Question: I have to get full marks on this. Requesting to do this math carefully and follow this given format, please. Thanks in Advance. WACC and

I have to get full marks on this. Requesting to do this math carefully and follow this given format, please. Thanks in Advance.

I have to get full marks on this. Requesting to do this math carefully and follow this given format, please. Thanks in Advance.

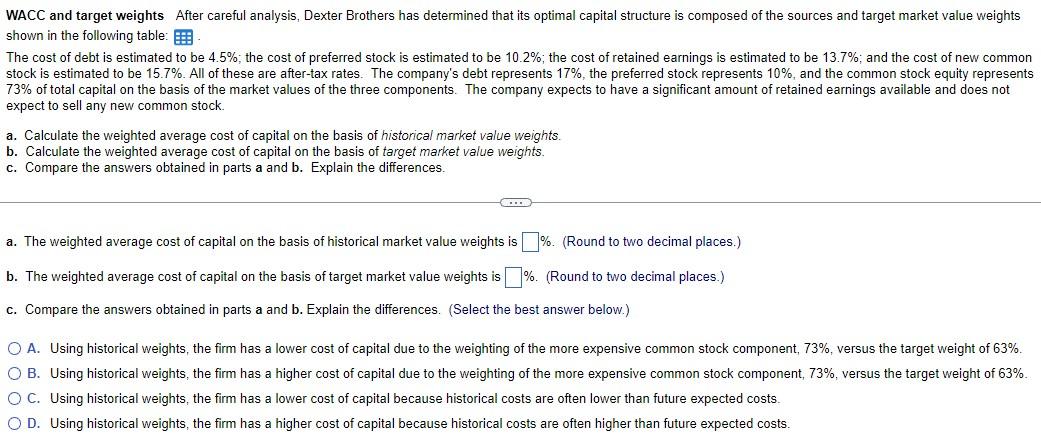

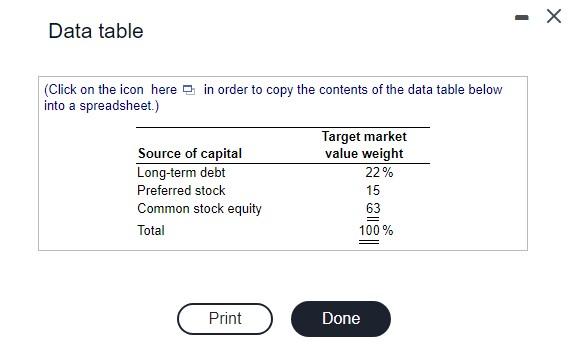

WACC and target weights After careful analysis, Dexter Brothers has determined that its optimal capital structure is composed of the sources and target market value weights shown in the following table: The cost of debt is estimated to be 4.5%; the cost of preferred stock is estimated to be 10.2%; the cost of retained earnings is estimated to be 13.7%; and the cost of new common stock is estimated to be 15.7%. All of these are after-tax rates. The company's debt represents 17%, the preferred stock represents 10%, and the common stock equity represents 73% of total capital on the basis of the market values of the three components. The company expects to have a significant amount of retained earnings available and does not expect to sell any new common stock. a. Calculate the weighted average cost of capital on the basis of historical market value weights. b. Calculate the weighted average cost of capital on the basis of target market value weights. c. Compare the answers obtained in parts a and b. Explain the differences. a. The weighted average cost of capital on the basis of historical market value weights is \%. (Round to two decimal places.) b. The weighted average cost of capital on the basis of target market value weights is \%. (Round to two decimal places.) c. Compare the answers obtained in parts a and b. Explain the differences. (Select the best answer below.) A. Using historical weights, the firm has a lower cost of capital due to the weighting of the more expensive common stock component, 73%, versus the target weight of 63%. B. Using historical weights, the firm has a higher cost of capital due to the weighting of the more expensive common stock component, 73%, versus the target weight of 63%. C. Using historical weights, the firm has a lower cost of capital because historical costs are often lower than future expected costs. D. Using historical weights, the firm has a higher cost of capital because historical costs are often higher than future expected costs. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts