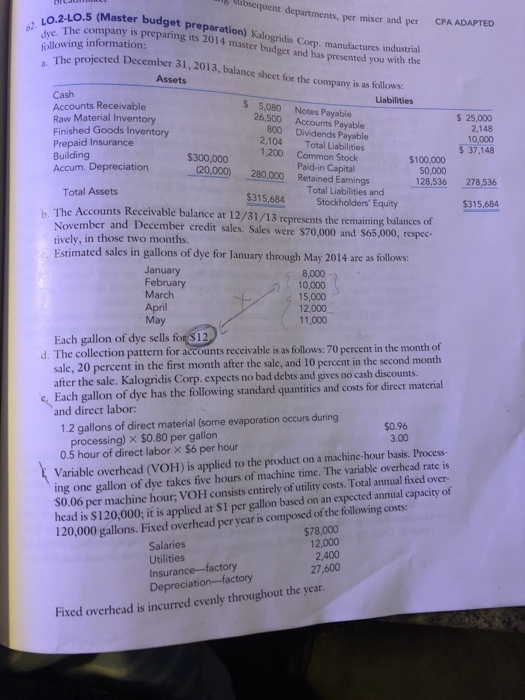

10.5 (Master bu epartments, per mixer and per dget preparation) Kalogridis Corp, manufactures industrial LOThe company is preparing its 2014 master budget and has presented you with the CPA ADAPTED dyc following information a. he projected December 31, 2013, balance shectfor the comparny is s followes Assets Cash Accounts Receivable Raw Material Inventory Finished Goods Inventory Prepaid Insurance Building Accum. Depreciation Liabilities S 5,080 Notes Payable 26,500 Accounts Payable 800 Dividends Payable 2,104 Total Liabilities S 25,000 2,148 10,000 37.148 1,200 Common Stock $300,000 Paid-in Capital $100,000 50,000 (20,000) 280,000 Retained Earnings 128,536 278,536 Total Liabilities and Total Assets The Accounts Receivable balance at 12/31/13 represents the remaining balances of November and December credit sales. Sales were $70,000 and $65,000, respec- tively, in those two months. Estimated sales in gallons of dye for January through May 2014 are as follows 315,684 Stockholders' Equity $315,684 January February March April May 8,000 10,000 15,000 12,000 11,000 Each gallon of dye sells for $12. d. The collection pattern for accounts receivable is as follows: 70 percent in the month of the first month after the sale, and 10 percent in the second month sale, 20 percent in after the sale. Kalogridis Corp. expects no bad debts and gives no cash discounts. e. Each gallon of dye has the following standard quantities and costs for direct material and direct labor: 1.2 gallons of direct material (some evaporation occurs during $0.96 3.00 processing) $0.80 per gallon 0.5 hour of direct labor S6 per hour Variable overhead (VOH) is applied to the product on a machine-hour basis. Process- ing one gallon of dye takes five hours of machine time. The variable overhead rate is S0.06 per machine hour; VOH consists entirely of utility costs. Total annual fixed over- head is $120,000; it is applied at SI per gallon based on an expected annual capacity of 120,000 gallons. Fixed overhead per year is composed of the following costs: Salaries Utilities $78,000 12,000 2,400 270 actory Depreciation-factory Fixed overhead is incurred evenly throughout the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts