Question: I have two case study questions below. Please help. This is due for 120 points. Question 48 (chapter8) and question 108 (chapter 14). The first

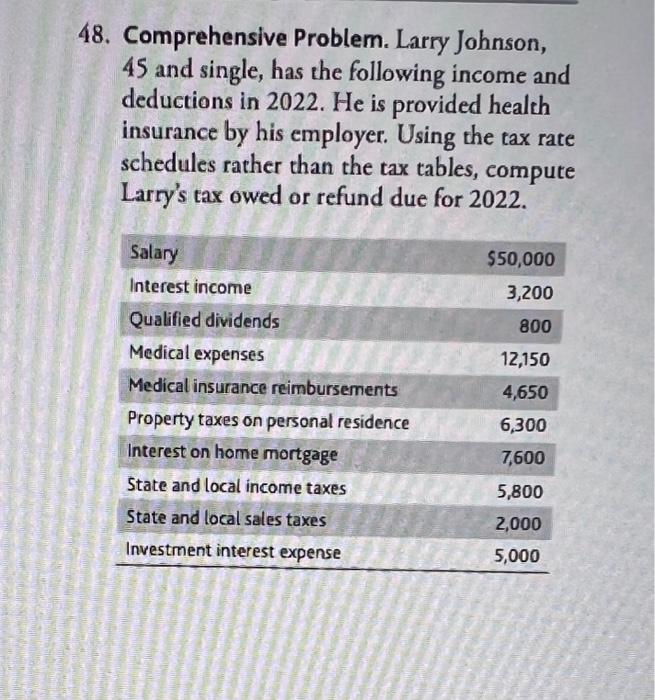

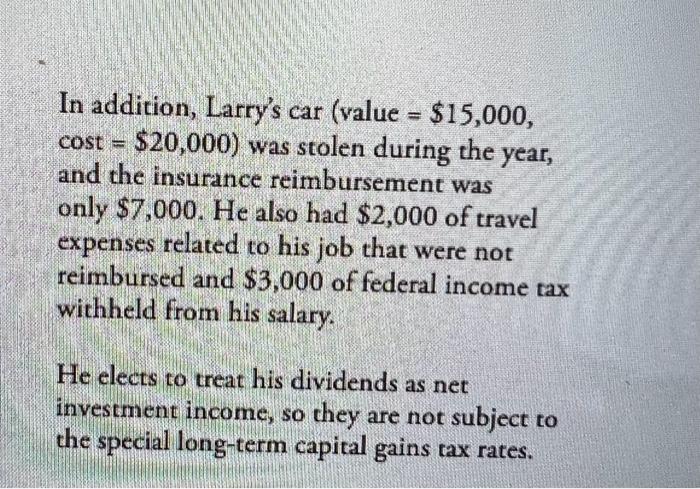

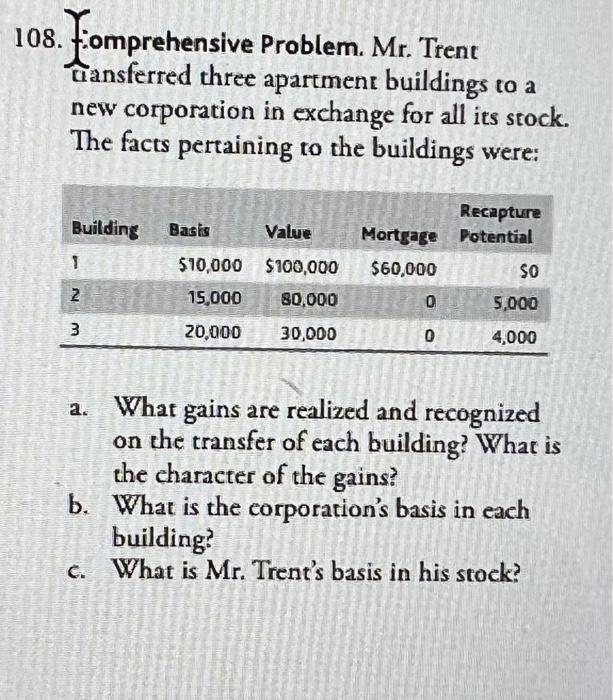

48. Comprehensive Problem. Larry Johnson, 45 and single, has the following income and deductions in 2022 . He is provided health insurance by his employer. Using the tax rate schedules rather than the tax tables, compute Larry's tax owed or refund due for 2022. In addition, Larry's car (value =$15,000, cost=$20,000) was stolen during the year, and the insurance reimbursement was only $7,000. He also had $2,000 of travel expenses related to his job that were not reimbursed and $3,000 of federal income tax withheld from his salary. He elects to treat his dividends as net investment income, so they are not subject to the special long-term capital gains tax rates. 108. Fomprehensive Problem. Mr. Trent tuansferred three apartment buildings to a new corporation in exchange for all its stock. The facts pertaining to the buildings were: a. What gains are realized and recognized on the transfer of each building? What is the character of the gains? b. What is the corporation's basis in each building? c. What is Mr. Trent's basis in his stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts