Question: i have the other ones correct but i keep doing the math still comes up wrong Selected ledger account balances for Business Solutions follow For

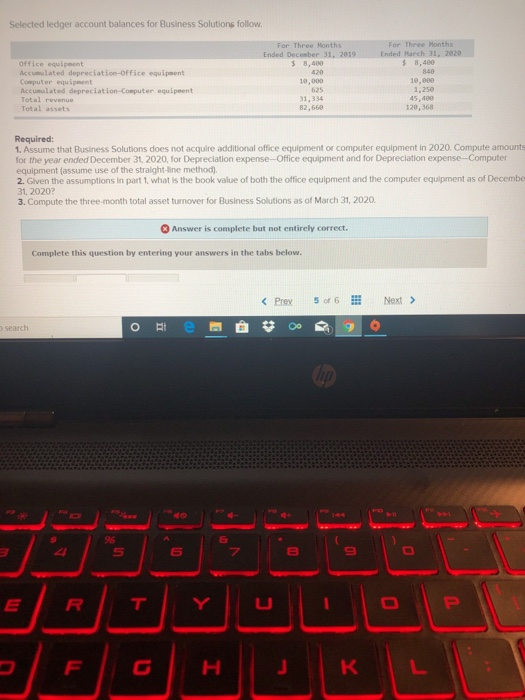

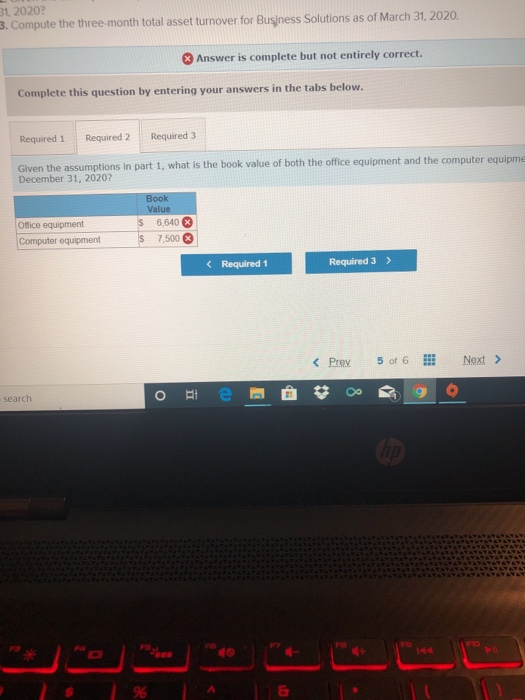

Selected ledger account balances for Business Solutions follow For Three Months For Three Months Ended March 31, 2020 $ 8,400 Ended December 31, 2019 Office equipment Accumalated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipeent Total revenue Total assets 8,400 420 10,000 625 31,334 82,660 840 10,000 1,250 45,4004 120,368 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2020. Compute amounts for the year ended December 31, 2020, for Depreciation expense-Office equipment and for Depreciation expense-Computer equipment (assume use of the stralght-line method) 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of Decembe 31, 2020? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2020. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. search &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts