Question: i have those two answers for this question . which one is the correct answer 1050 or 1000 ? please give me a clear answer

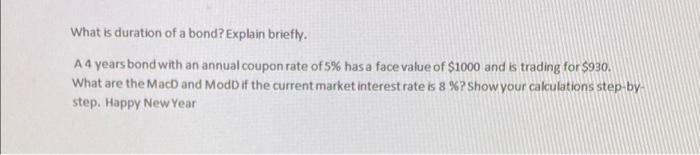

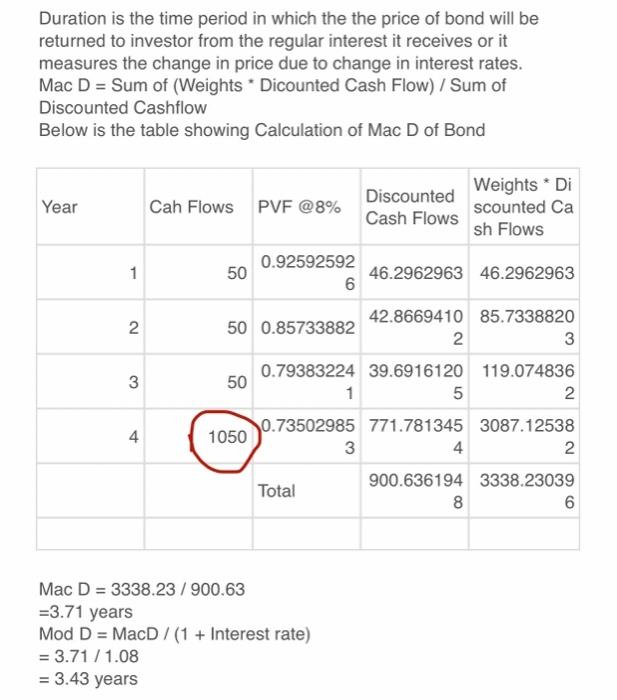

What is duration of a bond? Explain briefly. A 4 years bond with an annual coupon rate of 5% has a face value of $1000 and is trading for $930. What are the MacD and ModD if the current market interest rate is 8 %? Show your calculations step by step. Happy New Year Duration is the time period in which the the price of bond will be returned to investor from the regular interest it receives or it measures the change in price due to change in interest rates. Mac D = Sum of (Weights . Dicounted Cash Flow) / Sum of Discounted Cashflow Below is the table showing Calculation of Mac D of Bond Year 1 N Discounted Weights Di Cah Flows PVF @8% scounted Ca Cash Flows sh Flows 0.92592592 50 46.2962963 46.2962963 6 50 0.85733882 42.8669410 85.7338820 2 3 0.79383224 39.6916120 119.074836 50 1 5 2 10.73502985 771.781345 3087.12538 1050 3 4 2 Total 900.636194 3338.23039 8 6 3 4 Mac D = 3338.23 / 900.63 =3.71 years Mod D = MacD/(1 + Interest rate) = 3.71 /1.08 = 3.43 years time Cash flow Weight PV factor (8 Present val %) ue 0.92592592 46.25 59259258 1 50 1 2 50 42.85 2 3 50 0.85733882 03017831 0.79383224 10201695 0.73502985 27964532 39.65 3 4 50 36.75 4 4 4 CM 1000 0.73502985 27964532 735 4 Duration of bond= 4 years Macaulay Duration=3.705 years Modified Duration = Macaulay duration/ (1 + (YTM)) = 3.4319

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts