Question: I have the correct answer clicked. I need help understanding why we need to calculate the first 5 years if we just paid our fist

I have the correct answer clicked. I need help understanding why we need to calculate the first 5 years if we just paid our fist annual dividend and we are looking for the stock worth today. I also need help understanding the formula.

Thank You

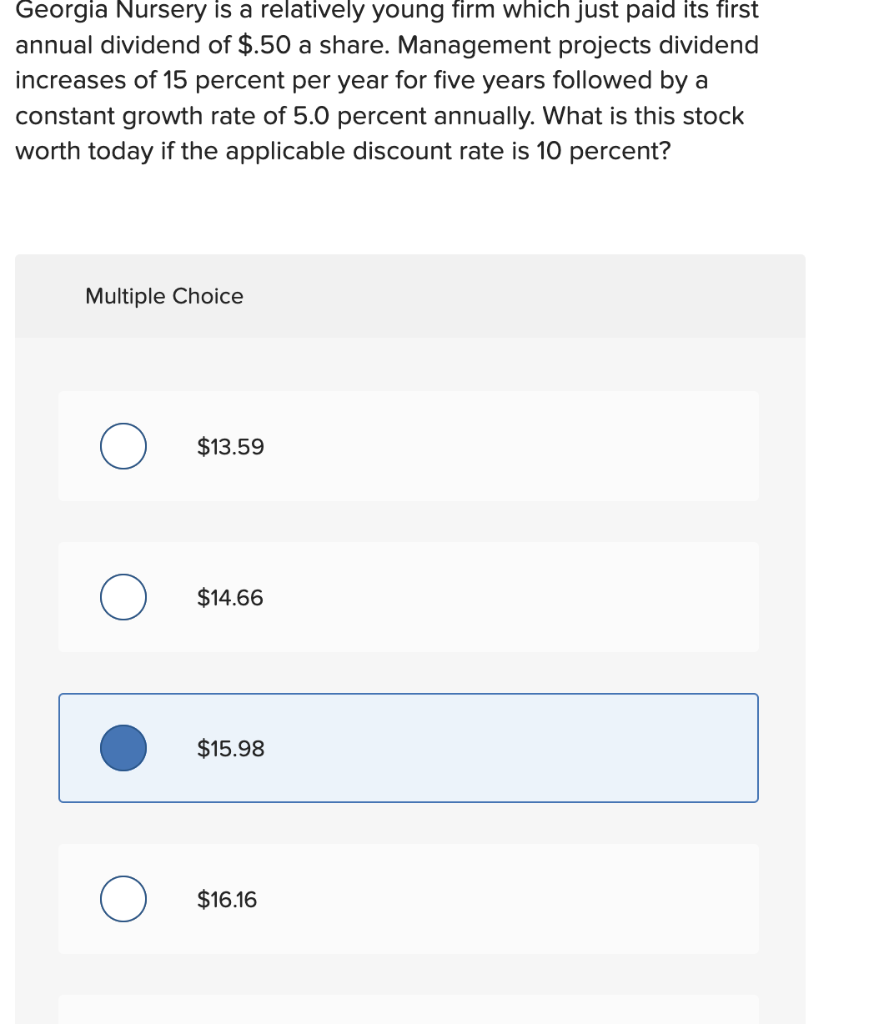

Georgia Nursery is a relatively young firm which just paid its first annual dividend of $.50 a share. Management projects dividend increases of 15 percent per year for five years followed by a constant growth rate of 5.0 percent annually. What is this stock worth today if the applicable discount rate is 10 percent? Multiple Choice $13.59 $14.66 $15.98 $16.16

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock