Question: i have the excel sheets if needed but please i need help with these. One-Month Project NOTE! Templates needed to complete these exercises, including onte

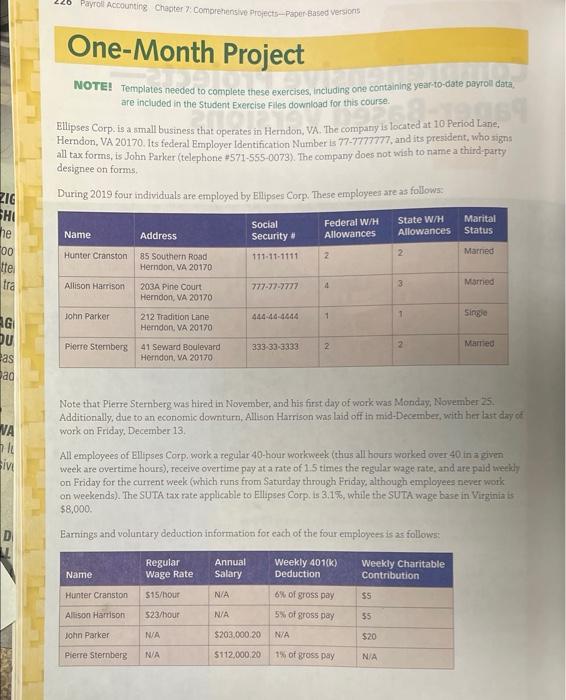

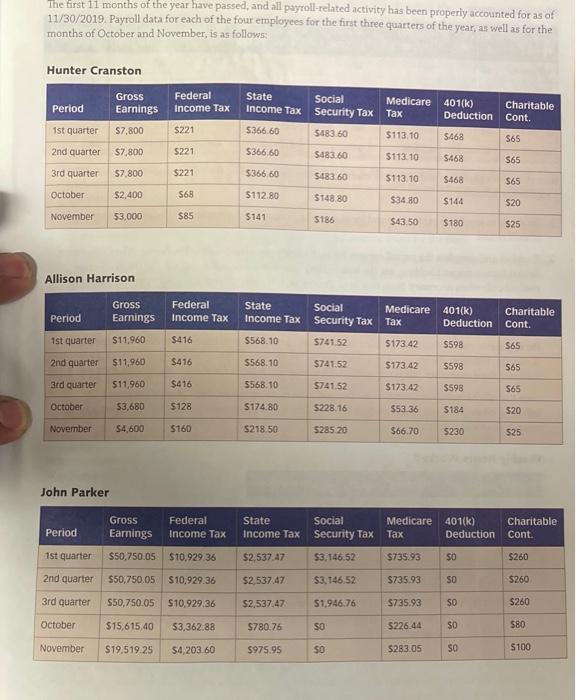

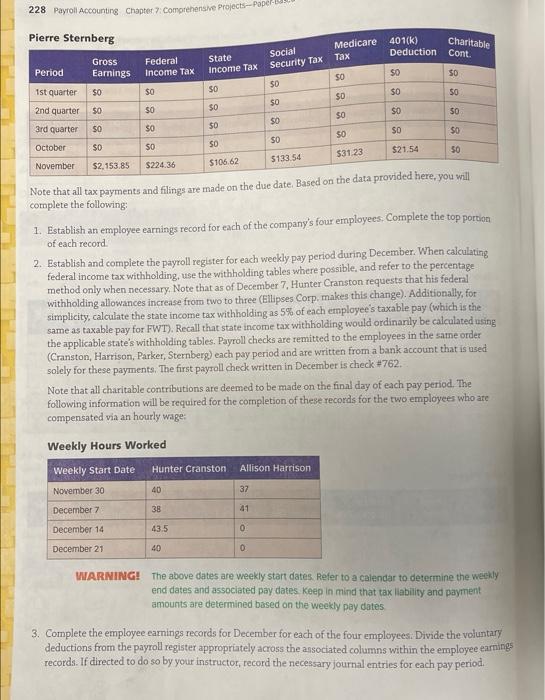

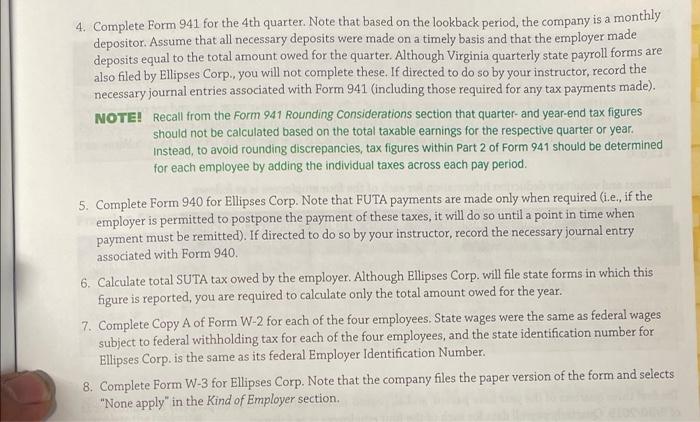

One-Month Project NOTE! Templates needed to complete these exercises, including onte containing year-to-date payroll data. are included in the student Exercise Files download for this course. Ellipses Corp. is a small business that operates in Herndon, VA. The company is located at 10 Period Lane. Herndon, VA 20170. Its fecteral Employer Identification Number is 77-7773777, and its president, who signs all tax forms, is John Parker (telephone $5715550073 ). The company does not waish to mame a third. party designee on forms, During 2019 four individuals are employed by Ellipses Corp. These employeet are as follows: Note that Pierre Stemberg was hired in November, and his first day of work was Monday, November 25. Additionally, due to an economic downturn, Allison' Harrison was laid off in mid-December, with hit last day of work an Friday. December 13. All employees of Ellipses Corp, work a regular 40 -hour workweek (thus all hours worked over 40 in a givin week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weuth on Friday for the current week (which runs from Saturday through Friday, although employees nerer wotk on weekends). The SUTA tax rate applicable to Ellipses Corp, is 3,19, while the SUTA wage base in Virginia is $8,000 Earnings and voluntary deduction information for each of the four employees is as followst The first 11 months of the year have passed, and all payroll-related activity has been properly accounted for as of 11/30/2019. Payroll data for each of the four employees for the first three quarters of the year, as well as for the months of October and November, is as follows: Hunter Cranston Allison Harrison 228 Payroll Accounting Chapter 7: Comprehenshe Projects-Poper-bosps Note that all tax payments and filings are made on the die date, Based on the data jururamnmensym man complete the following: 1. Establish an employee earnings record for each of the company's four employecs. Complete the top portan of each record. 2. Establish and complete the payroll register for each weckly pay period during December. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of December 7 , Hunter Cranston requests that his fedenl withholding allowinces increase from two to three (Ellpses Corp. makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee 's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarly be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Cranston, Harrison, Parker, Sternberg) each pay period and are written from a bank account that is used solely for these payments. The first paysoll check written in December is check #762. Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked UNRRMAG! The above dates are weekly start dates. Refer to a calendar to determine the werekly end dates and associated pay dates. Keep in mind that tax lability and payment amounts afe determined based on the weekly pay dates. 3. Complete the employee eamings records for December for each of the four employees. Divide the voluntary deductions from the payrol register appropriately across the ansociated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period. 4. Complete Form 941 for the 4 th quarter. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for the quarter. Although Virginia quarterly state payroll forms are also filed by Ellipses Corp., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with Form 941 (including those required for any tax payments made). NOTE! Recall from the Form 941 Rounding Considerations section that quarter-and year-end tax figures should not be calculated based on the total taxable earnings for the respective quarter or year. instead, to avoid rounding discrepancies, tax figures within Part 2 of form 941 should be determined for each employee by adding the individual taxes across each pay period. 5. Complete Form 940 for Ellipses Corp. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ellipses Corp. will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ellipses Corp. is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ellipses Corp. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. One-Month Project NOTE! Templates needed to complete these exercises, including onte containing year-to-date payroll data. are included in the student Exercise Files download for this course. Ellipses Corp. is a small business that operates in Herndon, VA. The company is located at 10 Period Lane. Herndon, VA 20170. Its fecteral Employer Identification Number is 77-7773777, and its president, who signs all tax forms, is John Parker (telephone $5715550073 ). The company does not waish to mame a third. party designee on forms, During 2019 four individuals are employed by Ellipses Corp. These employeet are as follows: Note that Pierre Stemberg was hired in November, and his first day of work was Monday, November 25. Additionally, due to an economic downturn, Allison' Harrison was laid off in mid-December, with hit last day of work an Friday. December 13. All employees of Ellipses Corp, work a regular 40 -hour workweek (thus all hours worked over 40 in a givin week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weuth on Friday for the current week (which runs from Saturday through Friday, although employees nerer wotk on weekends). The SUTA tax rate applicable to Ellipses Corp, is 3,19, while the SUTA wage base in Virginia is $8,000 Earnings and voluntary deduction information for each of the four employees is as followst The first 11 months of the year have passed, and all payroll-related activity has been properly accounted for as of 11/30/2019. Payroll data for each of the four employees for the first three quarters of the year, as well as for the months of October and November, is as follows: Hunter Cranston Allison Harrison 228 Payroll Accounting Chapter 7: Comprehenshe Projects-Poper-bosps Note that all tax payments and filings are made on the die date, Based on the data jururamnmensym man complete the following: 1. Establish an employee earnings record for each of the company's four employecs. Complete the top portan of each record. 2. Establish and complete the payroll register for each weckly pay period during December. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of December 7 , Hunter Cranston requests that his fedenl withholding allowinces increase from two to three (Ellpses Corp. makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee 's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarly be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Cranston, Harrison, Parker, Sternberg) each pay period and are written from a bank account that is used solely for these payments. The first paysoll check written in December is check #762. Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked UNRRMAG! The above dates are weekly start dates. Refer to a calendar to determine the werekly end dates and associated pay dates. Keep in mind that tax lability and payment amounts afe determined based on the weekly pay dates. 3. Complete the employee eamings records for December for each of the four employees. Divide the voluntary deductions from the payrol register appropriately across the ansociated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period. 4. Complete Form 941 for the 4 th quarter. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for the quarter. Although Virginia quarterly state payroll forms are also filed by Ellipses Corp., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with Form 941 (including those required for any tax payments made). NOTE! Recall from the Form 941 Rounding Considerations section that quarter-and year-end tax figures should not be calculated based on the total taxable earnings for the respective quarter or year. instead, to avoid rounding discrepancies, tax figures within Part 2 of form 941 should be determined for each employee by adding the individual taxes across each pay period. 5. Complete Form 940 for Ellipses Corp. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ellipses Corp. will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ellipses Corp. is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ellipses Corp. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts