Question: i have the numbers wrong Required information Problem 6-5A (Algo) Preparing a bank reconciliation and recording adjustments LO P3 [The following information applies to the

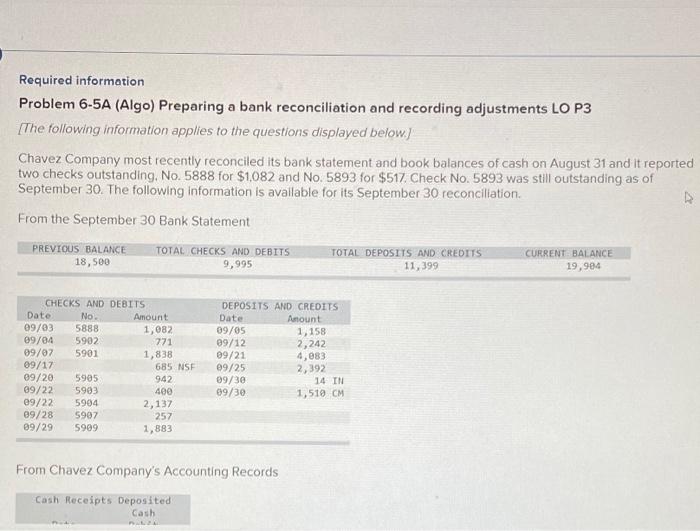

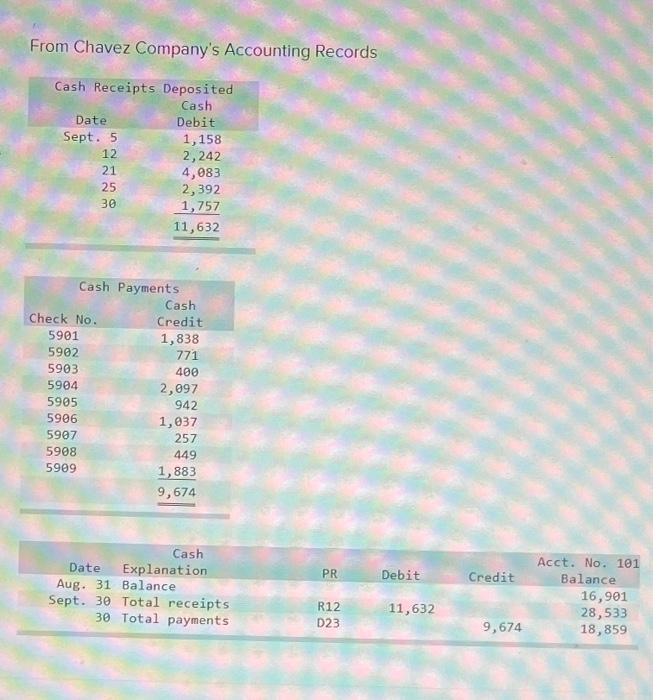

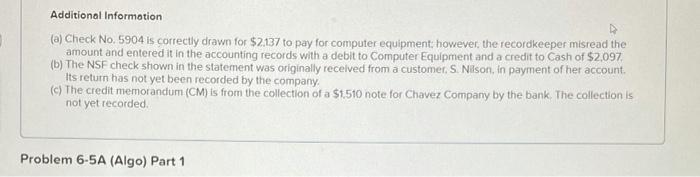

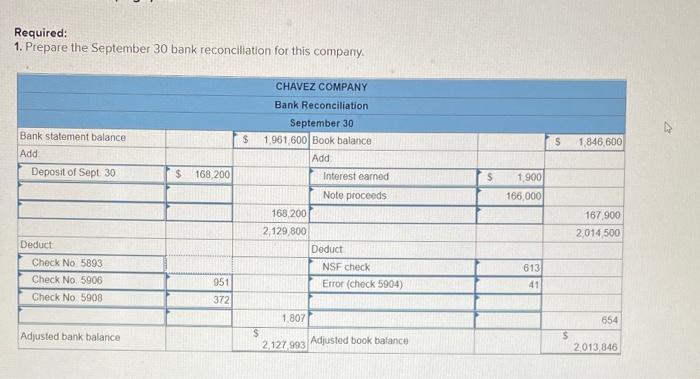

Required information Problem 6-5A (Algo) Preparing a bank reconciliation and recording adjustments LO P3 [The following information applies to the questions displayed below.) Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1.082 and No: 5893 for $517. Check No. 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation From the September 30 Bank Statement PREVIOUS BALANCE 18,500 TOTAL CHECKS AND DEBITS 9,995 TOTAL DEPOSITS AND CREDITS 11,399 CURRENT BALANCE 19,994 771 CHECKS AND DEBITS Date No. Amount 09/03 5888 1,082 09/04 5902 09/07 5901 1,838 09/17 685 NSE 09/20 5905 942 09/22 5903 400 e9/22 5904 2,137 09/28 5907 257 89/29 5909 1,883 DEPOSITS AND CREDITS Date Amount 09/05 1,158 09/12 2,242 09/21 4,083 09/25 2,392 09/30 14 IN 09/30 1,510 CM From Chavez Company's Accounting Records Cash Receipts Deposited Cash From Chavez Company's Accounting Records Cash Receipts Deposited Cash Date Debit Sept. 5 1,158 12 2,242 21 4,083 25 2,392 30 1,757 11,632 Cash Payments Cash Check No. Credit 5901 1,838 5902 771 5903 400 5904 2,097 5905 942 5906 1,037 5907 257 5908 449 5909 1,883 9,674 PR Debit Credit Cash Date Explanation Aug. 31 Balance Sept. 30 Total receipts 30 Total payments Acct. No. 101 Balance 16,901 28,533 18,859 R12 D23 11,632 9,674 Additional Information (a) Check No. 5904 is correctly drawn for $2,137 to pay for computer equipment, however the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,097 (b) The NSF check shown in the statement was originally received from a customer, S. Nilson, in payment of her account. Its return has not yet been recorded by the company (c) The credit memorandum (CM) is from the collection of a $1.510 note for Chavez Company by the bank. The collection is not yet recorded Problem 6-5A (Algo) Part 1 Required: 1. Prepare the September 30 bank reconciliation for this company CHAVEZ COMPANY $ s 1 846 600 Bank statement balance Add Deposit of Sept 30 $ 168 200 $ Bank Reconciliation September 30 1.961 600 Book balance Add Interest earned Note proceeds 168,200 2,129,800 Deduct NSF check Error (check 5904) 1.900 166000 167.900 2014500 Deduct Check No 5893 Check No. 5906 Check No: 5908 613 41 951 372 1.807 654 $ Adjusted bank balance s 2,127 993 Adjusted book balance 2013 846

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts