Question: I have to describe the closing process and explain why temporary accounts are closed each period . My brain is fryed I don't know how

I have to describe the closing process and explain why temporary accounts are closed each period . My brain is fryed I don't know how to bring records to explain this please help

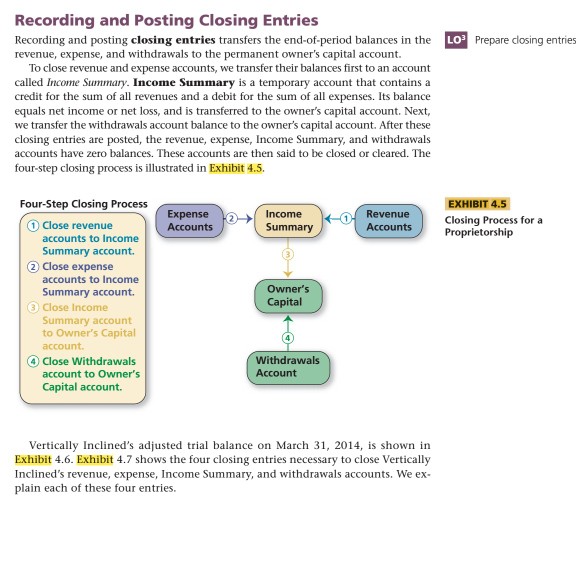

Recording and Posting Closing Entries Recording and posting closing entries transfers the end-of-period balances in the revenue, expense, and withdrawals to the permanent owner's capital account. LO Prepare closing entries To close revenue and expense accounts, we transfer their balances first to an account called Income Suummary. Income Summary is a temporary account that contains a credit for the sum of all revenues and a debit for the sum of all expenses. Its balance equals net income or net loss, and is transferred to the owner's capital account. Next, we transfer the withdrawals account balance to the owner's capital account. After these closing entries are posted, the revenue, expense, Income Summary, and withdrawals accounts have zero balances. These accounts are then said to be closed or cleared. The four-step closing process is illustrated in Exhibit 4.5. EXHIBIT 4.5 Closing Process for a Proprietorship Four-Step Closing Process Expense Accounts Income Revenue Accounts 1 Close revenue accounts to Income Summary account. 2 Close expense accounts to Income Summary account. Owner's Capital 3 Close Income Summary account to Owner's Capital Withdrawals Account 4) Close Withdrawals account to Owner's Capital account. Vertically Inclined's adjusted trial balance on March 31, 2014, is shown in Exhibit 4.6. Exhibit 4.7 shows the four closing entries necessary to close Vertically Inclined's revenue, expense, Income Summary, and withdrawals accounts We ex plain each of these four entries. Recording and Posting Closing Entries Recording and posting closing entries transfers the end-of-period balances in the revenue, expense, and withdrawals to the permanent owner's capital account. LO Prepare closing entries To close revenue and expense accounts, we transfer their balances first to an account called Income Suummary. Income Summary is a temporary account that contains a credit for the sum of all revenues and a debit for the sum of all expenses. Its balance equals net income or net loss, and is transferred to the owner's capital account. Next, we transfer the withdrawals account balance to the owner's capital account. After these closing entries are posted, the revenue, expense, Income Summary, and withdrawals accounts have zero balances. These accounts are then said to be closed or cleared. The four-step closing process is illustrated in Exhibit 4.5. EXHIBIT 4.5 Closing Process for a Proprietorship Four-Step Closing Process Expense Accounts Income Revenue Accounts 1 Close revenue accounts to Income Summary account. 2 Close expense accounts to Income Summary account. Owner's Capital 3 Close Income Summary account to Owner's Capital Withdrawals Account 4) Close Withdrawals account to Owner's Capital account. Vertically Inclined's adjusted trial balance on March 31, 2014, is shown in Exhibit 4.6. Exhibit 4.7 shows the four closing entries necessary to close Vertically Inclined's revenue, expense, Income Summary, and withdrawals accounts We ex plain each of these four entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts