Question: I have the solution, but if someone could better explain the methods for arbitrage in a single factor APT? Consider the single-factor APT. Assume that

I have the solution, but if someone could better explain the methods for arbitrage in a single factor APT?

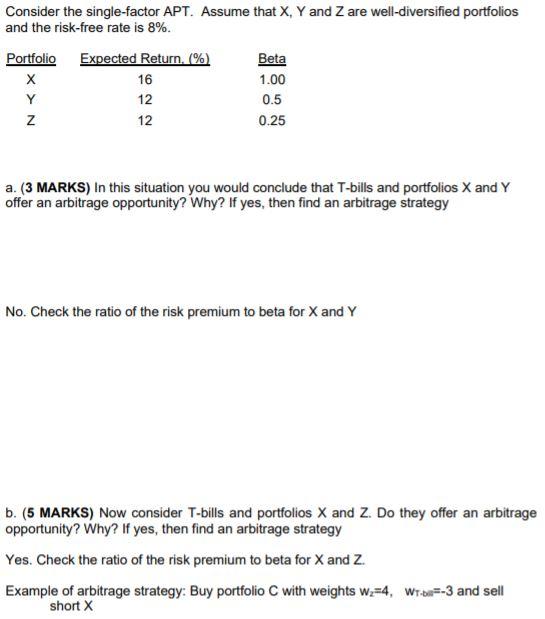

Consider the single-factor APT. Assume that X, Y and Z are well-diversified portfolios and the risk-free rate is 8%. Portfolio Expected Return. (%) Beta X 16 1.00 Y 12 Z 12 0.25 0.5 a. (3 MARKS) In this situation you would conclude that T-bills and portfolios X and Y offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy No. Check the ratio of the risk premium to beta for X and Y b. (5 MARKS) Now consider T-bills and portfolios X and Z. Do they offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy Yes. Check the ratio of the risk premium to beta for X and Z. Example of arbitrage strategy: Buy portfolio C with weights W2=4, WT-ba=-3 and sell short X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts